Coronavirus has left a trail of destruction across the world. No country is spared, including economic powerhouse United States and China. The last thing the world needs now is escalating tensions between both superpowers over the endless blaming game of China’s handling of the pandemic. But it appears the trade war is about to explode again, and it will get even worse.

What does Covid-19 pandemic have anything to do with trade war? None at all, but when it comes to Donald Trump, anything can be linked and politicised. Facing re-election in November, the U.S. president has gone back to its playbook in an attempt to impress upon American voters – again – how the good guy America will bash and punish the bad guy China.

The “Phase One” trade deal was Trump’s biggest win over Chinese President Xi Jinping after nearly 2 years of economic warfare, well, at least that was the narrative created by the White House. Trump had bragged about how he took the Chinese down and won. And he was hoping to ride on the deal to win re-election – until the Coronavirus turns his plan upside down.

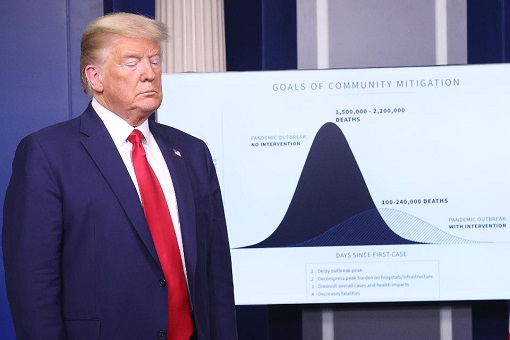

While Trump can continue trumpeting about China’s fault for not controlling the spread of the virus, the fact remains that his incompetency, arrogance and complacency were partly responsible for the death of 90,000 Americans. To win again, the desperate Trump has to restart the trade war with China. And the best way to annoy the Chinese is to attack Huawei.

So on Friday (May 15), the Trump administration declared a new export restriction specially designed to isolate Huawei Technologies Co. by cutting off overseas manufacturers from supplying semiconductors to the Chinese telecom-equipment manufacturer. But has not Huawei already been put on an export blacklist imposed by the U.S. Commerce Department a year ago?

Apparently, Trump was not happy that Huawei’s 5G technology was ahead of the United States. Under the pretext of national security, the Chinese tech giant, along with 68 affiliates, was added to a trade blacklist in May 2019 – effectively requiring American companies to get approval from the government before conducting business with the Chinese firms.

The export ban saw some American tech giants like Google, Intel, Xilinx, Broadcom and Qualcomm cutting business agreements with Huawei. It was Trump’s attempt to block Huawei from rolling out 5G around the world. Washington claims the 5G network technology offered by Huawei could be used by China for espionage, an allegation that the U.S. can’t prove until today.

However, in their thirst for business from the world’s second biggest economy, some manufacturers later found “legal loopholes” in the Trump’s blacklist rule that enabled them to resume shipments to Huawei. The trick was superbly easy. What chip makers like Intel and Micron had to do was to “not” label their products as Made-in-USA and voila, the blacklist rule was bypassed.

Therefore, the workaround to the export restriction was to sell to Huawei through overseas subsidiaries and classify their technology as foreign, even though the headquarters is in the U.S. Obviously, Micron, which has plants in Japan, Taiwan and Singapore, as did Intel who has factories in China and Ireland, could easily – and legally – resumed selling their products to Huawei.

Understandable, the stakes are high for the U.S companies. In 2019 alone, China accounts for about 36% of US$193 billion in sales made by American semiconductor companies globally. A huge portion of that revenue is then re-invested in R&D (research and development) to make highly sensitive chipsets critical for next generation fighter aircraft and military weapons.

For example, Xilinx, a Silicon Valley-based chipmaker that sells integrated circuits to Huawei that allows 5G base stations to be re-programmed from afar, also produces semiconductors for the F-35 Joint Strike Fighter program. Like it or not, indirectly, China was funding the technology development of the U.S. military and weapons.

True, Trump was furious with the loopholes exploited by American companies. But at the same time, he also realized that American companies would be severely hit. Commerce Secretary Ross admitted last year that the U.S. government received 260 requests from American companies to be granted exemption so that licenses could be approved for them to do business with China.

That was before the Coronavirus outbreak hit the U.S. and Trump is being partly blamed for mishandling the pandemic. Fighting for his second-term in the Oval Office, the Trump administration has determined to shut down the loophole. In fact, Washington had closed one-eye over the export blacklist loophole for about a year, largely because Trump thought he was winning.

Now, the rule change, scheduled to go into effect in September, says that overseas manufacturers such as TSMC (Taiwan Semiconductor Manufacturing Co Ltd), a major producer of chips for Huawei’s HiSilicon unit, is prohibited from supplying products to Huawei. That’s because almost all HiSilicon chips made by TSMC are using American chip-making equipment.

Last December, the Wall Street Journal revealed that according to an analysis by UBS and Fomalhaut Techno Solutions, a Japanese technology lab that took the device apart to inspect its components through what is known as reverse engineering and BOM (bill of materials) analysis, the Huawei Mate 30 phone was built without U.S. chips.

But as Trump struggles to re-use the Huawei and trade war cards to win re-election in November, even chipmaker TSMC who uses American equipment is not spared. Although Huawei did not use American-made chips, HiSilicon, Huawei’s in-house chip design agency, has used U.S. software and equipment to design and custom-made semiconductors for Huawei.

In the Huawei Mate 30 phones, for example, energy amplifiers supplied by American suppliers Qorvo or Skyworks had been changed with chips from HiSilicon. American-made Wifi and Bluetooth chips previously supplied by Broadcom had also been replaced with HiSilicon chips. Naturally, Beijing was not impressed with the Trump’s latest stunt.

Beijing warned it would similarly impose restrictions on U.S. companies such as Apple, Cisco Systems and Qualcomm, as well as suspending purchases of Boeing airplanes. According to Global Times, the mouthpiece of Beijing, China may retaliate by targeting the American corporations using Chinese laws and regulations like Cybersecurity Review Measures and Anti-monopoly Law.

At the same time, U.S. semiconductor makers worry that Trump’s new rules will slash their sales not only to Huawei, but other Chinese companies. The American companies fear that other Chinese firms will start looking for “more reliable” non-American suppliers, as the making of Huawei Mate 30 phone has shown that many American parts can be sourced elsewhere.

However, it appears that Huawei is well prepared. A Chinese mainland chipmaker, SMIC (Semiconductor Manufacturing International Corp), successfully mass-produced a smartphone processor for Huawei. The chipset – Kirin 710A – was produced through an advanced 14-nanometer manufacturing process by the Shanghai-based chip-maker.

In actuality, Huawei has already begun shifting its self-designed chips from Taiwan’s TSMC to local firm SMIC last month, before Trump’s latest export restriction on Friday. But according to Reuters, HiSilicon engineers have started designing for Shanghai-based SMIC rather than TSMC in late 2019 – suggesting that China had anticipated the moves by the U.S. much earlier.

- financetwitter

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.