The country's economy expanded at the fastest pace in more than two years in the second quarter on the back of domestic demand and robust exports, defying expectations for a slight slowdown.

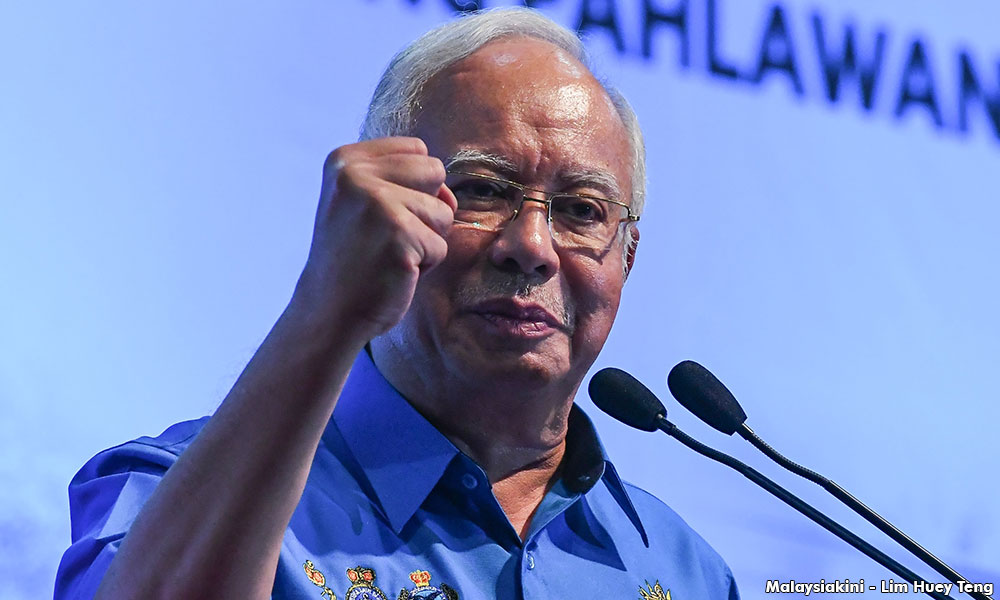

The strong performance is likely to add to speculation that Prime Minister Najib Abdul Razak will call early polls to take advantage of improving economic conditions and a fractured opposition.

Southeast Asia's third-largest economy grew 5.8 percent in April-June from a year earlier, data showed today, well above a Reuters poll forecast of 5.4 percent.

Growth accelerated from 5.6 percent in the first three months of the year, which had also been better than expected.

Following the data, the central bank raised its 2017 growth forecast to above 4.8 percent. The last forecast in March predicted growth of 4.3 to 4.8 percent.

"Based on the numbers from Q1 and Q2, we expect (full year) growth will go beyond our earlier forecast," Bank Negara governor Muhammad Ibrahim told a news conference.

Construction, services and manufacturing all grew at a faster pace in the quarter, offsetting weakness in mining and agriculture.

Muhammad expected domestic consumption and exports to improve further in the second half, but warned there were always risks related to global factors.

Exports grew 10 percent on-year in June, well below May's 32.5 percent. But analysts believe the slide may be due to seasonal factors, noting global demand still seems strong.

Fitch Ratings affirmed Malaysia's 'A-' credit rating with a stable outlook on Thursday, citing its strong economic growth and the government's ability to contain the impact of falling oil prices on its budget deficit.

"It is another recognition for the country's economic management," Najib tweeted earlier in the day about Fitch.

The current account surplus grew to RM9.6 billion over the second quarter from RM5.3 billion in January-March, due to a larger goods surplus and smaller services and primary income deficits.

Investment in stocks, bonds and other financial assets also improved sharply, with portfolio inflows rebounding to RM16 billion, compared with outflows of RM31.9 billion in the first quarter.

The turnaround may be partly due to improved confidence in the ringgit. It has firmed 4.5 percent against the dollar this year since hitting a 19-year low of 4.9880 on Jan 4.

But foreign direct investment dropped to RM8.3 billion, from RM17 billion in the first quarter. While FDI flows can be volatile, the weaker reading could point to some loss of economic momentum in the months ahead.

Election speculation

The central bank also said inflation is expected to ease further after moderating to four percent in the second quarter.

"Inflation will still be within the range of 3-4 percent, but we expect it to track lower for the rest of the year," Muhammad said.

The central bank has kept interest rates unchanged since July 2016.

But there is widespread concern about the rising costs of living, which Najib will need to temper before going to the polls.

He may be facing his toughest election yet as he looks to counter bad press from a corruption scandal involving state-owned fund 1MDB and a growing challenge from his former mentor turned foe, Dr Mahathir Mohamad.

On Wednesday, Najib brandished more than RM15 billion in housing packages for the country's majority ethnic group.

Last month, he gave cash handouts and offered debt waivers to palm oil farmers, a key voter base.

The handouts have fuelled speculation he will call an election earlier than the scheduled deadline of mid-2018.

"Although this is a cyclical upturn rather than a structural one, it certainly gives Najib some respite given the clouds hanging over the administration's management of the economy," said Trinh Nguyen, senior Asia economist of Natixis Asia in Hong Kong.

- Reuters

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.