1MDB TRIAL | A former banker with the defunct Singapore branch of BSI Bank expressed immense regret over his involvement in the layering of funds involving Malaysian sovereign wealth fund 1MDB.

Kevin Michael Swampillai testified this during today’s RM2.28 billion 1MDB corruption trial of former prime minister Najib Abdul Razak.

The 44th prosecution witness, who was with BSI from 2010 to 2016, was replying during cross-examination by lead defence counsel Muhammad Shafee Abdullah during proceedings before the Kuala Lumpur High Court.

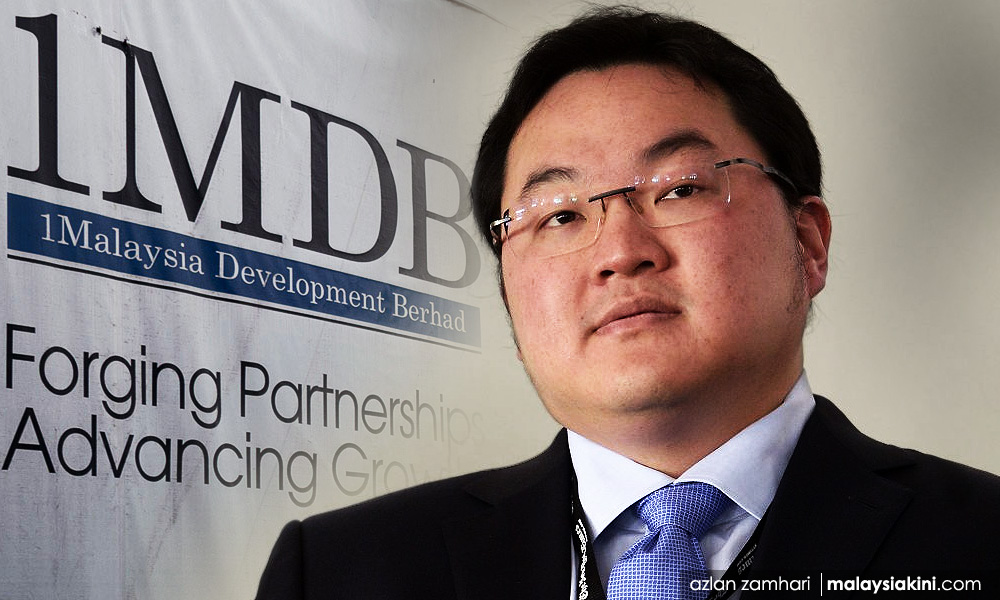

Shafee was referring to Swampillai’s extensive oral evidence of how he and a few others at BSI dealt with fugitive businessperson Low Taek Jho (Jho Low) invested billions of dollars of the funds of 1MDB and other related companies in an “obscure” method involving layering and hiding the identity of the client companies.

Shafee: I read your (witness) statement thoroughly. You currently regret how you got involved in the 1MDB and SRC (1MDB’s former subsidiary) and related companies?

Swampillai: Yes, immensely.

Shafee: The reason you regret immensely?

Swampillai: The consequence of my involvement and my action has been severe, that is the source of the regret. I wished in regard to some of my actions, I had acted differently.

The former head of the bank’s wealth management services testified that the scale of the white-collar crime ranked pretty high, with the Monetary Authority of Singapore (MAS) effectively shutting down BSI’s Singapore branch in 2016 over the debacle.

The 58-year-old Malaysian-born told trial judge Collin Lawrence Sequerah that it was the collective failure of the bank that led to MAS taking regulatory action against the bank branch, rather than the failure of several individuals.

On Oct 23, 2020, the Monetary Authority of Singapore (MAS) imposed a lifetime ban on Swampillai over the 1MDB affair.

According to MAS’ official web portal, Swampillai and his then subordinate, Yeo Jiawei, had channelled a portion of the fund management fees or “secret profits” - namely US$5 million (RM16.6 million) - to an entity beneficially owned by Swampillai, without BSI’s knowledge and authorisation.

The Singaporean authority contended that the secret profit was in relation to the duo having assisted 1MDB to restructure several of its joint venture interests.

‘BSI only dealt directly with Jho Low’

Earlier today during examination-in-chief by Mohamad Mustaffa P Kunyalam, Swampillai testified that BSI never dealt directly with any board member of staff of 1MDB and its related companies over the “obscure” offshore investments.

The former banker said that they only dealt with Low through the bank’s former relationship manager Yak Yew Chee.

The “obscure” investment method in question is fiduciary funds.

Mustaffa: When the fiduciary fund was chosen, was there an inquiry from SRC or the Minister of Finance (MOF Inc, the ultimate owner of SRC and 1MDB) regarding the (investment) structure?

Swampillai: No, there was no query. We never heard from the client company itself or heard back from employees or directors of those institutions. The contact was only with Jho Low.

The witness also told the prosecutor that following the investigation by MAS, he had “disgorged” (returned) the nearly US$6 million in secret profits to the Singaporean authorities.

Swampillai admitted that he and a colleague perpetrated the secret profit scheme because they were rebuffed by their bank superiors for an increase in their salaries and bonuses.

"We felt that was unfair and we stupidly tried to get these benefits ourselves," he said in alluding to the MAS accusation against him.

During further questioning from Mustaffa, Swampillai said MAS terminated BSI's licence to operate in Singapore due to control failure on client diligence.

No documentary evidence

Meanwhile, during further cross-examination by Shafee this afternoon, Swampillai conceded that he has no documentary evidence to show that Najib had direct knowledge that the then premier knew about 1MDB funds being subjected to the “obscured” transactions in BSI.

The witness said that he merely got the impression from other BSI bankers that Low was an advisor for Najib, and that he did not have documentary evidence that the businessperson was acting for the then-premier.

Swampillai added that MAS had issued a stern warning against him over the debacle rather than charge him in court.

Towards the end of proceedings this afternoon, deputy public prosecutor Ahmad Akram Gharib informed the court that the prosecution would call another five witnesses after Swampillai.

The prosecutor said they are former Bank Negara Malaysia (BNM) governor Zeti Akhtar Aziz, two investigating officers (one over the abuse of power case and the other on a money laundering case), a BNM analyst, and a witness over an alleged money laundering incident.

Proceedings will resume on April 17.

Najib is facing four counts of abuse of power and 21 counts of money laundering involving RM2.28 billion from 1MDB.

For the four abuse of power charges, the former Pekan MP is alleged to have committed the offences at AmIslamic Bank Bhd’s Jalan Raja Chulan branch in Bukit Ceylon, Kuala Lumpur, between Feb 24, 2011, and Dec 19, 2014.

On the 21 money laundering counts, the accused is purported to have committed the offences at the same bank between March 22, 2013, and Aug 30, 2013. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.