The European Union on Tuesday added Malaysia onto its "grey list" of non-cooperative jurisdictions for tax purposes.

This comes amid revelations in the Pandora Papers, exposing rich and powerful individuals storing assets in tax havens.

The EU list is a tool to address legal means of tax avoidance, or illegal means like tax fraud and money laundering, and concealment of origins of illegally obtained money.

According to the EU document, Malaysia has committed to amend or abolish "harmful foreign-sourced income exemption regimes" by Dec 31, 2022.

This is the first time Malaysia is placed in the EU list of non-cooperative jurisdictions for tax purposes.

Other countries placed on the grey list on Oct 5 are Costa Rica, Hong Kong, Qatar and Uruguay, while tax havens Anguilla, Dominica and Seychelles were moved from the black list to the grey list.

According to advisory firm Ernst & Young (EY), the grey list refers to "Annex II", which include countries which "have yet to comply with all international tax standards but have made commitments to reform tax policies".

This is as opposed to the black list, or Annex I, which jurisdictions are considered "non-cooperative".

The list was set up in 2017 to tackle tax evasion and is regularly updated.

Jurisdictions in the black list on Oct 5 are American Samoa, Fiji, Guam, Palau, Panama, Samoa, Trinidad and Tobago, the US Virgin Islands and Vanuatu.

Australia, Eswatini and Maldives have been removed from the grey list after reforming their tax regimes.

Changes to Income Tax Act 1967 may be required

EY said to comply with EU's demands, Malaysia would need to review its foreign-sourced income exemption under Paragraph 28 of Schedule 6 of the Income Tax Act 1967.

The EU's guidance on the matter acknowledges that such exemptions exist to avoid double taxation on income derived overseas, EY said in its advisory note to clients.

However, the EU found that some regimes "not only prevent double taxation but also create situations of double non-taxation", it said.

EY said the EU is particularly concerned over the exclusion of passive income without taxation "as this can result in ring-fencing and a lack of economic substance".

It is also concerned about the exclusion of foreign-sourced active income from taxation that does not align with international tax principles, EY said.

Among others, the EU guidance said tax regimes must have robust anti-abuse laws and remove administrative discretion for determining exclusions, EY said.

The Pandora Papers, which were released on Oct 4 worldwide, reveals secret documents of 14 service providers who help clients set up firms and trusts in offshore jurisdictions, like Samoa or the British Virgin Islands.

The largest leak of its kind, the documents were provided to the International Consortium of Investigative Journalists (ICIJ), who then shared it with its partners around the world, including Malaysiakini.

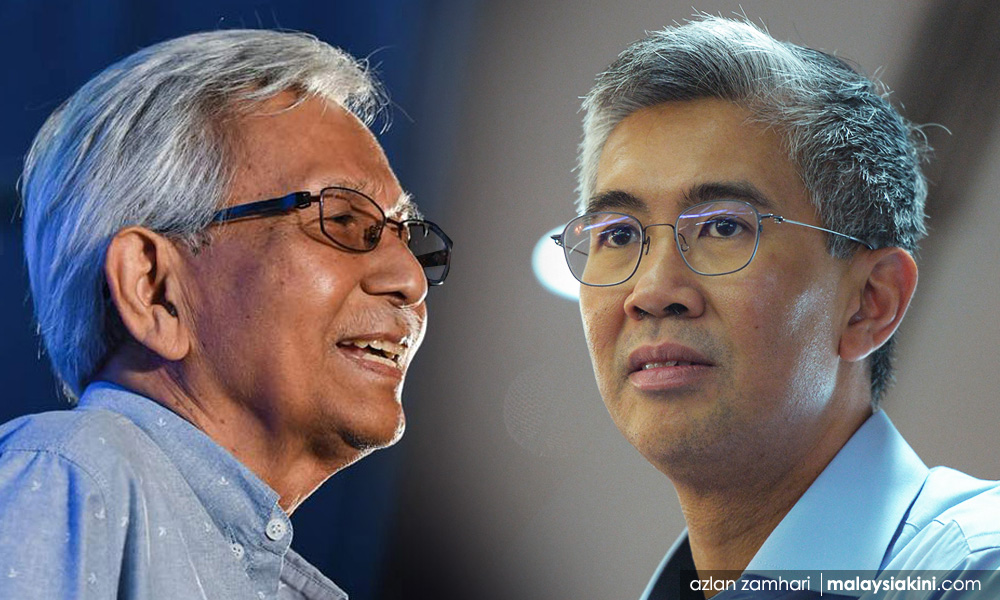

Notable Malaysian figures in the Pandora Papers are former finance minister Daim Zainuddin, who was revealed to be linked to various offshore trusts and firms, including BVI companies under his children's names holding properties in London worth several million British pounds.

Others include Finance Minister Tengku Zafrul Abdul Aziz, Deputy Finance Minister Yamani Hafez Musa, Umno president Ahmad Zahid Hamidi and PKR's Selayang MP William Leong.

All but Yamani responded to say the holdings are legitimate and no laws were broken.

Zafrul said he held a position in an offshore entity as part of his role in Kenanga Investments and resigned when he left Kenanga to become Maybank Investment Bank CEO in 2010.

Asked in Parliament what Malaysia intends to do to repatriate funds kept offshore, he instead said it is completely legal for Malaysians to have offshore accounts with licensed banks.

Today, opposition leader Anwar Ibrahim filed an appeal against the Dewan Rakyat's speaker decision to reject his motion that the Pandora Papers be debated in the House. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.