THE Employees Provident Fund reveals alarming statistics about Malaysians’ retirement savings: 48% of members under 55 and 52% of those in their 30s have less than RM10,000 in their accounts.

While this underscores the urgent need for better financial planning and retirement awareness, netizens are stunned by the reality of the economic situation among the youth.

It also highlights the urgent need for improved financial planning and retirement awareness.

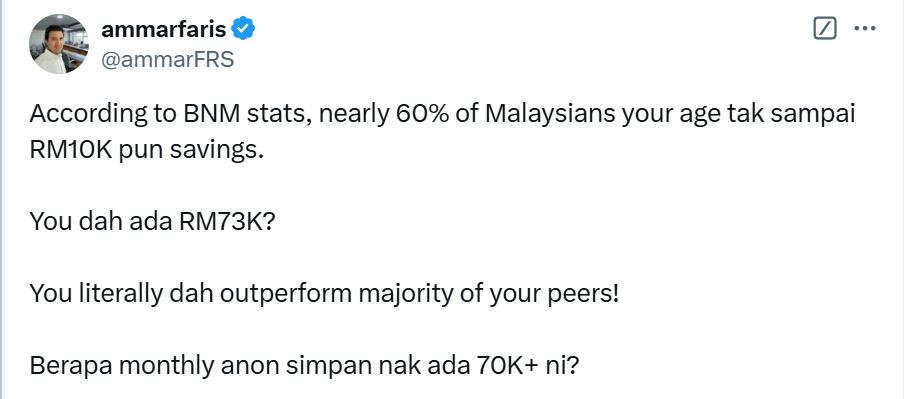

This has sparked a discussion on social media with an X user questioning if RM71,000 in savings is sufficient for a 31-year-old.

The X user highlighted the fact that many Malaysians in their 30s have low savings, which could be financially challenging for those in this age group.

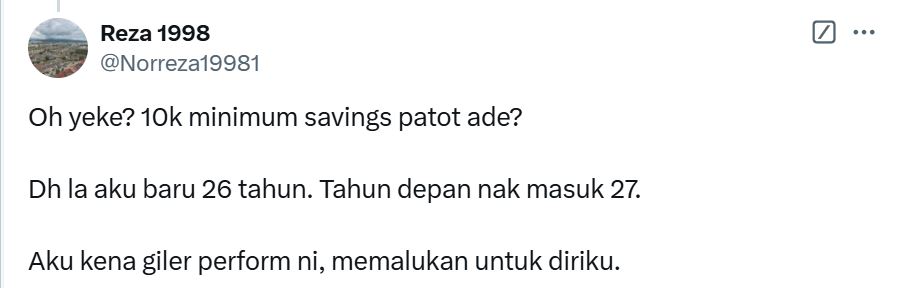

Netizens in their mid to late 20s express surprise at the idea of having RM10,000 in savings, feeling left behind in their financial journey.

Many emphasised the importance of building an emergency fund for unexpected situations.

Some noted that taking a career break could significantly impact savings, especially if finding a new job takes several months.

They also highlighted how today’s society increasingly pressures workers to remain employed without breaks, prioritising continuous work over personal pauses.

“31 taking a career break? Not a good idea. Just work until you die. That’s society now,” says a comment— Focus Malaysia

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.