PETALING JAYA: Increasing vulnerabilities are emerging among household borrowers that are highly leveraged and have limited financial buffers, says Bank Negara Malaysia (BNM).

The central bank’s latest Financial Stability Review for 2H 2022 finds that whilst household debt to gross domestic product (GDP) has fallen to 81.2% (84.5% in June 2022) due to nominal GDP growth, the low savings of some borrowers puts them at risk.

“For example, 51.5% or 6.67 million Employees Provident Fund (EPF) members under the age of 55 have extremely low savings of less than RM10,000 in their EPF savings accounts,” it said.

It noted that a survey by RinggitPlus in 2022 revealed 63% of the 3,144 respondents indicated they could only survive three months or less with their savings, compared to 50% in 2021.

The risk factors for households are also slightly different, with the ability to repay being more acutely impacted by income and employment shocks rather than higher borrowing costs.

For example, a rise in the unemployment rate to 6% would put up to 4.3% of loan exposures at risk of default.

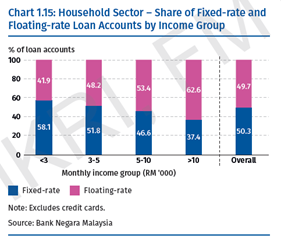

“This is due largely to the composition of their (borrowers’) debt, as half of total household loan accounts are on fixed rate terms which do not fluctuate with changes in the overnight policy rate (OPR),” said BNM.

The bulk (65%) of at-risk household borrowers earn below RM5,000 per month.

Borrowers earning in the RM5,000 to RM10,000 range are marginally more exposed to interest rate risk, as 53.4% have floating-rate loans. This widens for those earning more than RM10,000, whereby 62.6% have floating-rate loans.

Unsurprisingly, the bulk (60%) of household debt is made up of housing debt, with the key risk being sharp falls in housing prices. At end-2022, the median loan-to-value (LTV) ratio of outstanding housing loans remained stable at 65.5%.

Buy now, cannot pay later

In the last year, buy now pay later (BNPL) schemes have seen widespread adoption, though it grew at a moderate pace in 2022 due to tapering demand.

The schemes target younger Malaysians, with about 44% of BNPL users aged 18 and 30 years old.

Concerningly, BNM finds that more than 80% of BNPL users earn less than RM3,000 a month, and are more susceptible to financial stress.

“The relatively easier access to BNPL facilities may place users at a higher risk of spending beyond their means, without considering their ability to promptly repay the full loan amount,” it said.

Opaque fees and late payment charges make it more difficult for borrowers to ascertain how much it is they really need to repay.

The share of BNPL users with overdue payments has been on an increasing trend. In the Q4 2022, 17% of users had overdue payments, up from 14% in Q2 2022, and having doubled from Q4 2021 (7% of users).

Nonetheless, BNPL exposures account only for a microscopic 0.05% of total household debt.

“BNM is cognisant of the conduct risks that BNPL poses to consumers and has taken steps to mitigate this for BNPL schemes offered by entities that are regulated by the bank,” it affirmed.

This includes more transparency regarding fees, as well as efforts to ensure financial protection to consumers in relation to BNPL schemes. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.