KUALA LUMPUR: The ringgit extended its recovery momentum and closed marginally higher against the US dollar as risk appetite improved amid weaker greenback sentiment.

Bank Muamalat Malaysia Bhd chief economist Afzanizam Rashid said investors reacted accordingly to the higher-than-expected US jobless claims of 261,000 last week, compared with the consensus estimate of 235,000.

The latest data indicated that the US economy is softening, leading to the devaluation of the greenback.

Afzanizam predicted that the US Federal Open Market Committee meeting scheduled on June 13 and 14 would be closely monitored by market players.

“This week, we saw the Reserve Bank of Australia and Bank of Canada unexpectedly raising their policy rates by 25 basis points.

“So the perception is that the US Federal Reserve might follow suit as some of the members are still leaning towards a hawkish stance,” he told Bernama.

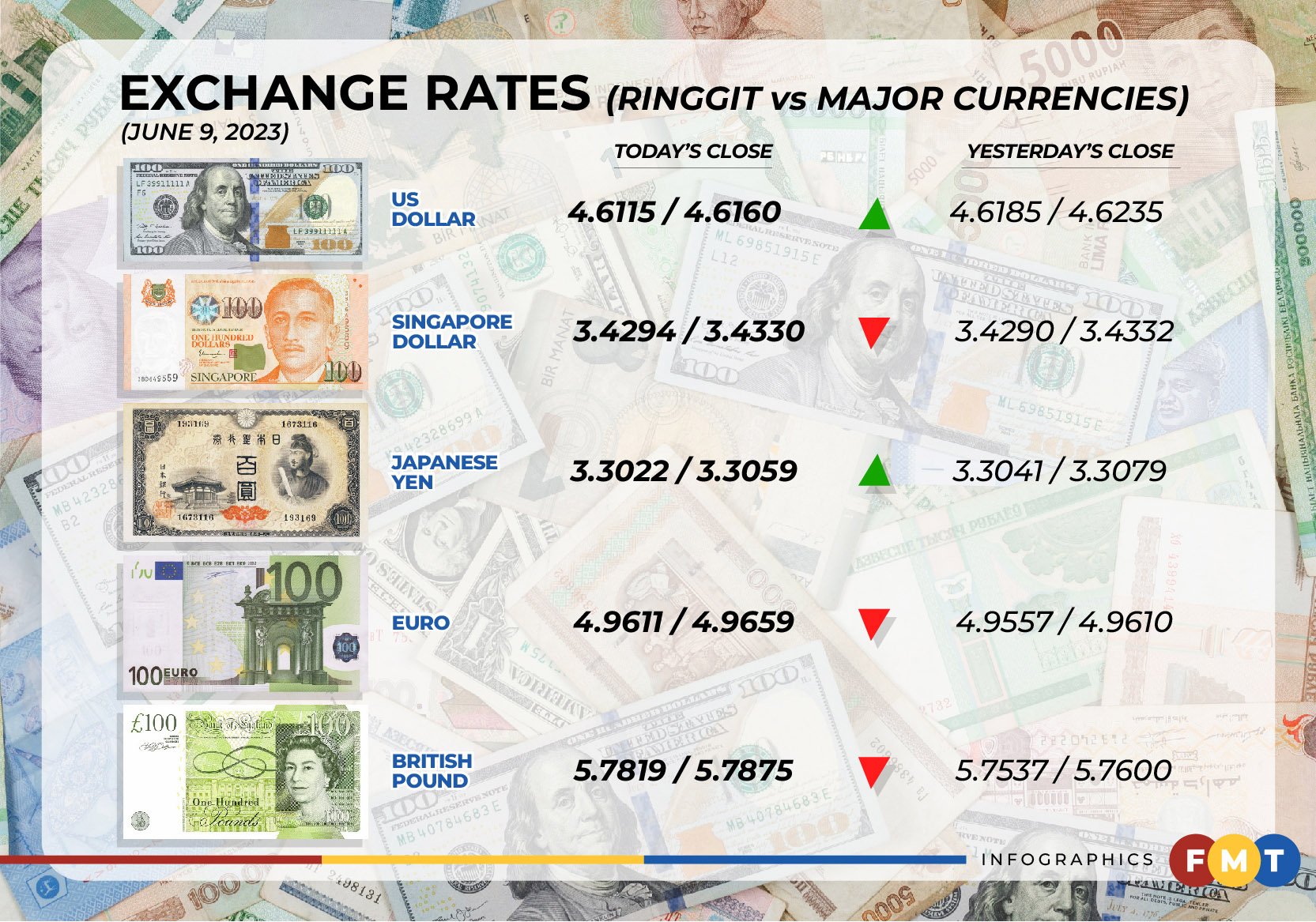

At 6pm, the local currency ended at 4.6115/6160 versus the greenback compared with yesterday’s closing of 4.6185/6235.

Meanwhile, the ringgit traded mixed against a basket of major currencies.

It depreciated versus the British pound to 5.7819/7875 from 5.7537/7600 at yesterday’s closing, fell vis-a-vis the euro to 4.9611/9659 from 4.9557/9610 yesterday, but rose against the Japanese yen to 3.3022/3059 from 3.3041/3079 previously.

The local currency also traded mostly lower against other Asean currencies.

The ringgit decreased against the Singapore dollar to 3.4294/4330 from 3.4290/4332 on Thursday, went down versus the Thai baht to 13.3196/3376 from 13.2647/2848, and weakened against the Indonesian rupiah to 310.6/311.2 from 310.0/310.5 yesterday.

The local currency was unchanged against the Philippine peso at 8.23/8.24. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.