KUALA LUMPUR: The ringgit ended lower against the US dollar for the third consecutive day today as global uncertainties continue to weigh on the local currency’s performance.

The local note’s negative trend came in light of US Federal Reserve (Fed) chairman Jerome Powell’s expected hawkish bias in his congressional testimony later tonight, and fading optimism about China’s economy.

SPI Asset Management managing director Stephen Innes said the combination of a more hawkish Fed stance against the backdrop of weaker sentiment in China is affecting the local currency.

“The yuan trades on the backfoot, and that typically means a weaker ringgit, compounded by the expectation of Powell sounding more hawkish than dovish during his speech and follow-up question-and-answer with Congress later tonight,” he told Bernama.

Commenting on global central banks’ moves and impacts on the ringgit, Innes said the Fed is generally the market maker when it comes to Asian currencies.

“I expect the US dollar to trade (against the ringgit) at 4.68 unless the Fed eases back or the US jobs data turns weak and core inflation falls significantly,” he added.

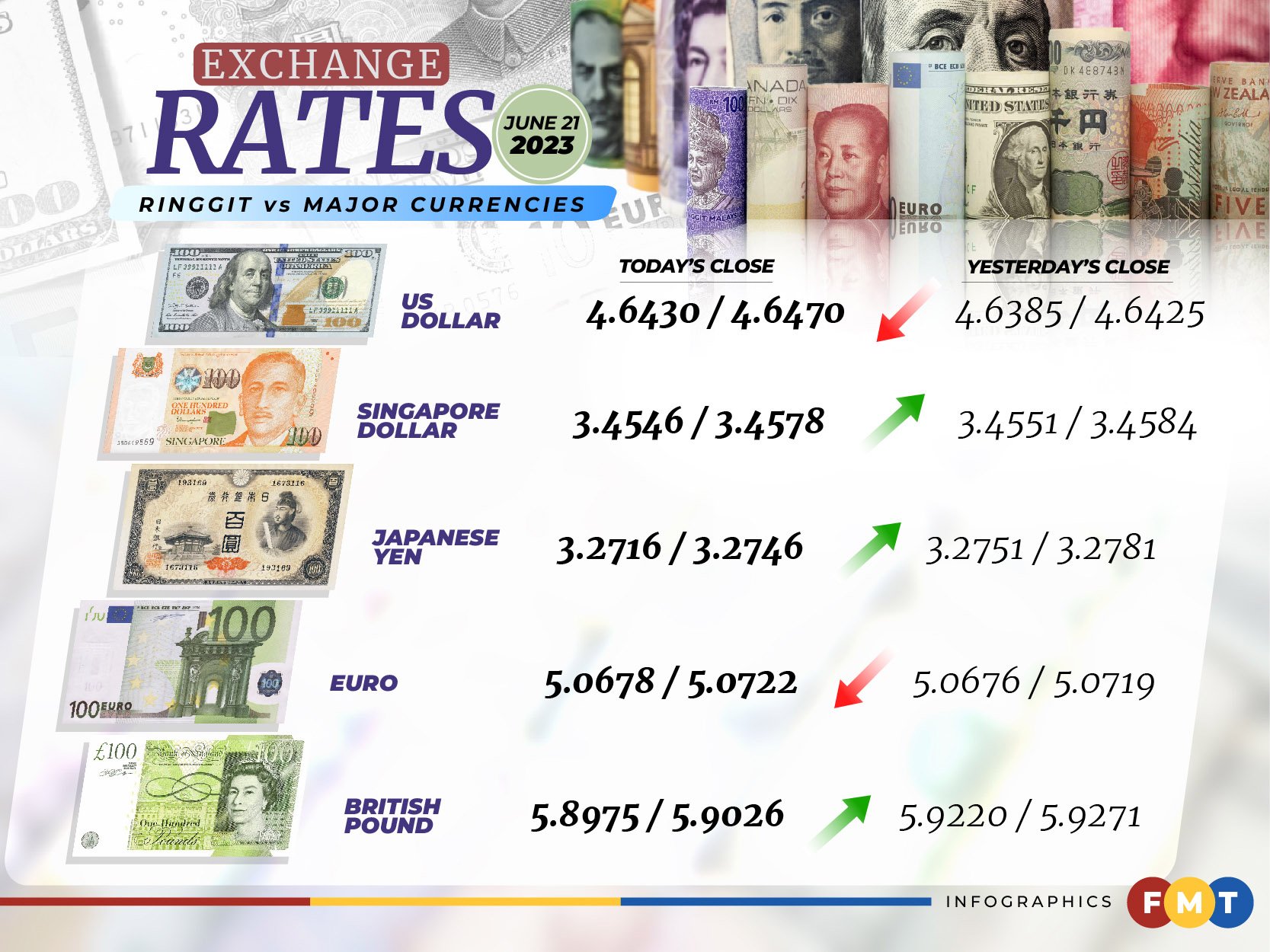

At 6pm, the local note ended at 4.6430/4.6470 against the greenback compared with 4.6385/4.6425 at the close yesterday.

Meanwhile, the ringgit was traded mostly higher against a basket of major currencies, except against the euro.

At the close, the local note appreciated further versus the British pound to 5.8975/5.9026 from 5.9220/5.9271, rose against the Japanese yen to 3.2716/3.2746 from 3.2751/3.2781, and eased marginally vis-a-vis the euro to 5.0678/5.0722 from 5.0676/5.0719 on Tuesday.

The ringgit was stronger against other Asean currencies except for the Indonesian rupiah.

It strengthened versus the Thai baht to 13.3194/13.3381 from 13.3486/13.3666 on Tuesday, went up against the Singapore dollar to 3.4546/3.4578 from 3.4551/3.4584 previously, fell vis-a-vis the Indonesian rupiah to 310.4/310.9 from 309.0/309.5, and inched up against the Philippine peso to 8.34/8.35 from 8.35/8.36 yesterday. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.