QUESTION TIME |

Recently Prime Minister Dr Mahathir Mohamad, in an interview with Reuters, said that the government may consider selling stakes in national oil company Petronas to states in which Petronas has oil and gas fields.

Such a move is not an easy one to make - Petronas is a behemoth, by far the largest and most profitable company in Southeast Asia and among the most profitable in the world.

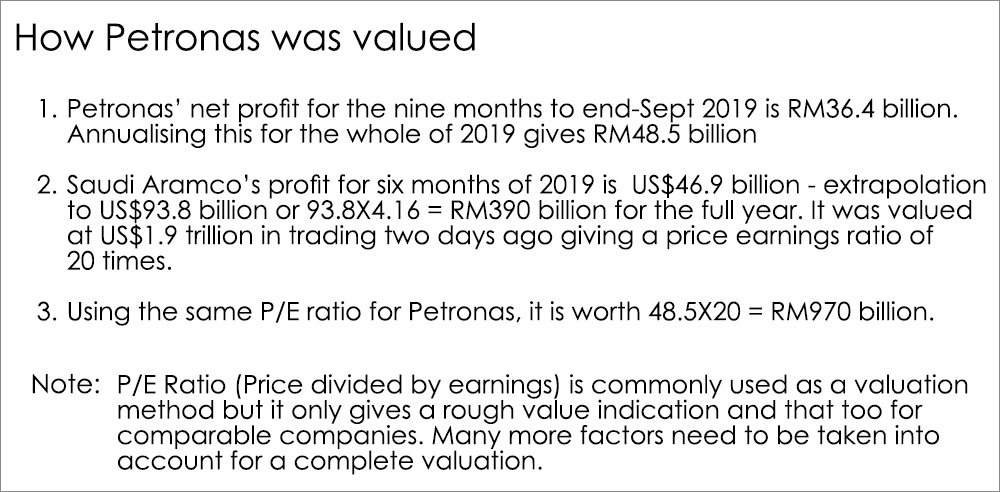

Back of the envelope calculations indicate that Petronas, if it were to be listed, would be worth nearly RM1 trillion, roughly equal to Malaysia’s debt as defined by Finance Minister Lim Guan Eng, but more than the roughly RM800 billion, going by conventional measurement of debt.

If listed, it will boost the Kuala Lumpur stock market’s value by nearly three-fifths to some RM2.7 trillion and will account for nearly two-fifths of total market value. Which naturally raises the question of whether it should be listed.

It would be ranked 27th in terms of profits of global listed companies, using a list compiled by Statista. The only oil companies which would be bigger than Petronas are, of course, Aramco (first place with a value of US$1.9 trillion), Exxon (13th place, US$343 billion) and Royal Dutch Shell (20th, US$264.9 billion). Petronas is at 27th and at a value of US$233.1 billion is just ahead of another oil company, Chevron, at US$228.3 billion.

If you want to take just a five percent stake in Petronas, it would cost you some RM50 billion, more than half the value of Malaysia’s largest listed company, Malayan Banking, for which the market value now hovers around RM95 billion. Thus, taking a significant stake in Petronas by states such as Sabah, Sarawak and Terengganu is out of the question because they simply would not be able to afford it.

The way Petronas was valued (see box above) was to get an indicative value using Saudi Arabia oil company Saudi Aramco, which was listed two days ago. It rose 10 percent over the initial public offer price to US$9.83, giving it a market value of US$1.9 trillion, surpassing its IPO value of US$1.7 trillion.

In the process, it became the world’s biggest listed company, easily overtaking the likes of Apple (US$1.17 trillion) and Microsoft (RM1.14 trillion). The listing price, based on projected earnings for 2019, gives it a P/E of 20 times.

Considering that both Aramco and Petronas are national oil companies that own the oil produced in their own countries and where most of the earnings come from domestic production, it is fair to use the same rating for Petronas, giving it a value of RM970 billion.

So, should Petronas be listed? Aramco’s listing raised over RM100 billion for the Saudi government, but only 1.5 percent of the shares were sold. Petronas could raise RM100 billion by selling 10 percent of its stake, which would mean getting an exemption for Bursa Malaysia’s free float, which is usually 25 percent. Given Petronas’ size, that’s not a problem.

It also has a credit rating which is higher than the government’s, which is an indication that it may be able to carry out such an IPO at a reasonable valuation. The question is, what will the government do with the revenue?

RM100 billion is a lot of money, but experience indicates when the government has that kind of money to spend, it can be used for rather poor projects and may even be squandered.

This is the time to think of a sovereign wealth fund à la Norway, which will invest this money in the best companies and investments around the globe to keep funds in reserve for when oil and gas reserves dry up, and to ensure that future generations benefit from the current oil wealth.

If that is the intention, instead of loosely spending the nation’s resources (remember, Petronas paid out a special dividend to the government of RM30 billion last year, on top of the usual RM24 billion), a professional wealth fund run by that rare breed of men and women with both ability and integrity would be a good and prudent move.

It’s not impossible for that to happen. One of the best things that Abdul Razak Hussein’s (above) government did way back in 1974 was to put all oil and gas reserves under the management of Petronas under the Petroleum Development Act, instead of in private hands. The nation’s oil wealth belongs totally to all of us.

Not just that, they got the best and most dedicated team of people in, whose first job was to negotiate better terms with the oil majors for exploration concessions.

After tough negotiations, the oil majors became contractors for Malaysia under agreements which gave a percentage of oil (around 20 per cent) to the oil majors, the rest coming to Malaysia after accounting for “cost oil”, oil given to the majors to recover costs.

That immediately gave Petronas, and the government, plenty of money. In the Eighties, the Mahathir administration pushed for Petronas to go into exploration and become an oil major in its own right, a highly risky proposition which may have caused losses to Petronas.

While Petronas gives revenue breakdown by geography, it does not do that for profits. Instead, it breaks that down by activity, thereby making it impossible to establish profits and losses by geographical region. But the management concedes most profit comes from Malaysia - because it owns the oil and gas here, whereas overseas it acts as an operator for other countries.

There is another advantage of listing. All these years, Petronas has not been very open about its accounts, especially the breakdown of profits by region. This is required in most listing jurisdictions, including Malaysia.

Thus, its reporting standards will have to improve and it will have to become much more transparent. Full profit and loss accounts, cash flow statements and balance sheets must be disclosed, which will enable a better analysis of the company and quicker identification of problem areas.

Those are good reasons for listing. But one hopes if there is a listing, there will be a large enough portion for retail investors who would like to invest in Petronas, and that Malaysians and Malaysian funds are given preference over foreigners. This will help ensure that there is less trading and price volatility in the shares.

P GUNASEGARAM believes in that old adage, a penny saved is a penny earned. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.