The Cabinet has decided that Plus Malaysia Bhd - the country's largest highway operator - will remain a state asset.

The company will also have to reduce toll charges by "18 percent" this year.

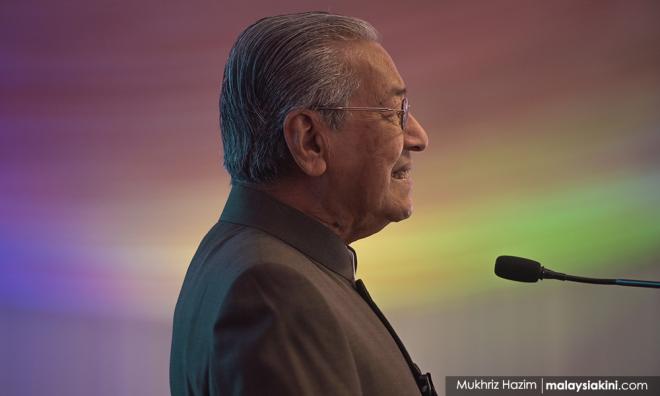

Prime Minister Dr Mahathir Mohamad also appeared to suggest that the toll charges will be not be increased for a long time - up to 30 years.

"Just remember, 18 percent (lower toll charges) at today's rate would mean that in 30 years time... the toll charges will be very, very low," he told reporters in Kuala Lumpur.

[Editor's note: The prime minister's department told Malaysiakini later that the prime minister meant 20 years, not 30.]

Reviewing highway agreements, with the view of abolishing toll charges, was one of the cornerstone policies in Pakatan Harapan's manifesto for the 2018 elections.

Now that the coalition is in power, it has shifted policy towards reducing toll charges in stages when it was clear that the debt-saddled government could not allow a complete removal.

Plus is owned by sovereign wealth fund Khazanah Nasional Bhd (51 percent) and Employees Provident Fund (EPF, 49 percent).

Previously, several private companies came forward with offers to acquire the highway with promises to lower toll charges.

Critics, however, said the public infrastructure of such importance should not be left to private hands.

Mahathir said the cabinet had listened to many briefings, considered all the bids made by the private sector and reviewed reports by Khazanah.

"In the end, we decided the best way is not to sell Plus to anybody but to retain it with Khazanah and EPF," he said.

Mahathir said it was possible for Plus to reduce rates without affecting their income.

He said the rakyat will benefit from the suspension of the scheduled increase in toll charges in the long term.

"Because we are fixing it at the present rate. It will be a flat rate minus 18 percent.

"Although traffic may grow, (Plus') earnings will not be as big as (had we maintained) the original concession (agreement)," he said.

Among the companies that have shown interest in acquiring Plus are Maju Holdings Bhd, Widad Group Bhd, RRJ Capital (based in Hong Kong) and Karongsa Private Capital Sdn Bhd. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.