CIGARETTE smuggling continues to rank among the most serious economic threats facing Malaysia, with the illicit cigarette market estimated to be worth up to RM5 bil annually, underscoring the scale of the shadow economy that remains deeply entrenched in the system.

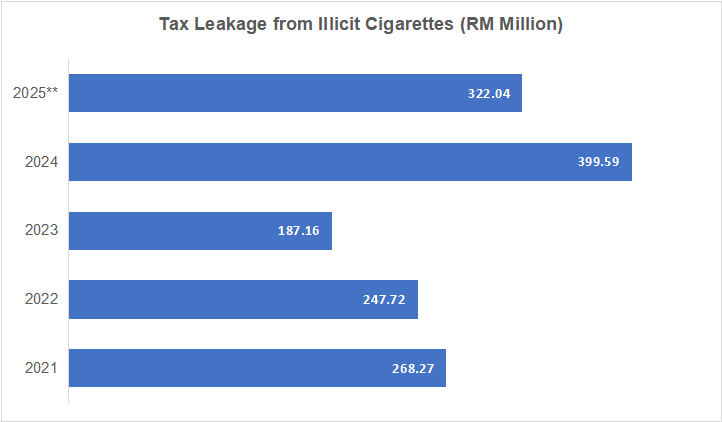

According to the Finance Ministry (MOF), Malaysia lost approximately RM1.4 bil in unpaid taxes over the past five years, partly due to cigarette smuggling activities. Unpaid duties linked to illicit cigarettes were recorded as follows:

These figures not only reflect significant revenue leakage but also point to the presence of well-organised and resilient smuggling networks capable of adapting to escalating enforcement pressure.

On this matter, security and defence specialist Zaki Salleh observed that the country’s illicit cigarette problem should be viewed as a strategic threat to national economic security rather than merely a border enforcement issue.

“National borders are not just geographical lines. They are the frontline of economic defence. As long as weaknesses exist at the borders, the shadow economy will continue to thrive,” he commented.

He further noted that enforcement efforts by agencies such as the Royal Malaysian Customs Department (JKDM), the Royal Malaysia Police (PDRM) and the Malaysian Anti-Corruption Commission (SPRM) remain critical and deserve recognition.

In 2025 alone, JKDM successfully foiled 2,742 attempted cigarette smuggling cases, reflecting a high level of operational intensity and commitment.

However, Zaki stressed that enforcement effectiveness must be assessed against overall market outcomes, not just operational activity.

“These efforts deserve praise, but they remain small when measured against the size of Malaysia’s illicit cigarette market. Without more comprehensive coordination, the impact is unlikely to be sustainable,” he remarked.

Zaki added that border control approaches can no longer rely solely on conventional methods as smuggling syndicates have become increasingly sophisticated and operate in a highly coordinated manner.

“Today’s smugglers use technology, modern logistics systems and alternative routes to avoid detection. Their operations span land and waterways, including areas that are difficult to monitor physically,” he continued.

Beyond enforcement, Zaki pointed to structural market factors as the core challenge. The significant price gap between legal and illegal cigarettes continues to sustain demand among both consumers and retailers.

“This price difference creates strong economic incentives for illicit cigarettes to keep circulating, especially in a challenging cost-of-living environment,” he explained.

“Under such conditions, enforcement alone becomes increasingly difficult to curb demand comprehensively.”

He cautioned that as long as demand remains unaddressed, the shadow market will continue to adapt even as enforcement is intensified.

In this context, Zaki said the government needs to explore broader policy reforms aimed at narrowing the demand gap for illicit cigarettes.

He noted that the existing policy framework should be objectively evaluated to ensure a better balance between public health objectives, revenue collection and market realities.

At the same time, he emphasised the importance of fully operationalising the Border Control and Protection Agency (AKPS) as the central coordinating body for border control to reduce overlaps and improve inter-agency efficiency.

In addition to coordination, Zaki highlighted the need for more aggressive deployment of technology, including drones, infrared sensors, AI-enabled smart cameras and GPS-based vehicle tracking systems, to strengthen detection capabilities and close persistent border vulnerabilities.

Without a consistent and integrated approach, he warned, the illicit cigarette market will continue to erode national tax revenues and weaken Malaysia’s economic resilience over the long term. ‒ Focus Malaysia

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.