BUDGET 2019 | The exchange rate has the highest impact on the consumer price index (CPI), which measures the inflation rate, followed by crude oil price, external debt/export ratio and indirect tax per capita.

In the Economic Outlook 2019 report released by Ministry of Finance today, it said that a 1.0 percent change in the exchange rate, crude oil price, external debt/export ratio and indirect tax per capita will increase the overall CPI by 0.337 percent, 0.112 percent, 0.094 percent, and 0.073 percent, respectively.

The CPI is weighed mainly by three out of 12 groups (67 percent), namely food and non-alcoholic beverages; housing, water, electricity, gas and other fuels; and transport.

“It is crucial to implement policies to strengthen the nation’s economic fundamentals, promote renewable energy, improve public transportation, facilitate high value-added products and enhance the efficacy and efficiency of tax collection,” the ministry said.

It also said that the Local Currency Settlement Framework, which promotes a wider use of local currencies for trade and investment, could be explored to further mitigate the impact of exchange rate volatility.

“The ringgit had depreciated through 2010-2018 mainly due to the external factors such as trade wars as well as the outflow of foreign funds due to the normalisation in the advanced economies,” it said.

The depreciation affects mainly through import inflation, especially for food items which costs about RM25 billion per year, it added.

As for the crude oil price, the Brent crude oil price fluctuated between US$124.93 per barrel in March 2012 and US$30.80 per barrel in January 2016, affecting the transport group which accounted for about 15 percent of the CPI weight.

Meanwhile, the external debt/export ratio provides a quick indicator of an economy’s capability to repay its external debt through export earnings.

“Malaysia’s external debt/export ratio has increased from 7.7 percent in 2010 to 11.3 percent in 2018,” it said.

A ratio below one suggests that debt can be repaid in less than a year.

For indirect tax per capita, the ministry said on average, the sales and service tax (SST) and goods and service tax (GST) per capita was recorded at RM127 and RM328, respectively.

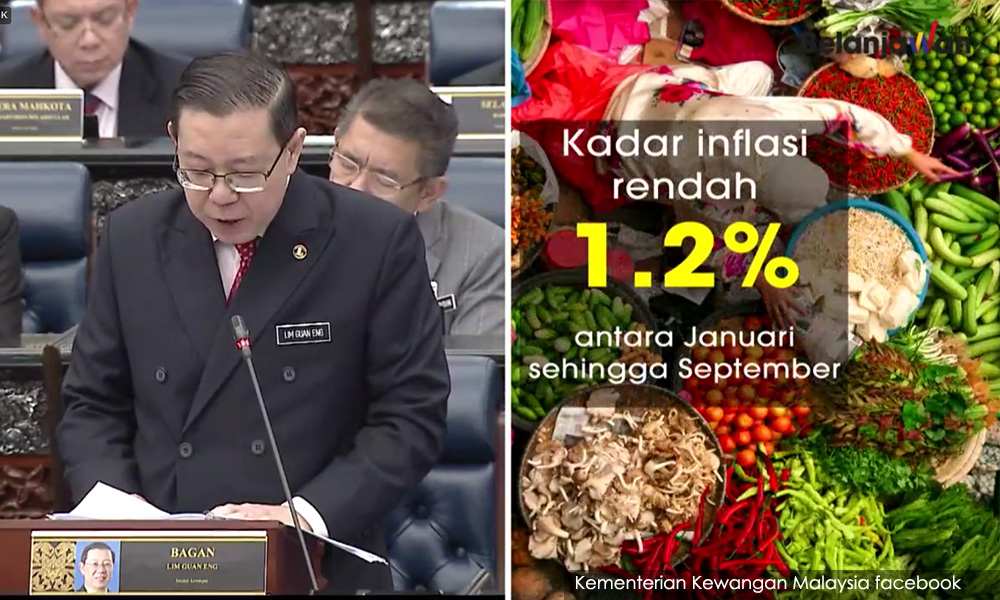

The report also noted that the long-term average inflation rate has been hovering around 2.5 percent from 2010 to 2018.

The inflation recorded its lowest increase in February 2015 at 0.1 percent and the highest at 4.9 percent on March 2017.

– Bernama

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.