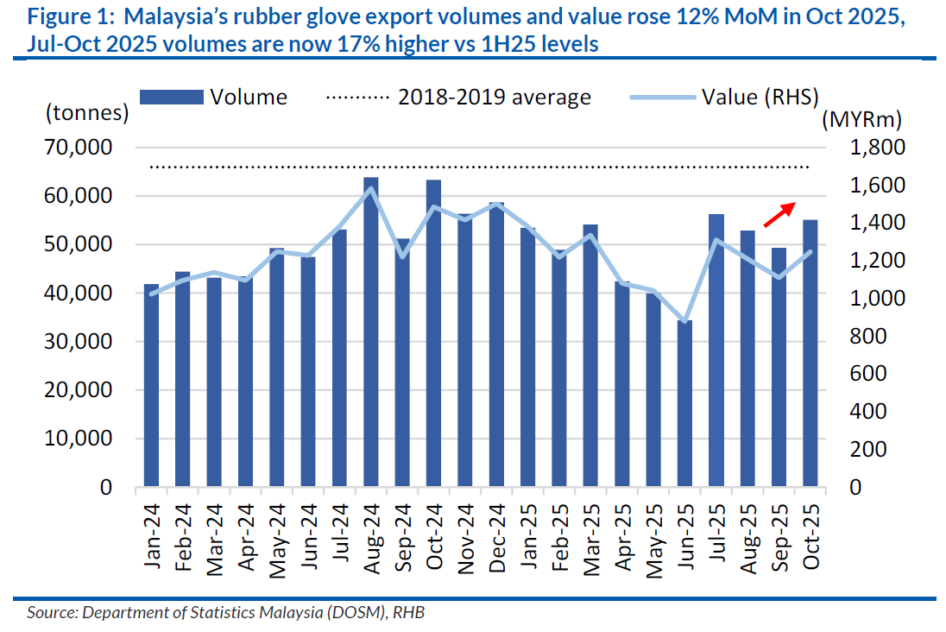

THE glove sector’s September reporting quarter disappointed, even as industry dynamics turned more nuanced.

Price competition intensified among Malaysian glove producers, leading to uneven quarter-on-quarter (QoQ) volume recoveries despite expectations of a stronger rebound following the absence of gas supply disruptions.

Industry-blended average selling price (ASP) slipped to USD21.30 per 1,000 pieces, as cost pass-throughs remained difficult in the face of softening raw material prices.

Of the six rubber product manufacturers under coverage, only Top Glove beat expectations, Hartalega reported in-line results, and the remainder missed projections.

Management commentaries across briefings indicate continued ASP pressure, potentially exacerbated by incremental supply from China manufacturers with offshore facilities.

Indonesia-based capacity has begun commissioning in stages, with ASPs estimated at USD1-2 below prevailing US ASPs of USD17-18 per 1,000 pieces for generic products.

Besides this, operating expense headwinds are set to materialise, including:

i) The mandatory EPF contribution for foreign workers (effective Oct 2025) is expected to raise glovemakers’ cost of production by 0.1%.

ii) The multi-tier levy mechanism on foreign workers could raise production costs by about 0.4-0.5%.

The only silver lining lies in whether ongoing cost-rationalisation initiatives can translate into meaningful margin expansion.

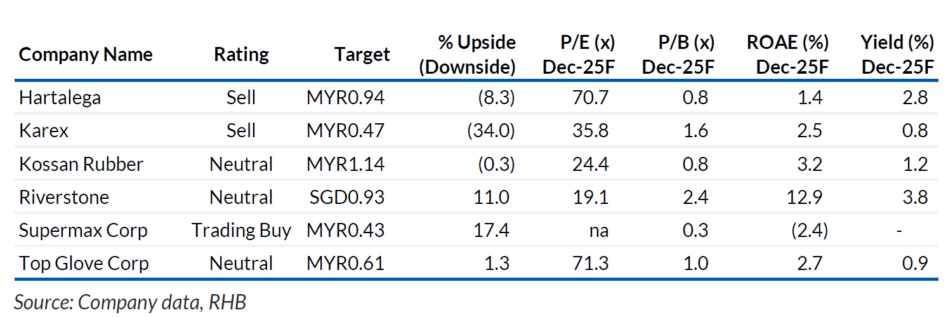

“We maintain our UNDERWEIGHT sector call but adopt a more tactical stance on stock selections, in view of the improving short-term risk-reward profile,” said RHB.

During the recent reporting quarter, RHB switched their call for Supermax to TRADING BUY (from Sell). The key swing factor was the inflection in operating cash flow, which challenges the bear-case narrative of persistent cash burn.

“With net cash of MYR691 mil and its valuation at distressed levels, we see near-term trading upside,” said RHB.

Risks identified for RHB’s sector rating are such as a stronger USD/MYR rate, an increase in glove ASPs, slower-than-expected capacity expansion, and lower-than-expected raw material prices. — Focus Malaysia

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.