The SME Association of Malaysia has urged Putrajaya to implement a blanket, automatic, and interest-free bank loan moratorium for all borrowers as a response to the "total lockdown" rule.

Its chairperson Michael Kang said 40 percent of small and medium enterprises (SMEs) have been forced to suspend their businesses.

"Many workers will lose their jobs in the coming months, especially in June and July. SMEs are in need of help immediately and an automatic moratorium is required to ease cash flow.

"With emergency powers, there is no issue of not being able to do so," Kang said in a statement today.

He said most SMEs are struggling to survive and their reserves are being exhausted.

He also urged SMEs to take the fight against the coronavirus seriously and ensure compliance with Covid-19 protocols.

Putrajaya's latest stimulus plan did not include an automatic bank loan moratorium.

Instead, Putrajaya offered two schemes: a three-month loan repayment moratorium or a 50 percent discount on loan repayments for six months; and a commensurate reduction in monthly repayments.

Those in the B40 category - defined as those qualified for Bantuan Sara Hidup (BSH) or Bantuan Prihatin Rakyat (BPR) welfare payments - or have recently lost their jobs, or are SMEs that are forced to close during the "total lockdown" period, are allowed to apply for the first scheme.

Anyone else experiencing a loss of income can apply for the second scheme.

Critics have pointed out that the schemes, albeit targeted, will not cover all who are affected by the lockdown.

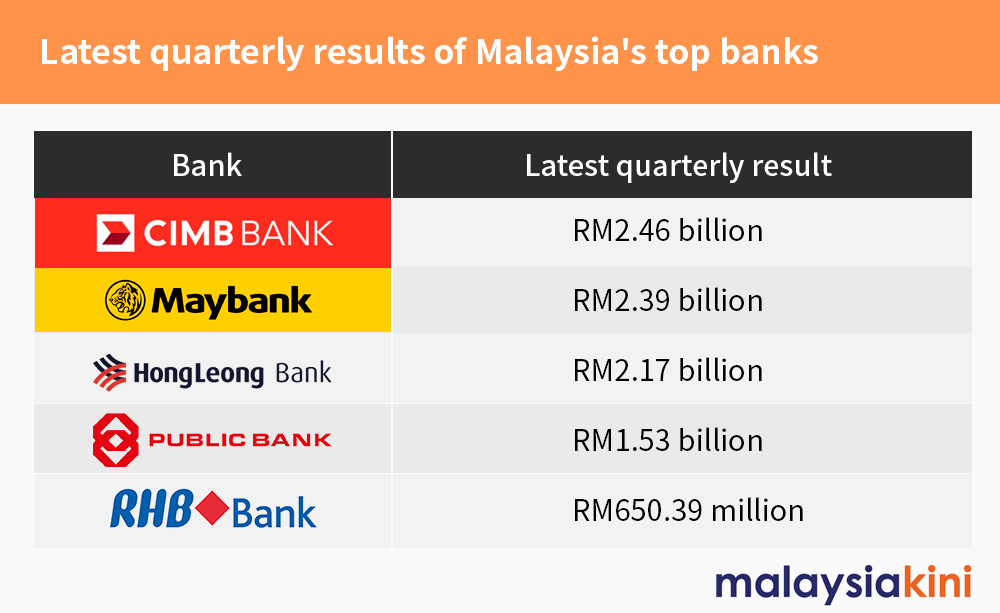

Moreover, critics said that banks have done very well during the pandemic, while most in the private sector are struggling.

Finance Minister Tengku Zafrul Abdul Aziz, who left the banking world to join the Perikatan Nasional government, argued that loan repayment moratoriums do not come at "zero cost" to the government.

He said that since the government will have to compensate banks, it would cost losses for the public funds which own equity in the banks.

He also claimed that using emergency laws to force the banks to impose the moratorium will erode investor confidence. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.