The government has to act without fear and favour to investigate the names cited in the Pandora Papers to find out the possible wrongdoing and corruption that are taking place. The aim of the investigation is mainly to clear their names.

The government should make it mandatory for all MPs and assemblypersons to declare all their assets onshore and offshore. This will enable the authorities to detect any new asset or property owned by MPs, especially those who hold high positions in political parties.

One way to overcome corruption and money laundering activities kept in offshore accounts is by introducing a central registry for beneficial ownership of companies registered in Malaysia and those keeping funds in Labuan. It will play an important role in the transparency of ownership.

A beneficial owner of a company is the person who truly owns, enjoys and controls the company, even though the title to some form of property or security is in another’s name.

Many financial criminals use shell companies to hide money and particulars of ownership through nominees, which allows corrupt criminals to launder and avoid their ill-gotten wealth. The use of nominee directors and shareholders will help mask the beneficial owners of these companies.

On another note, the Pandora Papers is another avenue in which the Inland Revenue Board can look to see if the tax filings of the taxpayers are consistent with the information that is automatically exchanged and received through the Common Reporting Standards (CRS) by participating countries.

The objective of the CRS, developed by the Organisation for Economic Co-operation and Development in 2014, is to help the international community fight tax evasion.

Fight against corruption

The Pandora Papers is a large scale investigative journalists’ project by the International Consortium of Investigative Journalists (ICIJ), which is located in Washington DC. The ICIJ has been working on it with 140 media organisations in 117 countries.

The media acts as a bipartisan observer that reports to the public on the functioning of the democratic process. Within this framework, investigative journalism plays a crucial role in the fight against corruption.

The leaks include over 6.4 million documents, about three million images, more than one million emails and almost half a million spreadsheets.

The confidential documents reportedly incriminate hundreds of global wealthy elites, high-level officials, oligarchs and billionaires using shell companies to move wealth offshore, anonymously buy real estate or luxury goods for tax avoidance and corruption in their offshore accounts.

According to the ICIJ, over 35 percent of former and current leaders are facing allegations of fraud, corruption, money laundering and global tax evasion.

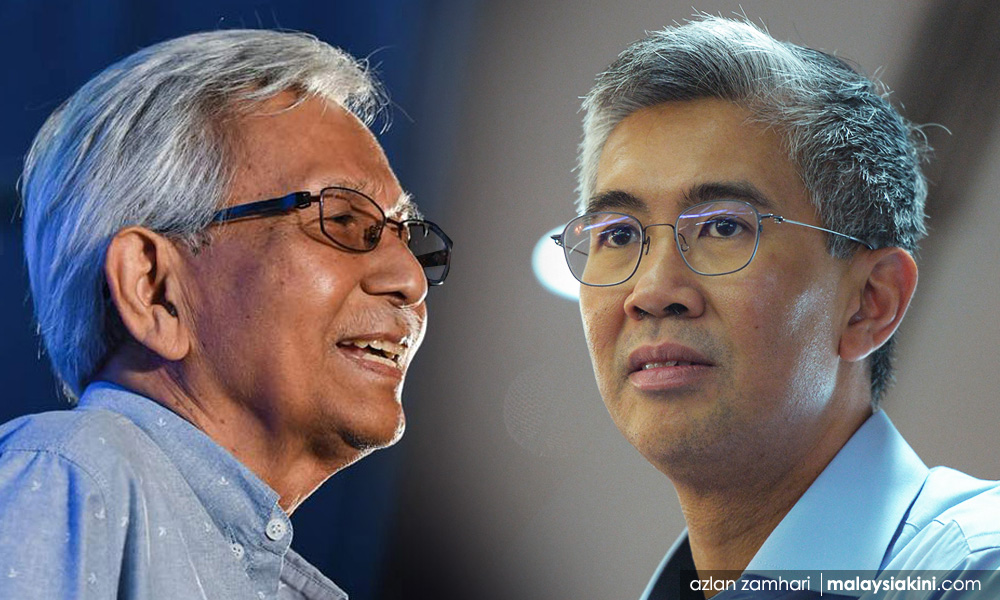

Among those named in the Pandora Papers were Malaysian businesspersons and politicians such as former finance minister Daim Zainuddin, the current finance minister Tengku Zafrul Abdul Aziz, Umno president Ahmad Zahid Hamidi, deputy finance minister Yamani Hafez Musa, former PKR treasurer William Leong and his wife Alice Chan Lee, businessperson G Gnanalingam and the parents of fugitive financier Low Taek Jho, better known as Jho Low.

The Pandora Papers also revealed the owners of more than 1,500 United Kingdom properties, including Qatar’s ruling family, the current finance minister of Pakistan, the king of Jordan, the Czech Republic prime minister and the Kenyan president.

The governments of Australia, Britain and Pakistan have launched investigations after the secret papers showed how the elite shielded their wealth.

Malaysia’s opposition leader failed to get a parliamentary debate over the revelations in the leaks involving several government officials from both political sides.

Offshore financial centres

Offshore financial centres (OFCs) are estimated to hold up to US$36 trillion (RM150 trillion) in cash, gold and securities, not including tangible assets such as real estate, art and jewels.

A few years ago, the Boston Consulting Group stated that Singapore held around one-eighth of the global stock of total offshore wealth while the International Monetary Fund (IMF) reported an estimated over 95 percent of all commercial banks in Singapore are affiliates of foreign banks which is a testament to its extreme dependence on foreign and offshore money.

The offshore service providers are located in the Cayman Islands, Switzerland, Hong Kong, the Bahamas, Luxembourg, Ireland, Singapore, Panama, Trinidad and Tobago and Seychelles, to name a few.

The offshore countries offer the following services: -

- Easy to set up companies

- Greater privacy, less regulations

- Strict banking secrecy their laws provide prevent the identification of the real owners of companies

- There is no, low or only nominal taxation or corporate tax

- Protection against local, political or financial instability

A loss to the country

An article in the Guardian wrote: "The discussion of offshore centres can get bogged down in technicalities, but the best definition comes from expert Nicholas Shaxson who sums them up as 'You take your money elsewhere, to another country, in order to escape the rules and laws of the society in which you operate.' In so doing, you rob your own society of cash for hospitals, schools, roads."

Many financial criminals have used offshore companies as fronts for drug trafficking, money laundering, weapon smuggling, monopolising industries, privatisation fraud and corrupt politicians and government officials.

An article in the Foreign Policy stated that money needed to pay for the pandemic is actually close at hand, hidden away in OFCs, more commonly known as tax havens.

Using offshore entities outside the country is not illegal, provided it is done for legitimate reasons. The offshore bank accounts in Malaysia are under the scrutiny of the Labuan Financial Services Authority (FSA).

But the practice is commonly used to dodge taxes. The main issue is how they got the large sums of money and their other sources of funds and wealth.

The UN Office for Drug Control and Crime Prevention stated that "the real issue, therefore, is not to issue blanket condemnations or make efforts to eliminate bank secrecy and offshore financial services, but to ensure that the legitimate uses of these facilities remain available, while making it much more difficult to use them directly for criminal activities or for laundering the proceeds of drug trafficking and other such forms of organised crime".

The Covid-19 pandemic has unfolded many weaknesses in government ministries which we thought were our strengths. With our B40, now B50, it is important for all taxpayers' monies to remain within Malaysia and not funnelled out to tax havens so that the funds can help rebuild Malaysians. - Mkini

AKHBAR SATAR is president of the Malaysian Association of Certified Fraud Examiners and former president of Transparency International Malaysia.

The views expressed here are those of the author/contributor and do not necessarily represent the views of MMKtT.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.