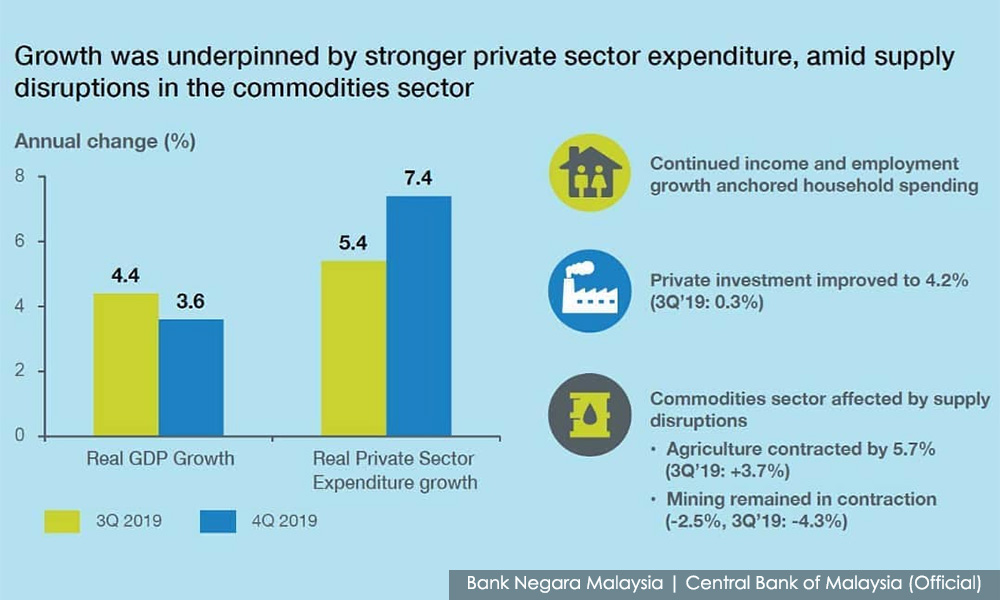

MALAYSIA’S economy expanded by 3.6% in the fourth quarter of 2019, dragging the full-year gross domestic product (GDP) growth at 4.3%, the lowest since the 2009 financial crisis amid supply disruptions in the commodity sector.

“GDP growth for 2019 would have been higher at 4.7% without the supply disruptions in the commodity sector,” said Bank Negara governor Nor Shamsiah Mohd Yunus.

In 2018, the GDP growth rate was 4.7%.

The Covid-19 outbreak is expected to affect Malaysia’s GDP growth for Q1 2020, depending on how the virus spreads and evolves, Nor Shamsiah said at a press conference today.

Headline inflation was lower at 1% for Q4 2019, pulling the overall 2019 inflation rate at 0.7%.

“If the outbreak could be contained in the very near future, the impact would not be as severe. But what if it was to prolong?”

The outbreak is likely to affect growth through lower arrival of foreign tourists and decreased spending on hotels, retail, transport and restaurants.

She said a number of measures suggested by Bank Negara would be introduced in the Covid-19 stimulus package.

Finance Minister Lim Guan Eng had said the stimulus package would be unveiled in early March at the latest and based on the impact of the virus.

For the year, growth will be supported by household spending, the realisation of approved private investment projects in recent periods and higher public sector capital spending, said Nor Shamsiah.

Nevertheless, there are downside risks to growth, she said.

These include uncertainties in external conditions arising from the ongoing virus outbreak, the various trade negotiations and geopolitical risks, as well as domestic factors, including weaknesses in the commodities sector and delays in project implementation.

Thus, two-way capital flows and exchange rate volatility should be expected.

Headline inflation in 2020 is projected to average higher than in 2019, but remain modest.

The trajectory of headline inflation will be dependent on global oil and commodity price developments and the timing of the lifting of the domestic retail fuel price ceilings.

“Underlying inflation is expected to be broadly stable, reflecting the continued expansion in economic activity and the absence of strong demand pressures,” she said. – Bernama

M’sia’s Q4 economic growth slumps to decade-low of 3.6pct

Malaysia’s economy grew 3.6 percent in the fourth quarter from a year earlier, the slowest pace in a decade, due to lower output of palm oil, crude oil and natural gas, and a fall in exports amid the US-China trade war.

The coronavirus outbreak in China will put further pressure on the economy this year, particularly in the first quarter, the central bank said on Wednesday after releasing the data.

The Malaysian government, which has forecast the economy to grow at 4.8 percent this year, is already working on a stimulus package for aviation, retailing and tourism because of the epidemic in its biggest trading partner.

The pace of expansion in October-December was well below the 4.2 percent rise forecast by analysts in a Reuters poll, and slower than 4.4 percent in the third quarter.

Full-year growth came in at 4.3 percent, below the government’s forecast of 4.7 percent and the weakest since 2016.

“The economy is still being supported by very firm private sector spending, and that is a positive development in our economy. More importantly, private investment might turn around,” Bank Negara Malaysia (BNM) Governor Nor Shamsiah Mohd Yunus told a news conference.

“But there are downside risks. It’s very difficult to predict how long it will take before (the virus) is contained… there are so many moving parts, but we do acknowledge it will impact us in the first quarter.”

BNM said foreign exchange rate volatility should be expected this year.

Malaysia’s economy, like many in Asia, came under heavy pressure last year from the escalating Sino-US trade war and softening global demand. The mining sector was particularly hard hit, and BNM responded with a preemptive cut to its benchmark interest rate in January.

While China and the United States agreed a preliminary deal last month, the fast-spreading epidemic has raised fresh global growth risks and heightened expectations of more stimulus in some of the more vulnerable economies.

Demand in China has slumped as the outbreak causes widespread business disruptions, and global tourism visits by mainland Chinese are down sharply as Beijing looks to contain the spread of the virus.

“The stimulus package will comprise of a number of measures. We have to look at the most optimum policy mix that would support the private sector, but at the same time ensure fiscal sustainability of the government continues to be sustained,” Nor Shamsiah said.

BNM said headline inflation in 2020 is expected to average higher than in 2019, but remain modest. – Reuters

BERNAMA / REUTERS

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.