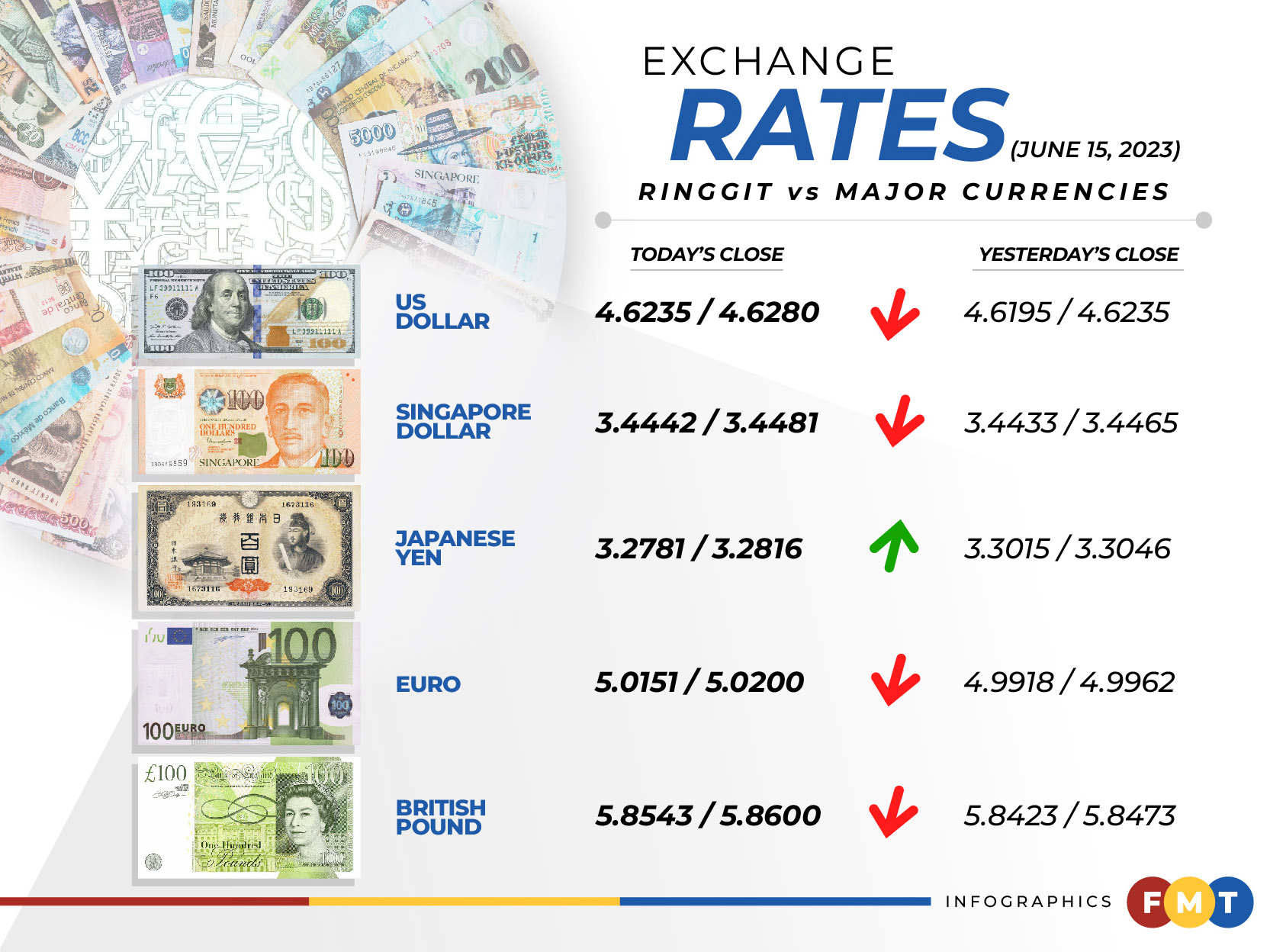

At 6pm, the local currency finished at 4.6235/4.6280 against the greenback from 4.6195/4.6235 at Wednesday’s close.

SPI Asset Management managing partner Stephen Innes said the market was prepared for a Fed pause and guidance to one additional 25 basis points (bps) hike in June, but the Fed changed its guidance higher to 50bps, implying two hikes.

“That guidance was more hawkish than what the market expected, and in turn, the US dollar strengthened against the ringgit. But after the initial hawkish shock is digested, the market will place more weight on economic data and inflation metrics rather than the Fed guidance.

“And with US inflation expected to head lower this summer, I think the US dollar could weaken a tad, and we could be nearing peak ringgit weakness, especially with China now stimulating the local economy, which should boost Malaysian exports to China,” he told Bernama.

Meanwhile, Bank Muamalat Malaysia Bhd chief economist Afzanizam Rashid said the projected Fed Fund Rate of 5.6% by year-end from the previous forecast of 5.1% suggested that the Fed would remain hawkish on their monetary policy stand.

“This may have contributed to the strength of the US dollar today,” he added.

Meanwhile, the ringgit traded mostly lower against a basket of major currencies.

It advanced against the Japanese yen to 3.2781/3.2816 from 3.3015/3.3046 but depreciated versus the British pound to 5.8543/5.8600 from 5.8423/5.8473 on Wednesday, and fell vis-a-vis the euro to 5.0151/5.0200 from 4.9918/5.9962 yesterday.

However, the local currency traded mixed against other Asean currencies.

The ringgit improved against the Thai baht to 13.2783/13.2981 from Wednesday’s 13.3192/13.3380 but eased against the Singapore dollar to 3.4442/3.4481 against 3.4433/3.4465 yesterday.

It was slightly higher versus the Indonesian rupiah at 309.1/309.6 from 309.8/310.3 but remained unchanged against the Philippine peso at 8.26/8.27. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.