Readers who are interested in reading more vigorous analyses on FGV are advised to read Pirates of Putrajaya. In the English language here and in Bahasa Malaysia here. I am offering a less rigorous analysis here as I feel not as competent as the Pirate in technical matters.

Here is what irks me and I hope it does others too. Felda settlers have given nothing but each felda household is promised and given RM 15,000 each. For what? In return for a promise to vote UMNO and BN in the next elections? And the gnome of the felda chairman says it’s not corruption. The RM 15,000 must be called as what it really is- the price of each settler as seen by the PM. Its bloody corruption.

If not, how do you explain why the PM gives out the 15,000? Does he do it for purely philanthropic reasons?

What is it that FGV offers for sale? Remember- as the Koperasi Permodalan Felda hasn’t parted off with its 51%, what FGV offers to the public is its 49% interest in Felda Holdings. It can’t and doesn’t have the capacity to offer 100% of Felda Holdings. But you be can sure the PM and his macais are rounding up the deep pocketed boys and telling them- don’t worry boys, we will chop off the heads of the KPF leaders one by one. We will deliver you 100% of Felda Holdings.

Or Perhaps we haven't uncovered yet, the devilish plans they have in store for the 51% which KPF owns in Felda Holdings?

Or Perhaps we haven't uncovered yet, the devilish plans they have in store for the 51% which KPF owns in Felda Holdings?

It’s shortchanging the investing public when it can only offer 49% of its interest in Felda Holdings and their valueless businesses abroad which did not make money anyway.

Now, Felda holdings is a different cattle of fish. It is one of Malaysia's largest, and most diversified agro-based enterprises which run the commercial business related to the Federal Land and Development Authority (FELDA), and the vast 880,000-hectare plantation land bank associated with it. It owns 360,000 hectares of land directly and manages 520,000 hectares of land belonging to settlers.

Felda Holdings became a public company on 3 October, 2003. Today, its total capitalization exceeds RM 5 billion with RM 220 million in paid up capital. It employs a dedicated workforce of almost 19,000 employees, complemented by a labor force of 46,795 workers at some 300 estates, 70 palm oil mills, seven refineries, four kernel crushing plants, 13 rubber factories, manufacturing plants and several logistic and bulking installations spread throughout Malaysia and several locations overseas.

Its assets include more than 50 active subsidiaries, associated companies and joint venture companies. It provides technical advice and support to the Felda Group. It has facilities to process rubber and cocoa products, manufacture fertilizers as well as operate several successful auxiliary businesses. Among these are IT, engineering, security, storage and logistic services.

It also does business at the international level it supplies 8% of world palm oil in 2009. It has joint-venture partnerships with large multinationals such as Procter & Gamble and Iffco. It has growing interests in businesses in the United States, Canada, Australia, China, Pakistan, Sri Lanka and South Africa.

But the most important thing to remember is this: FGV holds only 49% of all these. But they have an important partner in crime- the holder of the 1 golden share. The Ministry of Finance.

The non felda citizens of this country do not get any cash handouts. Buy they have the same stature as Felda settlers who have given nothing to UMNO and the government. So, they deserve the same cash handouts as settlers do. Why should the settlers be treated any differently? If ordinary citizens are wrongly treated they should respond the only decent way they can- by not voting in this corrupting government.

The minister in charge of felda is going ahead with the listing of FGV. He has called those who opposed the listing as accursed bastards- haramjadah. He has described them as thick-skinned if they take the RM 15,000 inducement. By doing so, he has displayed his inherent nature which I have been saying all this while- that Najib solves problems by paying his way through. He is not a leader who inspires the citizens with ideas and ideals.

There is a vast and barren void that lies between his ears.

Posted by sakmongkol AK47

Read the related article (in English) below:

Read the related article (in English) below:

Felda Listing Game Explained! IPO Price May Drop!!

After spending the last couple of days pouring over the FELDA IPO listing document, we can finally piece together this entire deal and reveal the true secrets that are being with held from the public.

Ok, there is a lot to cover, so lets get right to it

Let's start with this story about a company called Felda Global Ventures Sdn Bhd (FGVH). We shall call it Najib's Felda from now on. Technically, this company is owned by the taxpayers through the Government of Malaysia, in reality its owned by Najib, Rosmah and "other Super Puteras."

This company was initially acting as the ownership vehicle of the Government's 49% stake in Felda Holdings, where the remaining 51% of the stake was owned by the settlers through Koperasi Permodalan Felda.

We shall call this "Ma' Felda" because that is the Felda we all know.

So Najib Felda - BAD, Ma Felda, owned by the setllers, GOOD.

Ok got it?

Najib's Felda then was supposed to manage the overseas business, including the production of fatty acids and food oil in North America. They did this through a company called Twin Rivers Technologies, which made investments in plants and others stuff in US and Canada. Collectively, this business has lost RM 700 m pre tax since 2009. This was mentioned by Anwar Ibrahim a couple of months ago and is a fact!

Najib's Felda then bought Ma' Felda's investment in a JV with the IFFCO Group, a food conglomerate from Saudi Arabia, for RM 145 m . This JV is involved refining, processing and packing of palm oil based products. This business too is now performing poorly and the investment had to be impaired in 2011 for RM 29m.

So far, this business has been making losses, but their first big break happened when they took over Robert Kuok's sugar business from Perlis Plantation Berhad for about RM 1 billion. This deal was executed in January 2010. Najib's Felda then went on to acquire other sugar business assets, and in June 2011, they listed the entire group on the KLSE Exchange under a company called Malaysian Sugar Mills. When they listed, they sold down their ownership to 51% and made about RM 300 million flipping these business. Of course, the bottom line of this sugar business they were helped by Najib's Gomen increasing sugar price.

There were other things Najib's Felda bought, such as a 20% stake in Tradewinds (Al Bukharry) and a JV with Lembaga Tabung Haji in Indonesia through a company called Trurich. Collectively, they spent RM 300m on these acquisitions.

This was how the structure stood until Najib decided to put in play the plan to raise money for the General Election. Originally, the deal proposed was for a Reverse Take Over where FGVH would issue new shares to take over the control of Felda Holdings. We described this in great detail over here.

However, the settlers felt uncomfortable with the deal and it was killed. We congratulate Dato Dzul, the ex Director General of "Ma Felda" for standing up to political pressure!

Then Najib did something which the settlers still do not quite understand. He basically moved a major asset that was in control of the Government, which was 343,000 hectares of palm oil estate, that was originally managed via Felda Plantations to Najib's Felda. In return Najib's Felda will rent the land from the Government for about RM 700 per hectare per year - a super cheap price. With this deal in place, Najib's Felda has increased its worth by RM 10 billion!

Just to give you a kind feel for the numbers, when Boustead Holdings, rents its plantation land for about RM 3,300 per hectare! So what Najib has done was to raise money by selling out Government owned land!

The impact of this was deal is what makes the entire listing possible. With this deal, Najib's Felda can list and raise enough money to fund the General Election. They are targeting to raise RM 10 billion, of which RM 1 billion has been paid out to settlers via "durian runtuh" scheme.

That is the essence of this deal. Once again, we will never know how the money raised by Najib's Felda by selling out government controlled land to the capitalists will be used. This is the entire economic structure of this deal.

FELDA SETTLERS JAMMED

The settlers will also be jammed by this deal. Previously, a lot of the profits from Felda Holdings ('Ma Felda') came about through the management of the Government's plantation estate. Now this asset has been passed to Najib's Felda, which will materially impact the future dividends from Felda Holdings.

Read this:

page 685 of listing document

(iii) The management agreement between Felda Plantation Sdn Bhd ('FPSB'), a subsidiary of the Group, and FELDA ("Gomen/Najib") expired on 31 December 2011 and was not renewed. On 1 January 2012, FPSB therefore ceased from being the management agent for FELDA. On 6 January 2012, FPSB entered into a management agreement with Felda Global Ventures Plantations (Malaysia) Sdn Bhd ('FGVPM') for the management of FGVPM's plantation estates, which were leased from FELDA. This agreement is effective for a duration of one month, with a monthly renewal and can be renewed through written notification within 7 days before the expiration of the management agreement. This management agreement expired on 29 February 2012 and subsequently, the employees of FPSB were transferred to FGVPM.

Ok - the rest of this article is for the capitalists

HOW MUCH IS IT WORTH

So how much is the share actually worth. Ok, here is my estimate about RM 3.24

We considered a couple of folk - "Najib's Felda's Land", Golden Agricultural Resources (GAR), KLK Kepong and IOI. These are all super producers, who are able to generate more than 3 Million MetricTonnes of Fresh Fruit Bunch (FFB) a year. For those who do not know what happens its like this. You plant a an oil palm tree, and the fruit is collected in bunches, hence its called Fresh Fruit Bunch

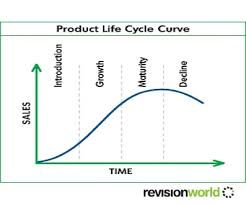

This is a comparison of the Age Profile of the Oil Palm trees in Najib's Felda versus that of Golden Agricultural Resources. As you notice, Najib's Felda's holding consists of over 51% of trees that are old. This means the trees are much taller and makes it expensive to harvest the fruit. This increases the cost and reduces the profitability.

But more importantly, is that each year goes by, Najib's Felda loses about RM 500 million worth in its estate because of such a huge skew towards these older trees. This is different when compared to Golden Agricultures which gains approximately RM 3 billion a year because their stock is moving towards maturity.

You can perhaps understand this from this chart

The chart is roughly ok, only thing that the decline is much more sever for oil palm.

Ok, right now Golden Agricultures trades for about 8.3 x EBIDTA. Furthemore Golden Agriculture Resources is a super king , with other very profitable businesses. I'll be generous and give Najib's Felda a multiple of 6.00x . To me, there is no way it can get a multiple about GAR because of the reasons I have mentioned above.

So when we can get the value like this

2011 Plantation EBIDTA Earnings x 6.00 = RM 9.7 billion.

ENTERPRISE VALUE AND EQUITY VALUE

The remainder of this technique is to add all the parts together. This gives a total enterprise value of RM 13 billion. To that we deduct the debt of RM 1.8 billion - giving an equity value of RM 11 billion++. Divide that by the number of shares, and you get a fair value about RM 3.24.

So its not really such a great deal, and don't lose sleep if you don't get a blue share.

More importantly, this deal seems to be priced on the high end for the retail investors, and with the large float there will be immediate selling pressure, especially leading up to the general election

UPDATED............MENJAWAB ZULKBO ZULKBO COM

Zulkbo zulkboCom said...

Zulkbo zulkboCom said...

JAWAPAN SIR WENGER KHAIRY

Sir Wenger Khairy said...

Sir Wenger Khairy said...

Ok, there is a lot to cover, so lets get right to it

What Actually is Happening

This company was initially acting as the ownership vehicle of the Government's 49% stake in Felda Holdings, where the remaining 51% of the stake was owned by the settlers through Koperasi Permodalan Felda.

We shall call this "Ma' Felda" because that is the Felda we all know.

So Najib Felda - BAD, Ma Felda, owned by the setllers, GOOD.

Ok got it?

Najib's Felda then was supposed to manage the overseas business, including the production of fatty acids and food oil in North America. They did this through a company called Twin Rivers Technologies, which made investments in plants and others stuff in US and Canada. Collectively, this business has lost RM 700 m pre tax since 2009. This was mentioned by Anwar Ibrahim a couple of months ago and is a fact!

| No so-po story is ever complete without mentioning Anwar Ibrahim |

Najib's Felda then bought Ma' Felda's investment in a JV with the IFFCO Group, a food conglomerate from Saudi Arabia, for RM 145 m . This JV is involved refining, processing and packing of palm oil based products. This business too is now performing poorly and the investment had to be impaired in 2011 for RM 29m.

So far, this business has been making losses, but their first big break happened when they took over Robert Kuok's sugar business from Perlis Plantation Berhad for about RM 1 billion. This deal was executed in January 2010. Najib's Felda then went on to acquire other sugar business assets, and in June 2011, they listed the entire group on the KLSE Exchange under a company called Malaysian Sugar Mills. When they listed, they sold down their ownership to 51% and made about RM 300 million flipping these business. Of course, the bottom line of this sugar business they were helped by Najib's Gomen increasing sugar price.

There were other things Najib's Felda bought, such as a 20% stake in Tradewinds (Al Bukharry) and a JV with Lembaga Tabung Haji in Indonesia through a company called Trurich. Collectively, they spent RM 300m on these acquisitions.

This was how the structure stood until Najib decided to put in play the plan to raise money for the General Election. Originally, the deal proposed was for a Reverse Take Over where FGVH would issue new shares to take over the control of Felda Holdings. We described this in great detail over here.

However, the settlers felt uncomfortable with the deal and it was killed. We congratulate Dato Dzul, the ex Director General of "Ma Felda" for standing up to political pressure!

Then Najib did something which the settlers still do not quite understand. He basically moved a major asset that was in control of the Government, which was 343,000 hectares of palm oil estate, that was originally managed via Felda Plantations to Najib's Felda. In return Najib's Felda will rent the land from the Government for about RM 700 per hectare per year - a super cheap price. With this deal in place, Najib's Felda has increased its worth by RM 10 billion!

Just to give you a kind feel for the numbers, when Boustead Holdings, rents its plantation land for about RM 3,300 per hectare! So what Najib has done was to raise money by selling out Government owned land!

The impact of this was deal is what makes the entire listing possible. With this deal, Najib's Felda can list and raise enough money to fund the General Election. They are targeting to raise RM 10 billion, of which RM 1 billion has been paid out to settlers via "durian runtuh" scheme.

That is the essence of this deal. Once again, we will never know how the money raised by Najib's Felda by selling out government controlled land to the capitalists will be used. This is the entire economic structure of this deal.

FELDA SETTLERS JAMMED

The settlers will also be jammed by this deal. Previously, a lot of the profits from Felda Holdings ('Ma Felda') came about through the management of the Government's plantation estate. Now this asset has been passed to Najib's Felda, which will materially impact the future dividends from Felda Holdings.

Read this:

page 685 of listing document

(iii) The management agreement between Felda Plantation Sdn Bhd ('FPSB'), a subsidiary of the Group, and FELDA ("Gomen/Najib") expired on 31 December 2011 and was not renewed. On 1 January 2012, FPSB therefore ceased from being the management agent for FELDA. On 6 January 2012, FPSB entered into a management agreement with Felda Global Ventures Plantations (Malaysia) Sdn Bhd ('FGVPM') for the management of FGVPM's plantation estates, which were leased from FELDA. This agreement is effective for a duration of one month, with a monthly renewal and can be renewed through written notification within 7 days before the expiration of the management agreement. This management agreement expired on 29 February 2012 and subsequently, the employees of FPSB were transferred to FGVPM.

That is why the old management of Felda under Dato Dzul was opposed to this deal!

Ok - the rest of this article is for the capitalists

HOW MUCH IS IT WORTH

Ok it is a very rough calculation, but I'll go with you on how its constructed. Lets focus on the 2 most important parts - the value of 51% of MSM Holdings and the value of the land rembat "deal".

MSM Holding

Value of 51% of MSM Holdings : Well, that's easy. Just go and look up the price of MSM and multiply by the number of shares outstanding x 51%

= 700 m X RM 5.30 X 51% = RM 1.9 billion

(Poor Robert Kuok - that's why he was pissed at the Gomen, Najib's Felda only invested RM 1 billion and can make RM 2.2 billion - they made RM 300m by selling down last year and now the remaining is worth RM 1.9 billion )

Value of 330,00+ Hectares Leased At RM 700/Hectare

Ok this required a bit of art. There are a couple things to consider, number one what is the current yield on the land and number two, what is the operating profit from harvesting the fruits.

We did some digging around and came up with this chart

They then process the Fresh Fruit Bunch to yield Crude Palm Oil, with a yield of about 20%.

As it is clearly shown, Najib's Felda, whilst being the largest Fresh Fruit Bunch producer in Malaysia (not shown in graph), has quite a low productivity and profitability. This fact is very important and will be a key determinant in coming out with a valuation.

But why is it so ?

Well consider the next chart

This is a comparison of the Age Profile of the Oil Palm trees in Najib's Felda versus that of Golden Agricultural Resources. As you notice, Najib's Felda's holding consists of over 51% of trees that are old. This means the trees are much taller and makes it expensive to harvest the fruit. This increases the cost and reduces the profitability.

But more importantly, is that each year goes by, Najib's Felda loses about RM 500 million worth in its estate because of such a huge skew towards these older trees. This is different when compared to Golden Agricultures which gains approximately RM 3 billion a year because their stock is moving towards maturity.

You can perhaps understand this from this chart

The chart is roughly ok, only thing that the decline is much more sever for oil palm.

Ok, right now Golden Agricultures trades for about 8.3 x EBIDTA. Furthemore Golden Agriculture Resources is a super king , with other very profitable businesses. I'll be generous and give Najib's Felda a multiple of 6.00x . To me, there is no way it can get a multiple about GAR because of the reasons I have mentioned above.

So when we can get the value like this

2011 Plantation EBIDTA Earnings x 6.00 = RM 9.7 billion.

ENTERPRISE VALUE AND EQUITY VALUE

The remainder of this technique is to add all the parts together. This gives a total enterprise value of RM 13 billion. To that we deduct the debt of RM 1.8 billion - giving an equity value of RM 11 billion++. Divide that by the number of shares, and you get a fair value about RM 3.24.

So its not really such a great deal, and don't lose sleep if you don't get a blue share.

More importantly, this deal seems to be priced on the high end for the retail investors, and with the large float there will be immediate selling pressure, especially leading up to the general election

UPDATED............MENJAWAB ZULKBO ZULKBO COM

Zulkbo zulkboCom said...

Zulkbo zulkboCom said...

salam..

melalui pengalaman saya bersama rakan yang bermain saham..

penyenaraian Felda di Bursa akan menjadikan Felda syarikat perladangan terbesar di Dunia, sebelum ini di pegang oleh Sime Darby..keuntungan yang dihasilkan Sime Darby setakat ini memang menggalakkan..cuma ada setengah kes baru ini rugi di beberapa pelaburan mereka..apa pun itu adalah adat dalam perniagaan..yang kurang cekap akan dibuang dan mungkin dihukum..kita tunggu je lah..pada saya, selagi tanah-tanah pereroka Felda yang telah di beri hak milik tidak diganggu gugat, perniagaan sebegini bersifat global..peluang menjana keuntungan akan menjadi lebih terbuka dan besar.

melalui pengalaman saya bersama rakan yang bermain saham..

penyenaraian Felda di Bursa akan menjadikan Felda syarikat perladangan terbesar di Dunia, sebelum ini di pegang oleh Sime Darby..keuntungan yang dihasilkan Sime Darby setakat ini memang menggalakkan..cuma ada setengah kes baru ini rugi di beberapa pelaburan mereka..apa pun itu adalah adat dalam perniagaan..yang kurang cekap akan dibuang dan mungkin dihukum..kita tunggu je lah..pada saya, selagi tanah-tanah pereroka Felda yang telah di beri hak milik tidak diganggu gugat, perniagaan sebegini bersifat global..peluang menjana keuntungan akan menjadi lebih terbuka dan besar.

Sir Wenger Khairy said...

Sir Wenger Khairy said...

Saudara Zulkbo,

Terima kasih kerana sudi berkongsi pendapat.

Dengan penyeraian felda ni, FGVH akan menjadi pengeluar buah kelapa sawit yang ketiga terbesar di dunia. Pertama Sime Darby, kedua Golden Agricultural Resources, syarikat yg disenaraikan di Singapura dan ketiga ialah FGVH.

Saya telah merungkai penyeraian ni dengan terperinci. Sebagai ringaksan, penyeraian ini bermaksud tanah2 yang dahulunya milik kerajaan akan dimasukkan ke dalam syarikat FGVH di mana sahamnya dijual kepada investor tempatan dan asing. Dana yang dikumpul akan digunakkan oleh PM untuk membeli Pilihan Raya. Kerana tu dia begitu bersungguh2 untuk menjayakan penyeraian felda ni.

Kedua, sebelum penyeraian , syarikat Felda Plantation, anak syarikat Felda Holding telah mengurus tanah tanah FELDA. Akan tetapi, kontrek tersebut ditamatkan dan kontrek baru diberi kepada FGVH dimana FGVH TIADA LANGSUNG SEBARANG KEPAKARAN untuk mengurus tanah2 perancangan Felda. Saya khuatir, ia akan menyebabkan dividend yg diberi kepada pemegang saham dalam Felda Holding akan turun, dan menyebabkan kesukaran kepada para peneroka. Pekara ni tidak langsung disebut atau dibahas oleh mana2 pihak media.

Ketiga, pengurusan FGVH nyata tidak mampu bersaing. Bisnes di Amerika Syarikat rugi. Bisnes di Malaysia melalui JV dengan Kumpulan IFFCO dari Arab Saudi pun rugi. Kalau pengurusan syarikat FGVH ini asyik mencatat kerugiaan camana dia boleh dipercayai untuk membawa kepada kejayaan. Inilah masalah Najib, asyik pilih bulu dengan orang

Terima kasih kerana sudi berkongsi pendapat.

Dengan penyeraian felda ni, FGVH akan menjadi pengeluar buah kelapa sawit yang ketiga terbesar di dunia. Pertama Sime Darby, kedua Golden Agricultural Resources, syarikat yg disenaraikan di Singapura dan ketiga ialah FGVH.

Saya telah merungkai penyeraian ni dengan terperinci. Sebagai ringaksan, penyeraian ini bermaksud tanah2 yang dahulunya milik kerajaan akan dimasukkan ke dalam syarikat FGVH di mana sahamnya dijual kepada investor tempatan dan asing. Dana yang dikumpul akan digunakkan oleh PM untuk membeli Pilihan Raya. Kerana tu dia begitu bersungguh2 untuk menjayakan penyeraian felda ni.

Kedua, sebelum penyeraian , syarikat Felda Plantation, anak syarikat Felda Holding telah mengurus tanah tanah FELDA. Akan tetapi, kontrek tersebut ditamatkan dan kontrek baru diberi kepada FGVH dimana FGVH TIADA LANGSUNG SEBARANG KEPAKARAN untuk mengurus tanah2 perancangan Felda. Saya khuatir, ia akan menyebabkan dividend yg diberi kepada pemegang saham dalam Felda Holding akan turun, dan menyebabkan kesukaran kepada para peneroka. Pekara ni tidak langsung disebut atau dibahas oleh mana2 pihak media.

Ketiga, pengurusan FGVH nyata tidak mampu bersaing. Bisnes di Amerika Syarikat rugi. Bisnes di Malaysia melalui JV dengan Kumpulan IFFCO dari Arab Saudi pun rugi. Kalau pengurusan syarikat FGVH ini asyik mencatat kerugiaan camana dia boleh dipercayai untuk membawa kepada kejayaan. Inilah masalah Najib, asyik pilih bulu dengan orang