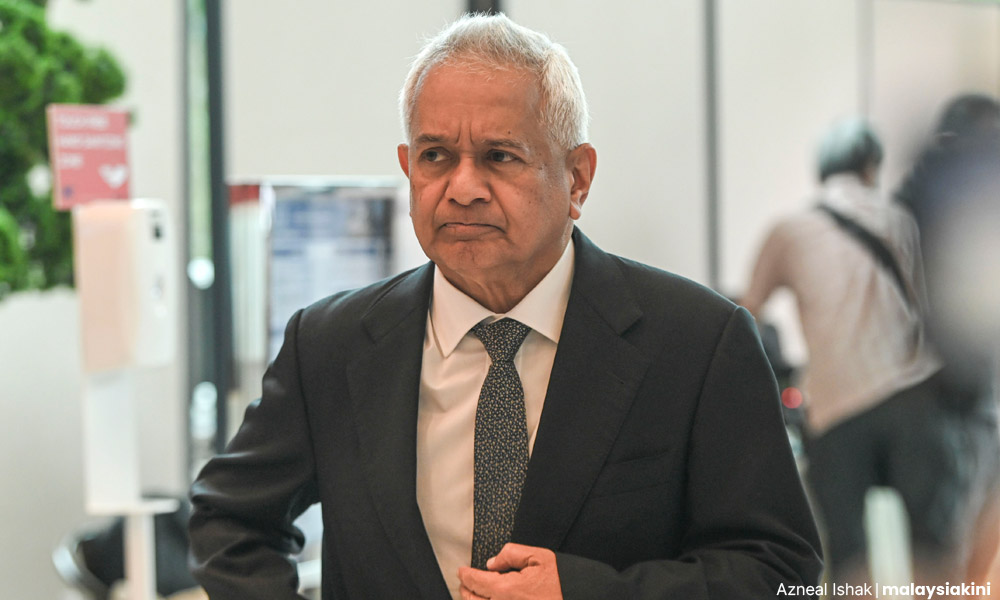

It is good that Prime Minister Anwar Ibrahim has appointed outspoken former second finance minister Johari Abdul Ghani, who has strongly criticised the Goldman Sachs-1MDB deal, to head a task force to investigate deals at 1MDB.

He seems to know the issues.

But he should be given the brief to investigate a number of other deals too.

This includes the flawed 1MDB-IPIC settlement, the possible complicity of China in the 1MDB deal involving some RM30 billion, a settlement with Najib Abdul Razak’s stepson Riza Aziz, and the question of why more people are not being charged in the 1MDB scandal.

Let’s take each in turn, starting with Goldman Sachs.

The Goldman Sachs Deal - shortfall of RM22.5 billion

As I explained in this article titled “Probe multi-billion Goldman-Muhyiddin govt settlement”, the deal was worth effectively just US$2.5 billion cash because the remaining US$1.4 billion (RM6.3 billion) was a guarantee if there were a shortfall in recoveries of assets purchased with proceeds from the Goldman Sachs arranged bond issue.

The likelihood of a shortfall was next to nothing.

The previous attorney-general, Tommy Thomas, who had filed 17 criminal charges against current and former directors of Goldman Sachs, was looking at a settlement closer to US$9 billion (RM40.5 billion) while then-finance minister Lim Guan Eng at the time said he was looking for US$7.5 billion (RM33.7 billion).

Using the lower figure, that’s a shortfall of US$5 billion or RM22.5 billion.

The IPIC Deal - shortfall of RM18 billion

In this deal, Thomas had set aside an agreement, which he called fraudulent, and was claiming US$5.78 billion (RM26 billion) from Abu Dhabi’s sovereign wealth fund, International Petroleum Investment Company, as I explained in this article titled “Govt must explain RM18b gap in 1MDB-IPIC deal”.

The gist of the story is this. 1MDB’s 2012 bonds totalling US$3.5 billion (RM15. 7 billion) were guaranteed by IPIC.

But in 2015, Najib renegotiated the deal. Under the new terms, IPIC agreed to lend US$1 billion (RM4.5 billion) and take on all interest and principal payments.

In return, 1MDB was to transfer assets of an equivalent value to IPIC, effectively indemnifying 1MDB’s performance.

“This was a fraud on a grand scale. The binding term sheet was self-inflicted upon Malaysia because the government assumed liability when it was previously not liable under any of the loans or bonds,” Thomas explained.

Thomas set aside the agreement based on fraud and was pursuing a US$5.78 billion (RM26 billion) settlement. But the government under Anwar agreed to a mere US$1.8 billion (RM8.1 billion), a shortfall of US$3.98 billion or some RM18 billion. No explanation has been given.

China’s complicity in 1MDB - a shortfall of some RM30 billion

This is one of lesser reported parts of the deal and lies shrouded in a veil of secrecy over the deal that the Pakatan Harapan government under Dr Mahathir Mohamad and with negotiations led by Daim Zainuddin did with China - in terms of East Coal Rail Link (ECRL) at a project cost of anywhere between RM55-75 billion.

In an interview with The Edge in early June 2018, barely three weeks after he came to power as prime minister, Mahathir said the ECRL contract was ”strange”.

The Edge, quoting sources in the same article, said the RM55 billion contract then was inflated by RM20 billion to meet some of 1MDB’s debt obligations and other associated payments.

As I explained in this comment titled ”China contracts, 1MDB and a further RM30 billion loss”, finance minister Lim revealed a new shocker - that there were two pipelines involving a total of RM9.4 billion awarded to a China company and to be undertaken by Suria Strategic Energy Resources (SSER), a wholly-owned subsidiary of the Finance Ministry set up specifically for the projects on May 19, 2016.

This was confirmed in a later report which I referred to in this comment, which made reference to the RM30 billion losses at 1MDB due to the over-pricing of the ECRL by about RM20 billion and the RM10 billion pipeline to nowhere project.

On top of that, rumours continue to swirl that China is sheltering Low Taek Jho, popularly known as Jho Low, the main culprit in the 1MDB scandal who pulled the strings under the authority given by Najib.

The bottom line is that there was a deal with China to plug the RM30 billion hole in 1MDB. But what happened to this money? Was it ever recovered?

This is something that Johari must get to the bottom of. It seems like only a few people, including Daim, seemed privy to how this deal eventually panned out.

Riza Aziz’s sweetheart deal - some RM5.5 billion in fines foregone.

Riza Aziz is Najib’s stepson and the son of his wife Rosmah Mansor.

As I said in this article titled ”Rotten deal over Riza Aziz must be investigated”: “Given the charges and punishment Riza Shahriz Abdul Aziz was facing, the deal offered by the prosecution to him over his US$248 million (about RM1.1 billion) money-laundering charges was a rotten one for the government, raising serious questions as to how the prosecution can even agree to such a deal. It needs to be investigated.”

For that, Riza Aziz would relinquish claims on US$108 million (RM486 million) already seized by the US Department of Justice - he had to anyway because it was 1MDB money.

In return, he was given a discharge not amounting to an acquittal, an astonishing deal. He was facing some 75 years in total prison terms and fines of five times the money laundered or RM5.5 billion. Why?

If you think, I am the only one who thinks this should be investigated, you are wrong. Former MACC chief commissioner Dzulkifli Ahmad called on a former judge, the late Gopal Sri Ram, to explain why the prosecution agreed to a plea bargain in Riza Aziz’s billion-ringgit money laundering case.

Since Riza Aziz was not acquitted but given a discharge, it might be possible to review this case.

Why have others not been charged over 1MDB?

There must be numerous 1MDB officials and other associates who have not been charged for offences.

Sure, many turned state witnesses, but still, can they be allowed to go scot-free? Take Tim Leissner, who turned state witness in the Goldman Sachs case - he still had to plead guilty to some charges.

There are no doubt other instances that need to be investigated and one hopes that these will be done properly. What is called for is for investigations to go beyond politics and who was in power at the time.

There is a need to unflinchingly investigate and get to the heart of the issues, no matter how unpleasant the outcome. Otherwise, it would be another task force which drives around in circles but goes nowhere. - Mkini

P GUNASEGARAM wrote the first book on 1MDB titled, “1MDB: The Scandal that Brought Down a Government”.

The views expressed here are those of the author/contributor and do not necessarily represent the views of MMKtT.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.