The peer-to-peer financing (P2P) scheme for home ownership proposed in Budget 2019 was part of the Finance Ministry’s attempt at using innovation to address financial issues facing the country, said Tony Pua today.

Pua, who serves as the political secretary to Finance Minister Lim Guan Eng, admitted that the scheme incurred a certain amount of risk, but said it offered an alternative to conventional mortgage financing schemes and would enable more sectors of the public to own a home.

“We wanted to be creative, we wanted to be innovative and we knew all the ideas did not come from the ministry itself.

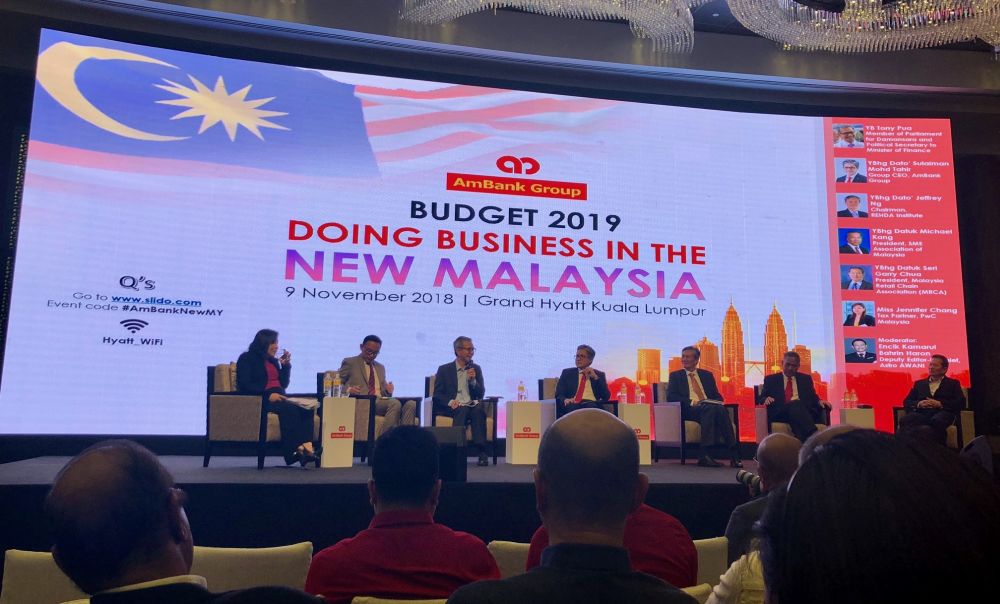

“(We) filtered through the ideas, pick out (those) that are beneficial (and) have a chance of working. And then, we took a little bit of risk in putting them in the budget,” he told the “Doing Business in The New Malaysia” forum in Kuala Lumpur this evening.

However, any risk in the P2P housing scheme would be minimised as the Securities Commission (SC) has been tasked with drawing up strict regulations in order to protect both house buyers and investors.

These include limiting the scheme to affordable housing, first-time house buyers and maintaining it as a pilot project. Anyone offering to facilitate such a scheme would also need to possess a certain amount of capital in case of failure.

“We expect the rules to be finalised by the first quarter of next year, after which the first (peer to peer) exchange can take place,” he added.

Nevertheless, Pua said the crowdfunding scheme, as with all attempts at innovation, was susceptible to failure.

“We believe that enabling capital access would be the key to driving innovation and entrepreneurship. And there will be failures.

“For every Amazon [...] you have thousands of other roadkill,” he said.

Not monopoly, anyone can apply

While the scheme had been proposed by private firm EdgeProp Sdn Bhd, the DAP Damansara MP explained that all parties are welcome to apply to facilitate the scheme, provided they complied with SC’s guidelines.

“To take away the misconception that this is a monopoly for (EdgeProp’s) FundMyHome scheme, it is not.

“It is just one of them because they came up with the idea. We are open to other parties forming the same type of platforms to make available these facilities to the public,” he said.

Pua later clarified that FundMyHome itself had not been approved by the SC yet.

Asked by the media later if it was fair for other applicants to comply with guidelines drafted based on the FundMyHome scheme, he said this was simply part of encouraging innovation.

“It is a new idea. That’s why you encourage innovation, (for) people to come up with new ideas,” he quipped.

'20 percent down payment too high'

During the forum, Real Estate and Housing Developers' Association Malaysia (Rehda) Institute chairperson Jeffrey Ng questioned the viability of the P2P housing scheme, especially how house buyers were required to fork out 20 percent down payment to qualify for the scheme.

“Any developer today will tell you that the biggest problem (for) why housing isn’t moving is because house buyers themselves are having problems, in some cases, settling the first 10 percent down payment.

“So in this P2P example, the so-called upfront payment will be a challenge, whether homebuyers will be responding to it positively, only time will tell,” Ng told the panel.

Similarly, Ambank Group CEO Sulaiman Mohd Tahir also expressed hesitation at the scheme, proposing a rent-to-own idea similar to P2P “but maybe the down payment does not need to be so high”.

On a separate matter, Pua had also said that the Pakatan Harapan government had “largely completed” its re-negotiations of mega-project deals.

“There are one or two more elephants that we need to deal with,” he hinted, refusing to elaborate when approached afterwards.

The other panellists at the forum were SME Association president Michael King, Malaysia Retail Chain Association president Garry Chua and Pricewaterhouse Coopers Malaysia tax partner Jennifer Chang.

Organised by Ambank, the forum was moderated by Kamarul Bahrin Haron of Astro Awani. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.