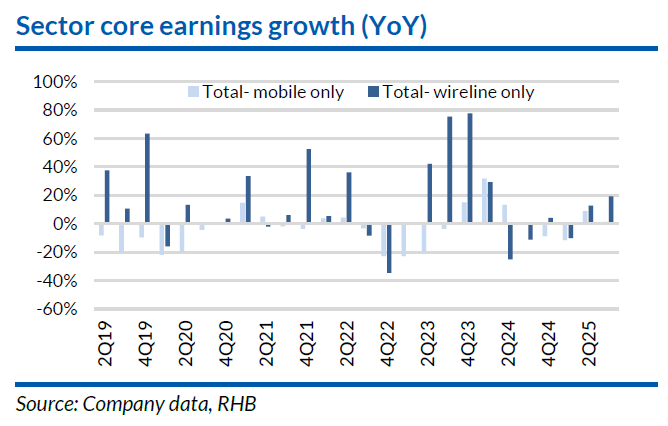

FIXED line players again outperformed their mobile peers, with stronger sequential and year-to-date (YTD) earnings delivery.

RHB sees the positive underlying earnings trend for the fixed line telcos continuing into quarter four 2025 (4Q25) and financial year 2026 (FY26) on structural drivers while mobile network operators (MNOs) would have to contend with losses from Digital Nasional (DNB).

Aggregate sector core earnings grew 7.1% quarter-on-quarter (QoQ), as strong fixed line earnings more than offset softer mobile earnings against a marginal 1% year-on-year (YoY) industry revenue increase in 3Q25.

YTD industry earnings before interest, tax, depreciation and amortisation (EBITDA) continued to hold steady, with the extended cost optimisation drives across all telcos.

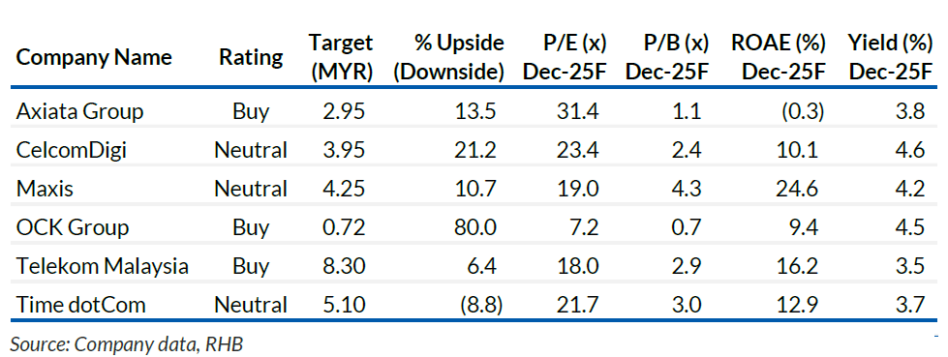

Of the two MNOs, Maxis’ revenue and EBITDA shares ticked up further to 43.1% and 45.1% in 3Q25, at the expense of CDB whose shares slipped to 56.9% and 54.9%, from 57.3% and 55.9% in 2Q25.

In tandem with the stronger nine months 2025 (9M25) results, Maxis lifted earnings before interest and tax (EBIT) guidance to a “mid-single digit” from “flat to low single digit”, flagging additional scope still for cost optimisation.

TM opted to remove its headline EBIT guidance, as it expects significantly higher manpower costs in 4Q25 as a result of a voluntary separation exercise.

In addition to the positive special dividend surprise, TDC said it would look to further optimise its underlevered balance sheet over the next 12-24 months.

Key downside risks to RHB’s forecasts and ratings are greater competition, weaker-than-expected earnings and margins, negative effects of FX rate changes, and adverse regulatory developments.— Focus Malaysia

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.