IT has been claimed that the e-invoicing brouhaha in which the Madani government has come under fire for its flip-flop policy is not the only taxation woe impacting the survival of small and medium enterprises (SMEs) in Malaysia.

Former Barisan Nasional (BN) strategic communication deputy director Datuk Eric See-To has exposed what he described as “another cunning way the Madani government manipulates the country’s financial position”.

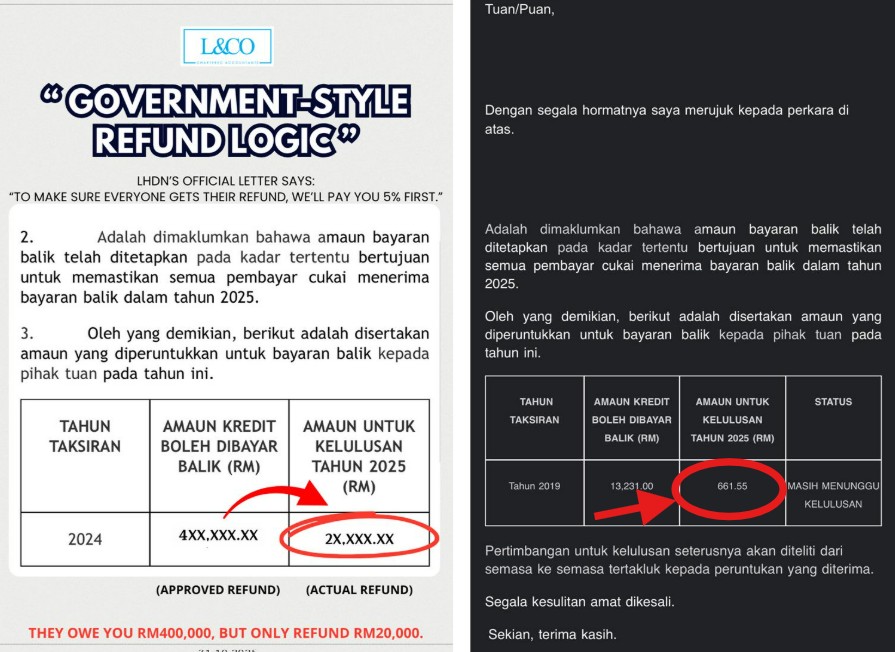

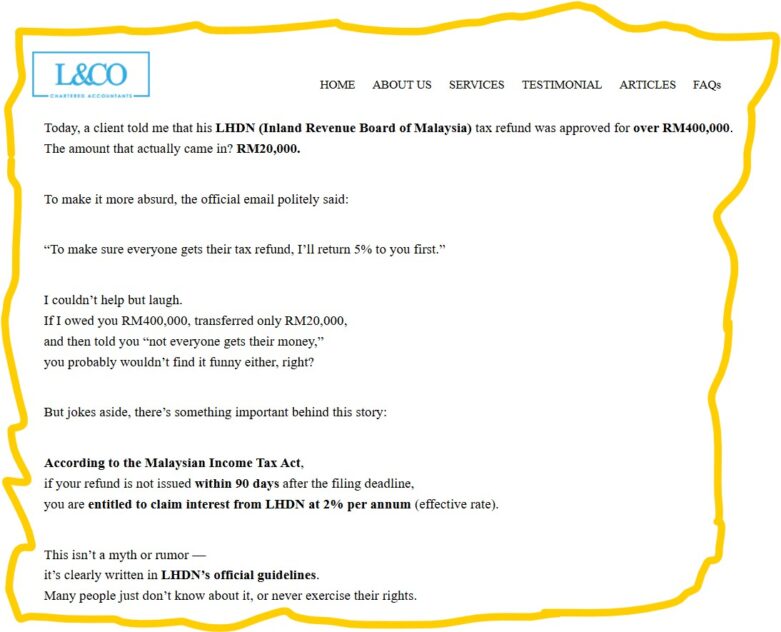

This follows a revelation by chartered accountants L & Co’s co-founder and principle partner Liew Chang Chee that a client has recertify shared with him that although a tax refund of over RM400,000 has been approved by the Inland Revenue Board (LHDN), only RM20,00 or 5% will be disbursed this year (2025).

What is laughable, according to Liew, is that LHDN even dare “to politely state that to make sure everyone gets their tax refund, I’ll return 5% to you first”.

But joke aside, the licensed independent auditor and tax consultant reminded business owners in such situation that under the Malaysian Income Tax Act 1967, they are entitled to claim interest from LHDN at 2% per annum if their refund is not issued within 90 days after the filing deadline.

“Looking good on paper’

Taking a leaf from Liew, See-To who is now an opposition-slant political influencer claimed that this pointed to the notion that “every sen of money outflow is counted as government expenditure”.

“This includes the IRB’s tax refund. So, if the government deliberately doesn’t pay the refund, the annual expenditure will appear low and the deficit will appear smaller,” justified the deemed loyalist of disgraced former premier Datuk Seri Najib Razak.

“Even if the refund is paid late, the IRB will be given a three-month interest-free period before being charged a rate of only 2% per year on the arrears.

“This 2% rate is lower than the 4% interest rate on government bonds. So, it’s still cheaper for Madani to ‘owe’ the rakyat by virtue of the slow refund than to borrow through bonds.”

According to See-To, the unjust irony here is that if the rakyat are late in paying their taxes, “the penalty can be up to 40% with interest of 5% per annum imposed”.

“This is clearly a case of two classes. It doesn’t matter if the rakyat are suppressed awaiting their refunds. What’s important is that the Madani’s fiscal figures look good on paper.”

Added See-To who used to blog with the moniker Lim Sian See:

At the same time, the national debt continues to soar up RM236 bil in two years and nine months. Likewise, the amount of tax refund arrears is suspected to have spiralled since Madani took over.

My check also found that the Madani government has never revealed the exact amount of tax refund arrears even though many MPs have posed such question in the Dewan Rakyat.

“The figure is huge and could reach tens of billions. That’s why they don’t dare to announce.”

- focus malaysia

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.