An analyst said the lack of momentum was due to investors shifting focus on three big central bank meetings this week.

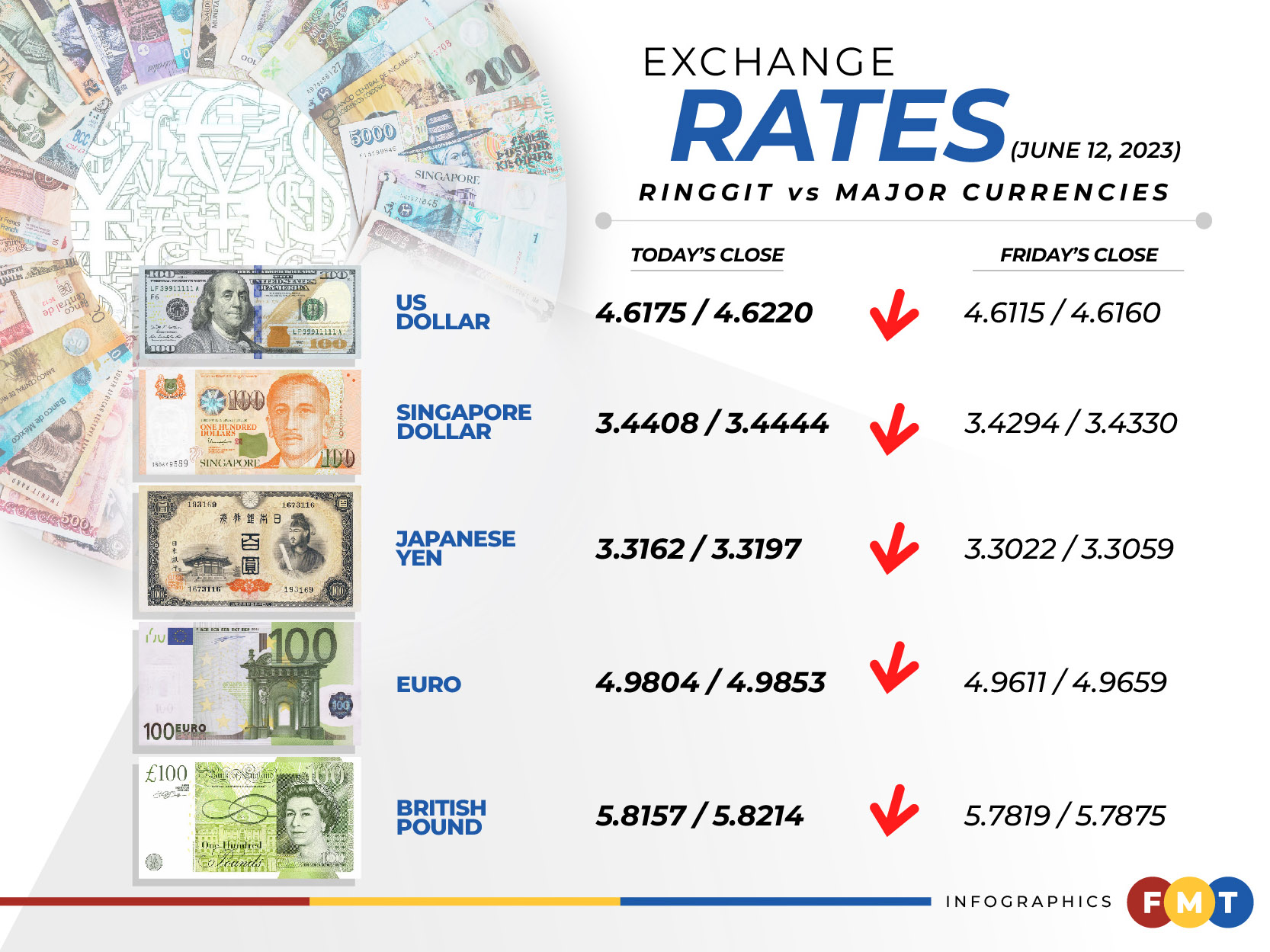

At 6pm, the local currency ended at 4.6175/4.6220 versus the greenback compared with Friday’s close of 4.6115/4.6160.

SPI Asset Management managing partner Stephen Innes said the ringgit struggled to decouple from the weaker yuan ahead of China’s activity data due on Friday.

“Outside of the region, the focus this week is on the three big central banks, the US Federal Reserve (Fed), European Central Bank (ECB) and Bank of Japan.

“While the prospect of an ECB rate hike is negative for the ringgit versus European currencies, all Asian foreign exchanges eyes are on the Fed which is expected to deliver a hawkish hold and signal a rate hike in July, which is still hurting the ringgit from an interest rate differential perspective,” he told Bernama.

However, the ringgit investors remained concerned about China’s economy and how disappointing the consumer and industrial recovery has been amid the reopening bounce.

“Hence, if this week’s China activity data is bad, it could force the People’s Bank of China to weaken the currency through a rate cut, and then the ringgit will get dragged weaker.

“A triple negative of a still hawkish Fed, another rate hike from the ECB, and a possible rate cut from China could play out negatively for the locals over the short-term,” said Innes.

Meanwhile, the ringgit traded lower against a basket of major currencies.

It depreciated versus the British pound to 5.8157/5.8214 from Friday’s closing of 5.7819/5.7875, fell vis-a-vis the euro to 4.9804/4.9853 from 4.9611/4.9659, and slipped against the Japanese yen to 3.3162/3.3197 from 3.3022/3.3059 previously.

However, the local currency traded mixed against other Asean currencies.

The ringgit decreased against the Singapore dollar to 3.4408/3.4444 from 3.4294/3.4330 on Friday, went down versus the Thai baht to 13.3400/13.3599 from 13.3196/13.3376, almost flat against the Indonesian rupiah to 310.6/311.0 from 310.6/311.2 and stood at 8.23/8.25 against the Philippine peso from 8.23/8.24. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.