QUESTION TIME | FundMyHome, the new peer-to-peer financing scheme for affordable homes, will neither solve housing woes nor make houses more affordable, but will instead facilitate a lopsided bet on housing, which circumvents central bank measures put in place to cool the market.

Finance minister Lim Guan Eng, in his first budget, proudly characterised the scheme as part of “new, technology-enabled and innovative mechanisms to solve our housing problems,” But it will do nothing of the sort because it is merely a financing scheme that enables those with money to dabble in the housing market.

It could even be destructive if too much money moves into the scheme to create an artificial demand for property by those unaware of the risks that it entails. It may create a property bubble, which Bank Negara was so keen to avoid when it put limits on house purchases by existing homeowners.

If the bubble keeps expanding and bursts, there will be serious consequences for buyers and financiers, and could well pose a systemic risk to the overall financial system. Inevitably, that system will be involved in financing, even if banks aren’t directly. But it looks like they are, with Maybank and CIMB providing financing in FundMyHome.

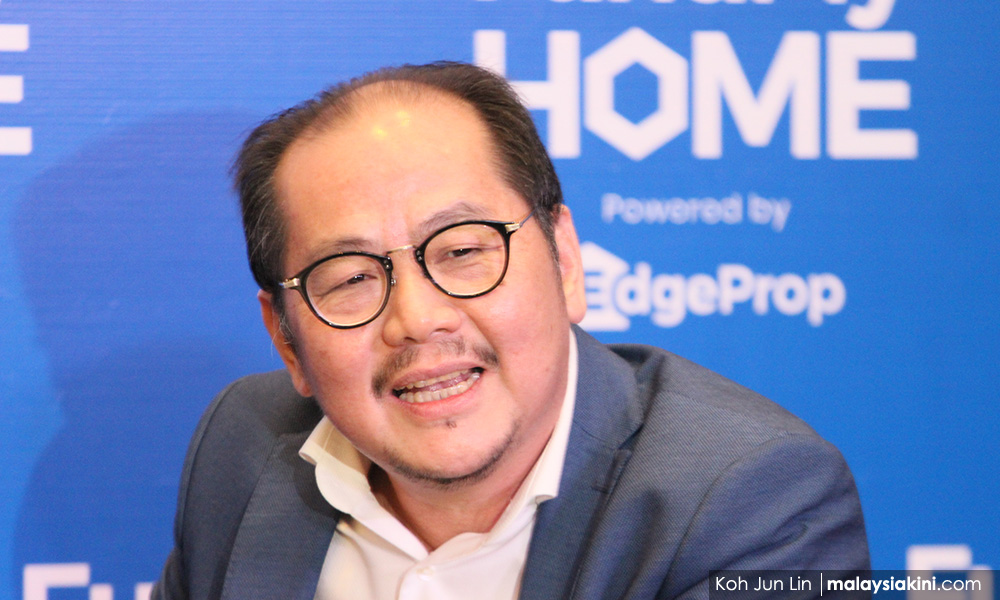

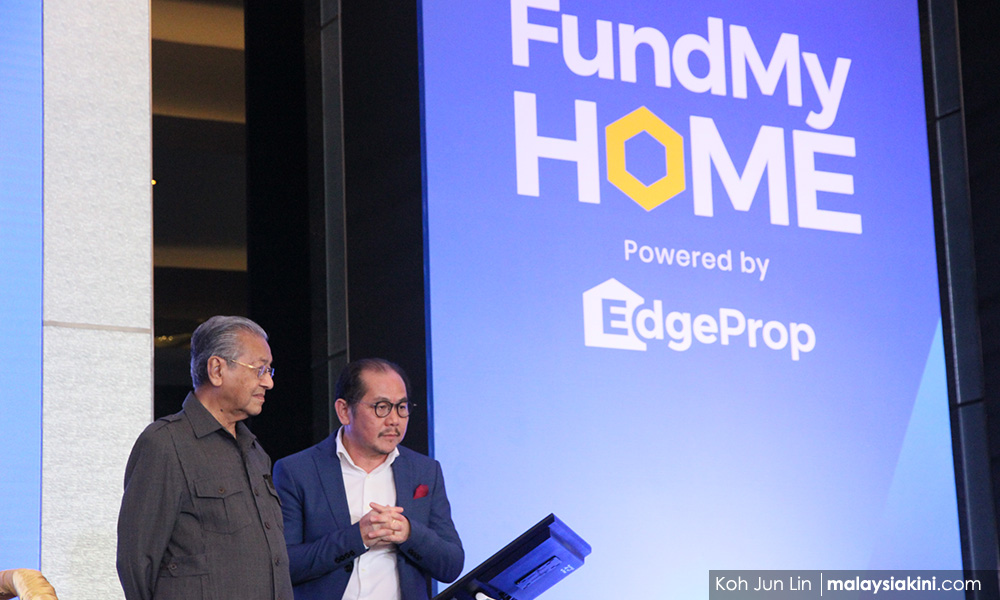

Also, by endorsing the scheme, which is very publicly led by The Edge Media Group chairperson Tong Kooi Ong (photo), the government opens itself to charges of cronyism. Tong has admitted that there have been discussions with the government over months, while both the prime minister and finance minister were present at the public launch of FundMyHome.

Previous crowd financing initiatives, such as equity crowdfunding, have been carefully developed by the Securities Commission, which ensures there are a number of platform operators, rules and regulations in place, and considerable public information available.

However, FundMyHome is owned by one operator, EdgeProp Sdn Bhd, a subsidiary of The Edge Media Group. By directly working with the government ahead of others, it has unfairly obtained a first-mover advantage over others who might also want to operate such a scheme.

Ideally, the SC should have set up the governing rules and regulations for such a funding scheme, and then invited those who want to set up and run a platform to apply for it. That way, everyone has an equal chance and the entire scheme can be examined properly ahead of time to weed out as many problems as possible.

Right now, details of the scheme are still sketchy, and there is no clear picture of how the scheme operates, how all participants benefit, and what the risks are. Here are the salient points of the scheme gleaned from the FundMyHome website.

- Open to all Malaysians who are first-time buyers. Minimum age 18. You don’t need to have financing, but have to pay 20 percent of the cost of the house upfront, with the rest coming from institutional funds. You cannot sell the house for five years, but you don’t pay rent.

- You bear all downside risks up to the amount of your original capital, but your upside risks are shared with investors who take all the first 20 percent of property appreciation after the first five years. Above that, profit is shared – 80 percent to investors and 20 percent to the purchaser.

- At the end of five years, you value your house professionally, and choose to either sell it or arrange refinancing to buy the house, but pay the new price of the house established by buyers. You can also roll over the scheme.

Skewed bet on housing

There a number of things to note about this scheme:

- It is a skewed bet on housing. However, purchasers bear more risk because they bear all of the downside risks up to a 20 percent depreciation in price for over five years. Also, purchasers start benefiting only if the price appreciation after five years is more than 20 percent. That stacks the odds against purchasers. They might be better off paying a 10 percent deposit and obtaining a loan from the banks for under five percent a year, grit their teeth and pay the instalments, rather than take this kind of a risk.

- Upside gains come in only if appreciation is over 20 percent, and the purchaser has to share this 20-80 with the investors/developers. If purchasers take loans, all of the upside (as well as the downside) risks will be borne by them.

- At the end of the five years, the purchaser has to buy the house at the new price which means a higher price for the house will likely be paid. If purchasers had arranged the financing earlier, a much larger capital gain would have been made, which they can keep all to themselves.

This scheme does nothing to solve the problem of affordable housing, which requires key structural adjustments within the industry and the overall economy to provide for the demands of the local marketplace. These include:

- Closing off residential housing to foreigners so that the market does not get skewed to higher-end properties, and reflects actual demand by Malaysians. This can be a condition for all future projects to reduce the impact on developers.

- Implementing a scheme, such as the one across the Causeway, where direct land and other subsidies are provided to reduce the cost of building houses and the final sale price. This means purchasers have to sell back to the controlling authorities to keep prices down.

- And finally, making a concerted effort to reduce income disparity through the raising of incomes for the lower income group, by recognising the value of labour and by increasing productivity through appropriate training and automation. Remember, something like one percent of the populace holds some 50 percent of the wealth.

The FundMyHome scheme does none of this, and is therefore in no way a scheme to solve the housing woes of the nation.

At the end of the day, it is nothing but a platform for people who have up to a couple of hundred thousand ringgit to bet on the housing market, with the odds skewed in favour of those who provide the financing. It helps to prop up the market for the benefit of developers and intermediaries.

It is an inferior replacement for the 5-95 scheme of the past, when with a five down payment on a loan, and nothing else to pay until completion of the project, people could take a leveraged bet on houses and keep all of the gains to themselves and bear all the losses too.

The central bank rightly outlawed this to keep property prices in check, and to prevent a systemic risk to the banking system if there was a property slump.

One other thing, how much are the platform operator’s charges for all of this? I can’t find the figure anywhere!

P GUNASEGARAM says if something looks too good to be true, it most likely is. E-mail: t.p.guna@gmail.com. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.