Contributors can start applying for a special withdrawal from their Employees Provident Fund (EPF) savings starting April 1 until 30, with the payouts beginning on April 20.

The applications can be done via the mobile app i-Akaun or the website portal at pengeluarankhas.kwsp.gov.my, according to a statement from EPF today.

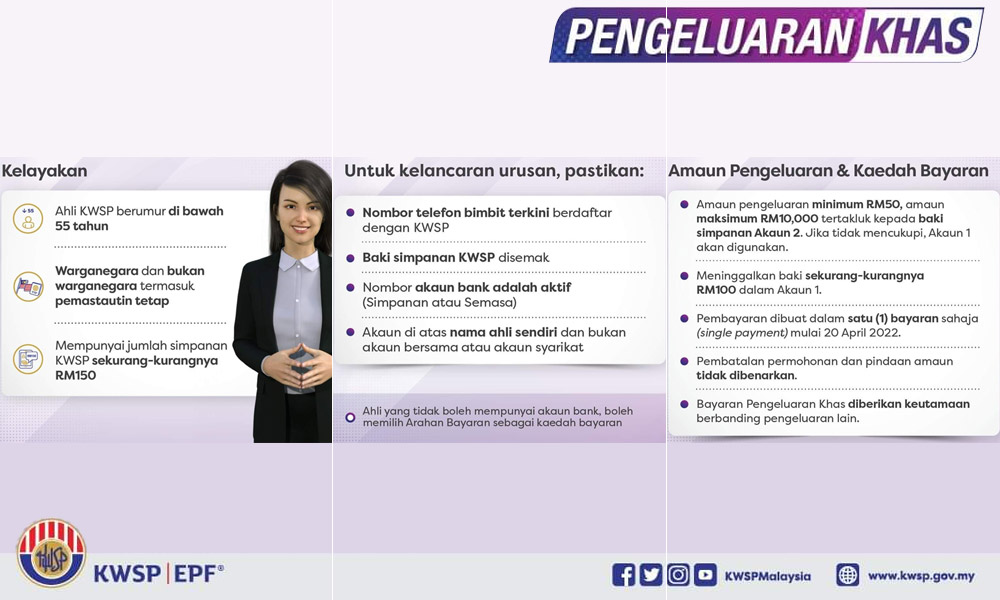

EPF said the payment will be made in a lump sum and credited into the savings or current accounts of the contributors. Joint accounts and accounts registered under a company name are not allowed.

Those who apply for the withdrawals can check the status of their application starting April 9 through the aforementioned website portal.

“Before submitting an application, members are encouraged to check the balance in their EPF account.

“This special withdrawal is meant to help members who are still affected by the Covid-19 pandemic in order to help with their pressing needs,” the statement read.

The EPF also reminded its members to consider their future income and only make withdrawals if they truly need it.

“Members can meet with advisory officials at EPF branches nationwide to get free advice about their EPF savings,” it added.

Up to RM10k available

The maximum amount that can be withdrawn is RM10,000 and the minimum is RM50. Members have to fully use up the funds in their Account 2 before they can access Account 1. They also have to maintain a minimum of RM100 in their account.

Prime Minister Ismail Sabri Yaakob had previously announced that the government will allow contributors to withdraw up to RM10,000 from their EPF savings for the fourth time.

He said this decision was made based on findings and research as a whole on the ongoing recovery phase of the Covid-19 pandemic as there are still those who are financially affected and trying to rebuild their lives.

Before that, the government had allowed three other EPF withdrawals schemes, namely i-Lestari, i-Sinar and i-Citra, amounting to RM101 billion, involving 7.34 million contributors when the pandemic hit in 2020.

Previously, Finance Minister Tengku Zafrul Abdul Aziz had warned that if the government allowed another similar one-off scheme, a maximum of RM63 billion could be withdrawn and this will force EPF to sell off some of its assets.

He also said that the EPF’s dividend for conventional savings for 2021 had been lowered due to the previous rounds of withdrawals. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.