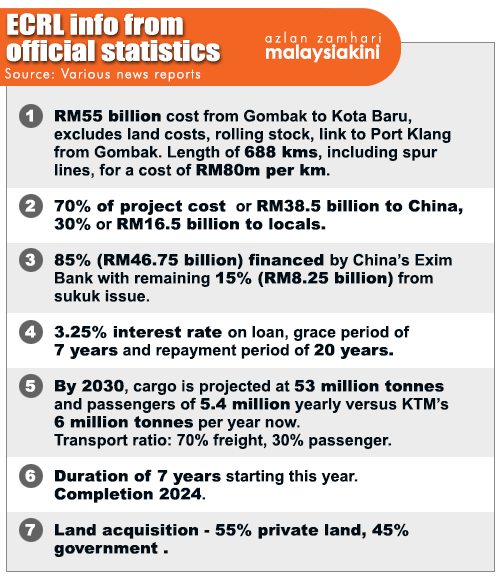

A QUESTION OF BUSINESS | Official statistics on the RM55 billion East Coast Rail Link launched last week paint a grimmer future scenario with costs likely to escalate through land acquisition, purchase of rolling stock, the construction of a Port Klang to Gombak stretch, and cost overruns.

Our calculations indicate that total true costs may eventually escalate to an astronomical over RM100 billion eventually with much of cost overruns accruing to the China construction companies which will have a major share of the project.

Only 30% of the project cost of RM55 billion, or RM16.5 billion, will be for local contractors with the lion’s share of 70%, or a massive RM38.5 billion, going to China contractors (see table). China finances 85% or RM46.75 billion.

That basically implies that the inflow of funds over the project period of seven years will be a mere RM8.25 billion (RM46.75 billion - RM38.75 billion), or RM1.2 billion a year, and therefore the multiplier impact of the project will be rather small locally.

In effect, while Chinese financing is RM46.75 billion for the project, RM38.75 billion simply goes back to the Chinese (the construction company, China Communications Construction Company or CCCC, is state-owned) as payments. Over the course of the project, China effectively forks out just RM8.25 billion out of the project cost of RM55 billion.

In effect, while Chinese financing is RM46.75 billion for the project, RM38.75 billion simply goes back to the Chinese (the construction company, China Communications Construction Company or CCCC, is state-owned) as payments. Over the course of the project, China effectively forks out just RM8.25 billion out of the project cost of RM55 billion.

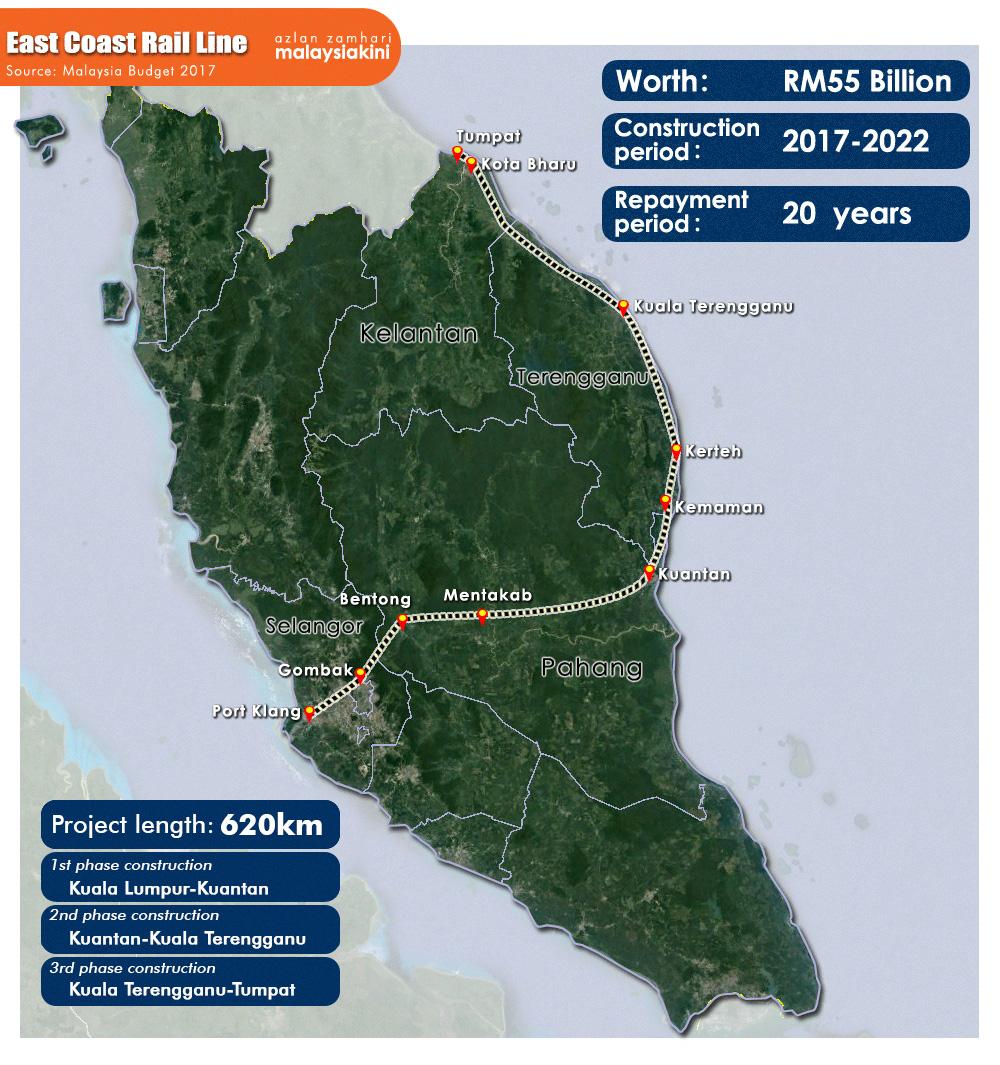

That is a pretty good deal for China considering that the main reason for the existence of the project itself is to lower transport costs for goods to and from China by skipping the route through the entire Straits of Malacca, transporting goods overland between Port Klang on the west coast of Peninsular Malaysia and Kuantan on the east coast on the South China Sea.

Even so, there seems to have been no undertaking given by China to ensure that its goods use the ECRL and for an agreed transport rate.

More on that later but first, what could the ECRL really cost?

Whether it is private or government land - 55% is private - one needs to take the full market value of the land acquisition costs. The land required for 688km of tracks, signal equipment and stations will be quite considerable. Let’s put this at a conservative RM5 billion. And let’s say the rolling stock, associated accessories and stocks cost another RM5 billion.

We have to include the Port Klang to Gombak stretch which costs a further RM5 billion, using current costs per km. Since this will be in heavily urbanised areas, let’s put the cost of land acquisition at a further RM5 billion. So far, that makes RM20 billion.

But that’s not all - consulting firm McKinsey and Company estimates that for mega rail projects, cost overruns average about 45% while demand is overestimated by over 50%, a double whammy which can put paid to the economic feasibility of the most well-planned project - and ECRL certainly does not deserve to be in that category.

If project costs go up by 50%, add on a further RM27.5 billion. That will put the total true cost of the project at an astronomical RM102.5 billion (RM55 billion + RM20 billion + RM27.5 billion). To be viable, the return on cost for such a project should be about 10%, or a massive RM10.25 billion, way more than what any company is making in Malaysia bar Petronas, the national oil corporation.

Malaysia is a sure loser

Can returns justify such an investment? No, not even close. The prime minister said at the launch of the ECRL last week that cargo is projected to reach an annual 53 million tonnes by 2030. Some 13 years from now, the cargo will be less than 10% of Singapore’s cargo throughput in 2016 of 593 million tonnes. Passengers carried are projected to be 5.4 million.

Currently KTM transports just six million tonnes per year and its revenue is estimated at no more than RM600 million last year, which gives an average transport charge, ignoring passengers, of RM100 a tonne. If we use this figure for ECRL, 53 million tonnes will give it a revenue of RM5.3 billion for freight or RM7.6 billion in total, assuming the given ratio of 70% freight to 30% passenger for revenue.

A 20% margin on this gives income of RM1.5 billion, only 15% of our calculated required return on cost of RM10.25 billion. Even if we use the given cost of RM55 billion and 10% return for a required income of RM5.5 billion, the RM1.5 billion figure is just 27% of that.

Will it at least pay for interest costs and repayment of loan? No. Our calculations indicate that at the end of seven years of grace period from repayment, the loan amount of 85% or RM46.75 billion would have gone up to RM58 billion at an annual interest rate of a compounded 3.25%. Thereafter, loan repayments on the RM58 billion over 20 years amount to just under RM4 billion a year. Income of RM1.5 billion is only 37.5% of repayment, short by RM2.5 billion a year when repayment starts.

Malaysia is a sure loser - of the order of billions. Is the public a winner? Some, because of easier transportation but anyone who rides the current highway from Kuala Lumpur to Kuantan - it takes only two and a half hours by the way - knows that it is considerably underutilised. The amount spent for that kind of dubious and small gain in convenience is ridiculously high.

The only winner in this horrific scam is China. Yes, it extends the loan but it gets the major 70% share of construction. Its goods can be transported at a lower cost - it may even be a captive customer enabling it to dictate prices. It undertakes no risk as it has no stake in the project - if the country cannot repay, it will take something else. It gives no undertaking to use the port facilities, allowing it to go where prices are cheapest.

Look at Sri Lanka, Pakistan and some of the African countries. Sri Lanka reportedly assigned its port to China for 99 years under a lease for a song, reminiscent of China’s 99-year forced lease of Hong Kong to Britain. Sri Lanka refused a debate in parliament over the deal.

There is only one reason why China can foist this on to another sovereign country - by dangling the carrot of corruption and patronage opportunities on a crooked leadership who will pawn the future of the country for the short-term gains they get now for they will not be there when disaster strikes

further down the railway line.

The frightening thing is while this one project may not be enough to kill our economy, a number of them may well do so. Think 1MDB, think the RM200 billion Carey Island superport project, think Malacca’s gateway project of RM40 billion, the RM40 billion high-speed rail link to Singapore, and more.

P GUNASEGARAM is an independent consultant and writer. E-mail: t.p.guna@gmail.com. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.