Two days from now, the great debate on whether to save controversial oil and gas company Sapura Energy will take place between PKR president and Pakatan Harapan head Anwar Ibrahim and former PM Najib Abdul Razak. It will be interesting to see how they justify their respective positions.

Anwar is expected to be against saving Sapura Energy to conserve funds to be put to better use and for wider benefit, while Najib is expected to be for its saving mainly to preserve a vital industry presence for bumiputeras and to save jobs.

So far, the initial sparring has been between PKR vice-president and aspiring deputy president Rafizi Ramli who said that an executive director, referring to former CEO Shahril Shamsuddin, had received nearly RM1.1 billion in pay and benefits between 2009 and 2021.

The issue, however, is much more complicated and should involve questions of how exactly the energy services provider will be saved, what will be the new business model, what chances of survival they have and who will be saved at the end of the day. Not exactly stuff that can be debated easily.

It becomes more complex because national unit trust operator Permodalan Nasional Bhd (PNB) which operates funds of RM337 billion, became the major shareholder of Sapura Energy in September 2018.

It subscribed for excess rights shares to the tune of RM2.7 billion to take its stake up to 40 percent from just 12.2 percent previously. Further, it subscribed for almost all of an RM1 billion convertible loan issue, taking total new investments to almost RM3.7 billion.

These new investments are now less than one-tenth of the sum of RM3.7 billion in additional amounts invested, leading to criticism of the PNB move. Najib correctly pointed out that the investments were made during Harapan’s tenure in government. But surely, it is a move that he supports since he advocates saving Sapura Energy.

Huge losses

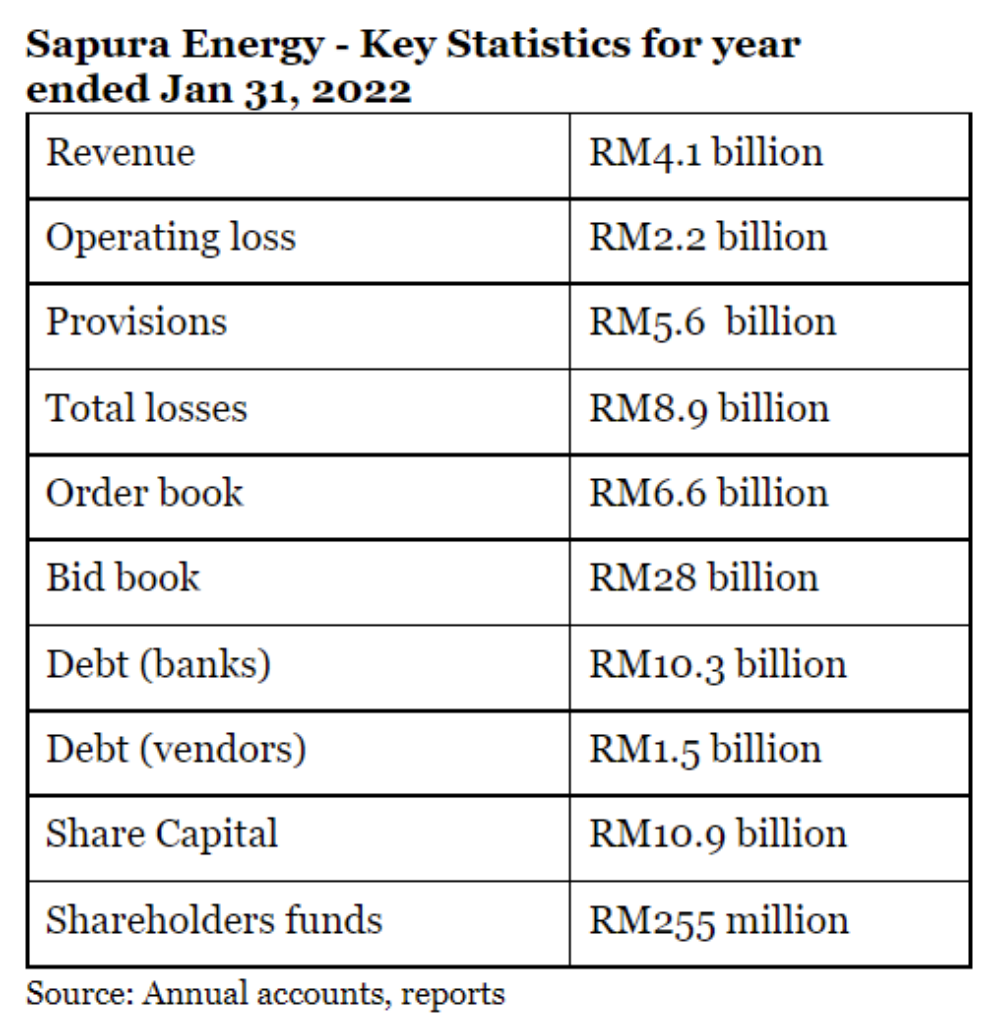

The table below shows that Sapura Energy’s financial position to be quite bad with huge losses in the books, most of it caused by provisions. But considering a bid book of RM28 billion, business possibilities are there if margins can be improved. Much of the losses are due to one-off provisions.

In March, Najib had urged the government to protect Sapura Energy from bankruptcy by providing loans or instructing Petronas or Khazanah Nasional to take over ownership from PNB, in other words an outright bailout.

Rafizi however retorted that Sapura’s problems can be solved without Najib’s proposal of a government bailout.

“Under the new Sapura Energy leadership which is lined with distinguished professional leaders in the country, I am confident they are trying their best to save Sapura Energy without dragging in the rakyat’s money as Najib has been pushing for,” Rafizi said in a statement.

Among those who Rafizi is referring to is probably the new CEO of Sapura Energy Mohd Anuar Taib effective Oct 1, 2020, as part of a six-month transition then.

Despite PNB becoming the major shareholder way back in September 2018, it took two years for its nominee to take over at the helm, an unusual lapse of control which probably cost it dearly as the share price continued to slide in the absence of any signs of a turnaround.

In an extensive interview earlier this year, Anuar said the main cause of Sapura Energy’s problems were from legacy contracts which were obtained at very thin margins to fill the order books. These are now being reviewed and restructured.

He further added that the banks which lent Sapura Energy some RM10.3 billion will be asked to take a haircut. In addition, the group owed vendors RM1.5 billion. Anuar’s plan is to restructure debt, and get financing to pay the vendors and resuscitate the business.

But the sticking point is likely to be the amount of haircut, which Anuar wants to be 75 percent, in other words he wants debt forgiveness of three-quarters of RM10.3 billion or RM7.7 billion. That’s a hefty sum to forgive - the banks, which include some big names like Malayan Banking and RHB, and who have institutional shareholdings such as PNB and the Employees Provident Fund.

That’s not something the banks are likely to agree with. This is although on March 10, the High Court granted an order under Section 366 of the Companies Act to allow Sapura and its 22 subsidiaries to summon meetings with creditors to consider and approve a proposed scheme of arrangement and compromise as part of its debt restructuring plan, theEdge reported.

Debt converted to shares?

What could be more palatable is to have an equity option for the banks. The debt could be converted to shares, giving them a sizable stake in Sapura Energy and diluting out existing shareholders. The financing then follows.

According to a statement from Sapura Energy, PNB and associated funds emerged as the single largest shareholder with 40 percent shareholding in Sapura Energy after the September 2018 equity restructuring.

Sapura Technology Sdn Bhd will continue to be a significant shareholder, being the second largest after PNB, with a direct and indirect shareholding of 16.3 percent. Minority shareholders comprising both local and foreign participation will hold a total of 42.2 percent.

By issuing shares to creditors in return for forgiveness of the debt, existing shareholders' stakes would be diluted and the rescue will therefore not be of the shareholders themselves.

But the downside is PNB’s investment will likely remain depressed and a smaller effective stake - the price it has to pay for a wrong decision. However, with RM337 billion in funds under management, it will be well able to absorb a loss of RM3 billion or so which will be less than one percent of total assets under management.

Meantime, there is little the Anwar-Najib debate will likely achieve in terms of moving towards the settlement of the Sapura Energy conundrum and will probably focus on the politics of it and scoring points, each one at the expense of the other.

The real solution for Sapura Energy will be to re-establish and grow a viable business through a market-driven restructuring which, while requiring injection of funds, does not necessarily involve the bailout of shareholders who should bear the brunt of all business losses since they gain the benefits too.

In fact, that should be the principle of all restructuring involving public funds and government-linked companies - save the business if there is a viable way of salvaging it, but let the shareholders bear the losses of the past. If the business is not worth saving, just close it down.

It’s not about saving Sapura Energy but how, and whether it is worth saving. - Mkini

P GUNASEGARAM, a former editor at online and print news publications, and head of equity research, is an independent writer and analyst.

The views expressed here are those of the author/contributor and do not necessarily represent the views of MMKtT.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.