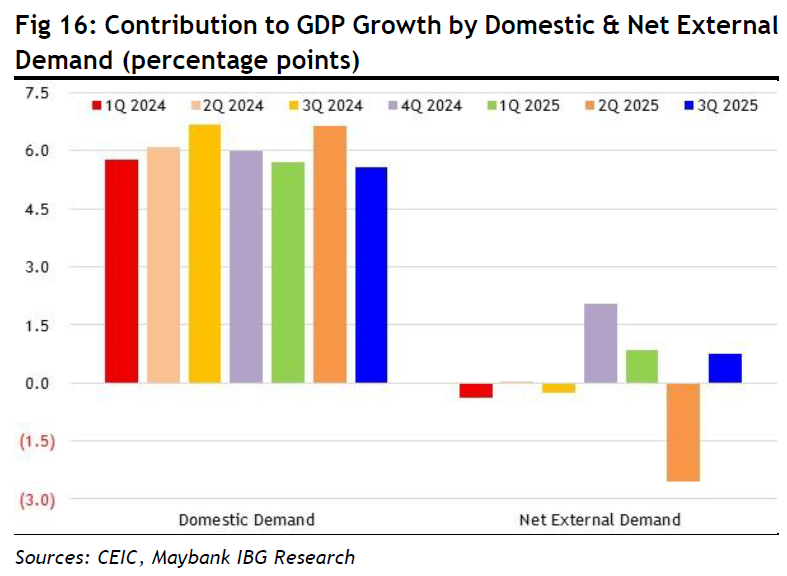

MALAYSIA’s gross domestic product growth dynamics is a case of resilient domestic demand amid volatile net external demand. Steady domestic demand is crucial at the time of volatile net external demand.

“Anchoring our outlook of resilient domestic demand is the steady growth momentum in private consumption, underpinned by income-related measures in Budget 2026,” said Maybank Investment Bank (MIB).

In addition, the on-going post-pandemic tourism growth that comes with rising tourist spending, will get an additional boost from the Visit Malaysia 2026.

At the same time, the combination of resilient growth, low and stable inflation rate will result in Bank Negara Malaysia maintaining the overnight policy rate at the current mildly accommodative level of 2.75% throughout 2026.

The other engine of domestic demand is the on-going investment upcycle, underpinned by the continued robust lead indicator, that is, private investment approvals, with an average MYR334 bil p.a. since 2021.

At the same time, the trend and outlook for gross operating surplus points to a corporate profit growth trend supportive of growth in gross fixed capital formation.

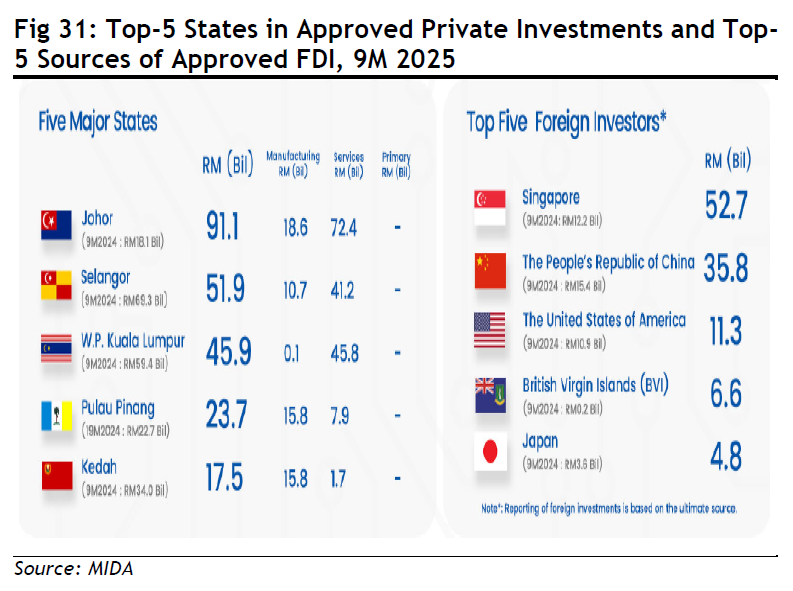

Current and new catalysts for investment upcycle include Johor-Singapore Special Economic Zone (JS-SEZ), – where Johor and Singapore occupy the top spots in terms of approved investments by states and approved FDI by sources respectively for 9M2025.

There is also the added impetus for investment upcycle from the rise in the consolidated public sector capital expenditure amid major infrastructure projects and strategic initiatives.

Among them are the Penang Light Rail Transit (LRT) Mutiara Line; Johor Bahru Autonomous Rapid Transit (ART); Phase 2 of Klang Valley Double-Track Electrification Project and the 3,190 km long MADANI undersea cable (SALAM) project linking Johor, Sarawak and Sabah for digital parity between East and West Malaysia.

External demand remains a wildcard as trade-related uncertainties and risks remain.

Despite developments like the finalised reciprocal tariffs as well as trade deals/agreements between US and its trading partners which has led to the easing in Trade Policy Uncertainty Index, the World Trade Uncertainty Index remains elevated. — Focus Malaysia

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.