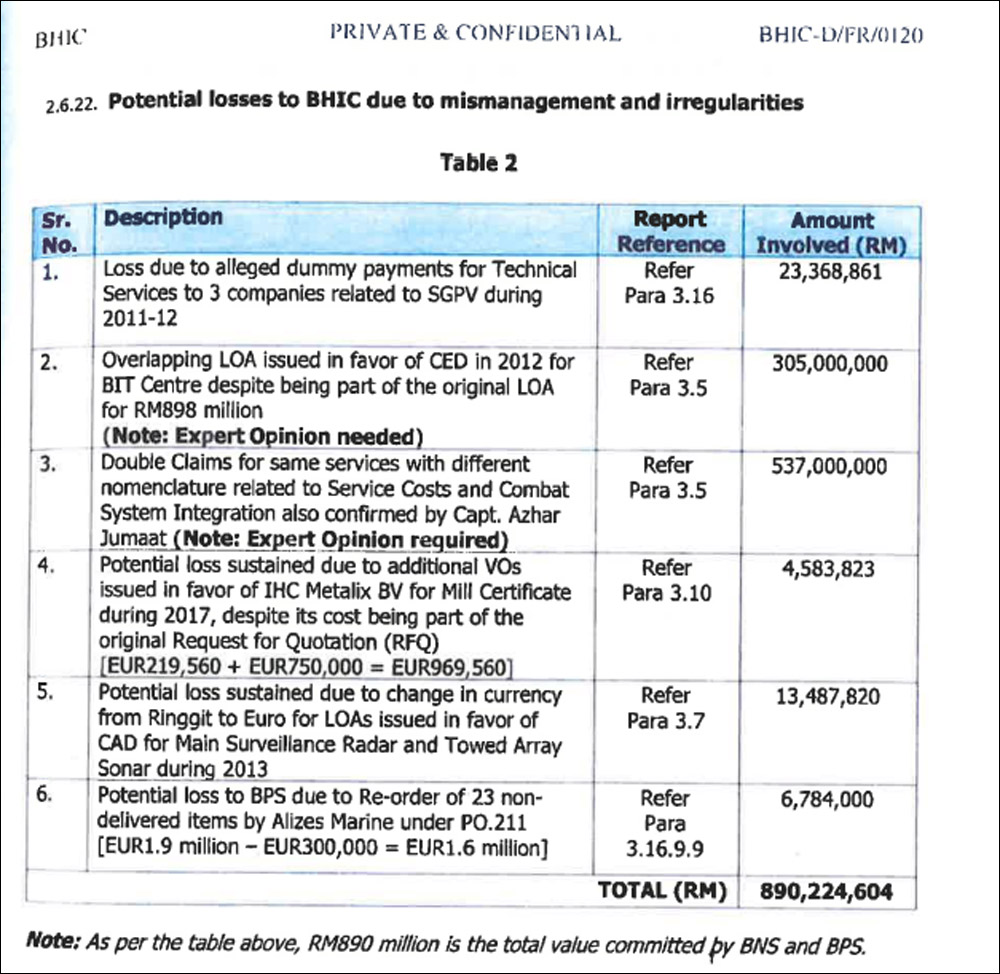

An estimated RM890 million may have been lost in the early stages of the littoral combat ship (LCS) project, according to a forensic audit.

The audit report, ordered by Boustead Heavy Industries Corporation (BHIC), said the potential losses stemmed from six cases.

BHIC is the parent company of Boustead Naval Shipyards (BNS), the main contractor of the LCS project.

The audit was restricted to the period from the start of the project until BHIC’s financial year 2014.

However, the internal auditor said some decisions’ cascading effect would impact transactions until 2018.

The first case listed as having caused potential losses was alleged dummy payments totalling RM23.37 million for technical services to three companies in 2011 and 2012.

Details on this incident are unclear, as many sections pertaining to it have been redacted in the audit.

However, the parts still readable implicated Zainab Mohd Salleh and her husband, Abdul Latiff Ahmad.

PKR deputy president Rafizi Ramli claimed this refers to Minister in the Prime Minister’s Department Abdul Latiff Ahmad, who was formerly a deputy defence minister under Ahmad Zahid Hamidi.

Abdul Latiff has denied that Zainab is his wife.

The audit report listed Zainab as a director of three companies - Sousmarin Armada Sdn Bhd, Alizes Marine Malta and Alizes Marine Labuan.

“Our investigation has confirmed that (Sousmarin) was owned by the same person who impersonated Alizes Marine France by having a company named Alizes Marine Ltd Labuan to get the funds diverted through Singapore,” it said.

Of the RM23.37 million allegedly misappropriated, RM8.26 million went through Sousmarin.

In another case, the auditor said Boustead Penang Shipyard (BPS) may have lost RM6.78 million from having to re-order 23 non-delivered items by Alizes Marine.

The elaboration and details on this case have been redacted.

Meanwhile, the report said another three sources of potential losses over the LCS project were linked to Contraves Advanced Devices Sdn Bhd (CAD) and its subsidiary Contraves Electrodynamics Sdn Bhd (CED), totalling RM855 million.

BHIC has a 51 percent stake in CAD, while the remaining 49 percent is owned by German defence contractor Rheinmetall Air Defence (RAD).

Despite having majority ownership, the audit found that BHIC’s board had relinquished management of CAD to RAD.

In one case, the audit found that an overlapping letter of approval (LOA) had been issued for the development of a Boustead Integrated Technology (BIT) Centre.

The audit noted that the cost of developing the centre had already been included in an RM1.185 billion LOA to develop the LCS’ combat management system (CMS) to CAD.

This was awarded to CAD on April 9, 2012.

However, CAD reassigned the project to CED on the same day, and six months later, an additional LOA for RM305 million was issued to develop the BIT Centre.

The audit said the supplemental agreement was “based on a changed nomenclature, and it could not be confirmed, based on evidence, that it was necessary”.

The second case involving CAD is also tied to the RM1.185 billion LOA.

The auditor said that during its review and discussions with BNS chief executive officer Azhar Jumaat, it was found that several components under the LOA, totalling RM537 million, appeared to be duplicated with different nomenclatures for the same component.

“One should note that the management of BNS agreed and issued LOAs which directly impacted the overall cost of the LCS programme,” the report stated.

The third case involving CAD involves an unfavourable currency change in several agreements.

The report stated that in October 2013, CAD was at risk of incurring substantial losses due to the ringgit weakening against the euro.

The audit said that CAD should have taken steps to minimise losses.

However, then-BNS managing director Ahmad Ramli Mohd Noor, acknowledging concerns expressed by CAD’s bosses, proposed changing the currency in LOAs - on the main surveillance radar and towed array sonar - from ringgit to euro.

“This was an unexpected move since his decision was in conflict as he was also expected to take care of the larger interest of BHIC group, which he was representing on the CAD board,” the audit said.

The audit said concerns over forex losses expressed by the LCS’ audit committee were ignored.

The currency change was implemented on Nov 1, 2013 - which resulted in a net loss of RM13.49 million on that day itself due to the difference in currency rates.

The remaining source of potential losses for BHIC, the audit report noted, involved the appropriation of hull construction steel kits from Dutch company IHC Metalix.

The audit noted that additional variation orders worth RM4.58 million had to be issued in favour of IHC mill certificates, despite the certificate cost already being included in the original quotation.

The audit noted that the LCS project’s commercial team originally favoured a different company to supply the hull kits, which made a cheaper but “technically superior” bid.

However, the LCS project director instructed the team to renegotiate with IHC to see if they could match the competitor’s bid - an order which the team leader protested and was removed from the project.

The LCS project is an RM9 billion project meant to deliver six ships to the navy.

The first ship was supposed to be delivered in 2019, but to date, all vessels are still under construction. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.