An investigating officer from the MACC told the High Court in Kuala Lumpur today a complaint was lodged on Sept 4, 2018, against lawyer Muhammad Shafee Abdullah on suspicion of receiving two cheques, amounting to RM9.5 million, from Najib Abdul Razak.

Mohamad Farid Jabar, 37, said following the report, the lawyer was investigated under the MACC Act 2009, the Anti-Money Laundering and Anti-Terrorism Financing Act 2001 and the Anti-Money Laundering, Anti-Terrorism Financing and Proceeds from Illegal Activities Act 2001.

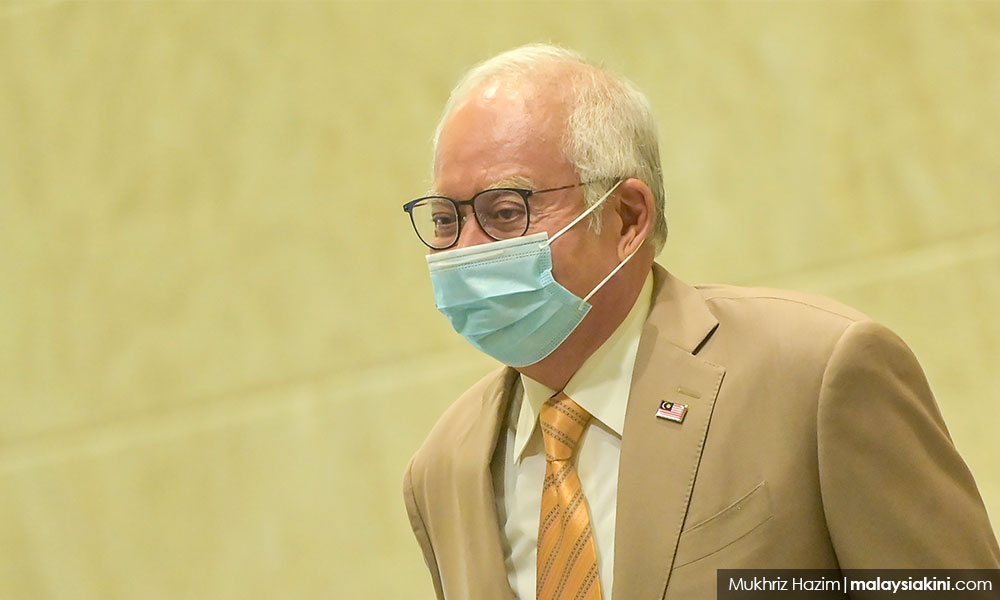

The eighth prosecution witness said the investigation revealed that Najib had issued two cheques, for RM4.3 million and RM5.2 million, respectively, under Shafee’s (above) name, on Sept 13, 2013, and Feb 17, 2014, at a meeting at the former prime minister's office in Putrajaya.

“Both the cheques were not paid in the name of the law firm Shafee & Co. The payment was not credited into any of the law firm’s accounts.

“The RM9.5 million is payment for legal advice provided by the accused to Najib, the party and the prime minister previously because the lawyer had provided legal service to clients from BN or Umno for 46 election petition files from 2004 and 2006.

“The legal fees of RM9.5 million are taxable accrued income, but Shafee did not report the income to the Inland Revenue Board (IRB)," said Farid, who is the last prosecution witness, when reading out his witness statement at Shafee’s trial over alleged money laundering and making false statements to the IRB.

He told the court that the lawyer also did not report the (RM9.5 million) income as Income From Previous Years That Were Not Declared in Part E of Form B of the Year of Assessment for 2013 and 2014.

On Sept 13, 2018, Shafee pleaded not guilty to two charges of receiving RM9.5 million which were proceeds from unlawful activities through two cheques issued by Najib which were deposited into his CIMB Bank Berhad account.

He was also charged with two counts of engaging in transactions resulting from illegal activities, namely submitting incorrect tax returns, which is in violation of paragraph 113 (1)(a) of the Income Tax Act 1967 for the financial years ending Dec 31, 2013, and Dec 31, 2014.

The prosecution was conducted by deputy public prosecutor Afzainizam Abdul Aziz, while Shafee was represented by lawyer Harvinderjit Singh.

The trial before judge Muhammad Jamil Hussin continues on April 27.

- Bernama

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.