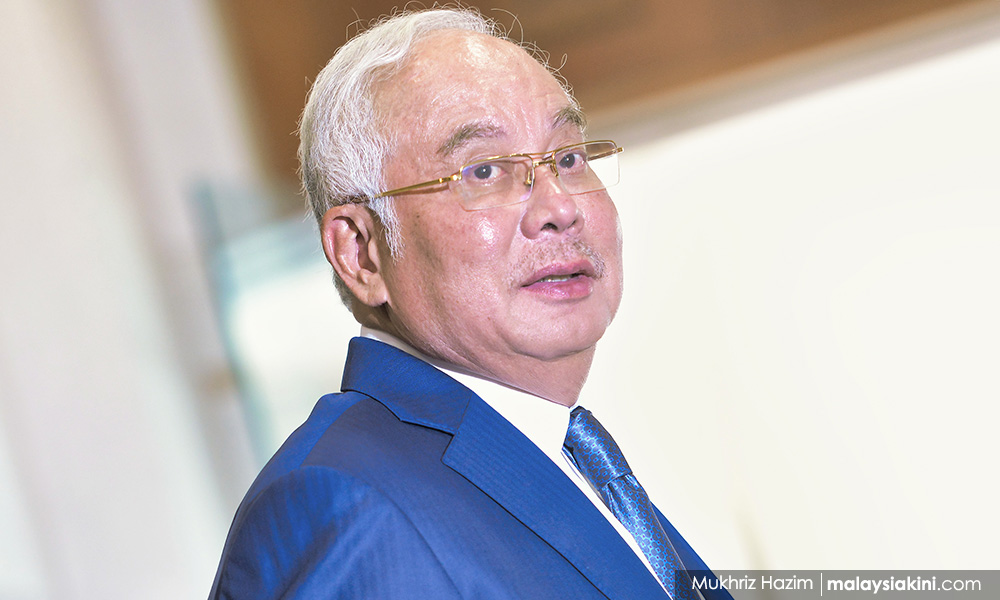

The criminal trial of former prime minister Najib Abdul Razak involving the alleged abuse of power and money laundering of 1MDB funds enters its 16th day today at the High Court in Kuala Lumpur.

Malaysiakini brings you live reports of the proceedings.

KEY HIGHLIGHTS

- Auditor KPMG raised question on 1MDB foreign assets: Shahrol

- I was removed after expressing worry over speedy financial deals: witness

- 1MDB leakages via siphoning borrowed funds for national projects - Shahrol

- 1MDB had RM30b debt in 2013, the burden was on M’sian gov't

- Ex-CEO: Najib never inquired about 1MDB money after scandal broke out

- RM18b 1MDB-Aabar Investment PJS deal was Najib's "baby": witness

11.39am - Proceedings resume with lead DPP Gopal Sri Ram questioning former 1MDB CEO Shahrol Azral Ibrahim Halmi, following the witness completing the reading of his 270-page witness statement.

11.20am - The court goes for a short break after star prosecution witness, former 1MDB CEO Shahrol Azral Ibrahim Halmi, wraps up his witness statement.

DPP Gopal Sri Ram is expected to continue with several additional questions to the witness after this.

Auditor KPMG raised question on 1MDB foreign assets - Shahrol

10.50am - From 2012 to 2013, auditor KPMG questioned the actual value of international assets owned by 1MDB, the court hears.

Former 1MDB CEO Shahrol Azral Ibrahim Halmi testifies that however, KPMG was not able to confirm the value of the underlying assets of the investment by Bridge Global Absolute Return Fund SPC (Special Purpose Vehicle).

"This was caused by Bridge Global Absolute Return Fund SPC via BSI Bank giving the excuse of client asset confidentiality for not giving out the full information on the underlying asset," Shahrol says.

Shahrol then wraps up his 270-page witness statement, and he then signs on the document.

I was removed after expressing worry over speedy financial deals: witness

10.17am - Former 1MDB CEO Shahrol Azral Ibrahim Halmi testifies that he was removed from 1MDB as he had expressed dissatisfaction over how rapid the fund's transactions were done.

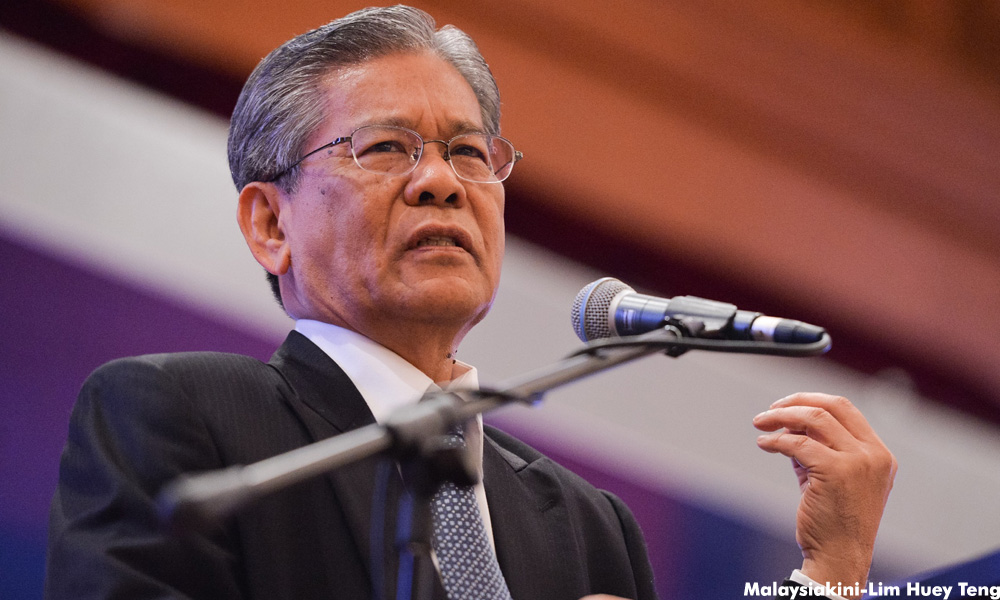

He says this during examination-in-chief by lead DPP Gopal Sri Ram (below).

“I suspect that I was removed from 1MDB because, at that time, I frequently expressed disquiet with how fast its financial deals were done.

“However, I was still in the 1MDB board at that time, with the excuse given by Jho Low was to manage optics.

"After the brouhaha of the 1MDB issue in 2015 and 2016, the 1MDB Board of Directors unanimously offered to resign but we were ordered by Najib to stay on until the new directors were appointed in 2016," Shahrol says.

1MDB leakages via siphoning borrowed funds for national projects - Shahrol

10.07am - The pattern of leakages from 1MDB from 2009 to 2013 was always via siphoning some of the funds borrowed for national projects, the court hears.

Former 1MDB CEO Shahrol Azral Ibrahim Halmi testifies this during examination-in-chief by lead DPP Gopal Sri Ram.

"I now realise the pattern of leakages from 1MDB from 2009 to 2013 has always been to borrow funds for projects that are ostensibly good for the nation and to siphon some of the borrowed funds.

"Throughout the years, the method used by the perpetrators has been refined and tightened up, in the sense that the talking points and mandated tight timelines for fundraising leave less and less room for discussion at the 1MDB management and BoD (Board of Directors) levels.

"For example, during the 2009 PSI (Petro Saudi International) Joint Venture, there were discussions at the BoD on the investment.

"Contrast this with the 2013 US$6 billion joint investment fund with IPIC (ADMIC or Abu Dhabi Malaysia Investment Company Limited) that was done solely via DCR (director's circular resolution) and Shareholder Resolutions," Shahrol says.

1MDB had RM30b debt in 2013, the burden was on M’sian gov't

10am - The court hears from a former 1MDB CEO that all the company's debts had to be carried ultimately by the Finance Ministry and the federal government due to the fact that it was wholly owned by the ministry.

Shahrol Azral Ibrahim Halmi, who served as 1MDB CEO from 2009 until his resignation in March 2013, testifies that the company was in a total debt of about RM30 billion then.

He says this during examination-in-chief by lead DPP Gopal Sri Ram.

Gopal: You were with 1MDB from 2009 to 2013, when you left there was about RM30 billion (debt), who carried this exposure ultimately?

Shahrol: MOF, and the government of Malaysia due to the fact that 1MDB is wholly owned by the MOF.

According to the witness, these debts include RM5 billion bonds issued by the company that was guaranteed by the MOF, and subsequent bonds totalling US$3.5 billion jointly guaranteed by IPIC and MOF.

On the joint guarantees, Shahrol testifies that in the event of a default, 1MDB was supposed to pay first and in the event it cannot pay, bondholders can call on the IPIC guarantee.

According to his testimony, IPIC would claim the money to pay the bondholders from MOF, as the parent of 1MDB.

He testifies that IPIC had made such a claim before, and this had been raised during one of 1MDB board meetings either in 2015 or 2016, which Shahrol says he cannot remember the exact date.

Ex-CEO: Najib never inquired about 1MDB money after scandal broke out

9.55am - Former prime minister Najib Abdul Razak had never asked 1MDB management what had happened to all the monies disbursed to various parties, the court hears from a star witness.

The witness, former 1MDB CEO Shahrol Azral Ibrahim Halmi, testifies that Najib had never called for a board meeting after news about the company's financial scandal broke out in 2014.

Gopal: After the 1MDB scandal broke, I believe in 2014, did the accused call you and ask you what happened to this money?

Shahrol: No.

Gopal : I mean all the monies that 1MDB had disbursed to the various parties.

Shahrol: No, he never did.

Gopal: Did he call you and other board members for a meeting?

Shahrol: No.

Gopal: As to ask the whereabouts of these monies?

Shahrol: Never.

RM18b 1MDB-Aabar Investment PJS deal was Najib's "baby": witness

9.45am - The RM18 billion strategic partnership deal signed between 1MDB and IPIC subsidiary Aabar Investment PJS was then premier Najib Abdul Razak's "baby", the court hears.

Former 1MDB CEO Shahrol Azral Ibrahim Halmi testifies this in regards to the deal signed during a ceremony covered by the media at the Prime Minister's Office in Putrajaya on March 12, 2013.

The ninth witness says the deal was also signed by then 1MDB chairperson Lodin Wok Kamaruddin (above) and Aabar chairperson Khadem Al Qubaisi.

He says the ceremony was held in the presence of Najib and Deputy Supreme Commander of the UAE Armed Forces General Sheikh Mohamed Zayed Al Nahyan.

"Najib's presence at the ceremony as well as at the PMO ceremony showed that he clearly had an interest, and it was Najib's baby. Najib's actions was in line with Jho Low's plans," Shahrol tells lead DPP Gopal Sri Ram during the examination-in-chief.

9.35am - Najib enters the dock, and the proceedings begin.

9.30am - Accused Najib Abdul Razak enters the court and takes a seat at the front row of the public gallery to wait for proceedings to begin.

Also seen in court is lead DPP Gopal Sri Ram and other DPPs, as well as lead defence counsel Muhammad Shafee Abdullah and other members of the defence team.

With 28 more pages to go, former 1MDB CEO Shahrol Azral Ibrahim Halmi is expected to wrap up his 270-page witness statement on the 16th day of Najib Abdul Razak's RM2.28 billion 1MDB trial today.

Judging by the pace of the examination-in-chief conducted by lead deputy public prosecutor (DPP) Gopal Sri Ram over the trial’s past five days since last week, the prosecution should be able to complete the questioning of the ninth witness Shahrol, which was not short of eye-opening revelations.

In yesterday's proceedings alone, Shahrol (photo) testified that he heard from wanted businessperson Jho Low that a fund-raising linked to a proposed joint-venture between 1MDB and Aabar - a subsidiary of International Petroleum Investment Company (IPIC) - would have a major impact on the then-upcoming 13th General Election.

Shahrol told the court that then prime minister Najib never once contradicted the instructions given to the witness by Jho Low, which led him (Shahrol) to believe that the fugitive financier had the mandate from Najib to act on the accused's behalf.

The prosecution witness also testified that over US$790 million in security deposit paid by 1MDB as part of the acquisition of power producer Genting Sanyen was purportedly misappropriated by Jho Low, among other sensational testimony.

As Shahrol is expected to finish the prosecution's examination-in-chief today, it would pave the way for Najib's defence team to cross-examine the witness. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.