PETALING JAYA: Not many people know that Bank Negara Malaysia (BNM) sought out award-winning fund manager Tan Chong Koay three decades ago, and offered him an asset management licence.

The offer was conditional on him leaving Singapore, where he was then working with a London-based asset management firm.

Tan happily took up BNM’s offer and, within a month, had established Pheim Asset Management Sdn Bhd (Pheim Malaysia) in January 1994.

A year later, he expanded his fund management business when he established Pheim Asset Management (Asia) Pte Ltd (Pheim Singapore) in Singapore.

Over the next 29 years, the 73-year-old investor and his boutique asset management group won numerous international awards that justified BNM’s faith in him.

‘Small-cap King’

Reputed for his acute sense of stock selection, Tan was labelled “Southeast Asia’s Small-cap King” in a Bloomberg article in 2006, and “The Warren Buffett of Asia” by organisers of the World Wealth Creation Conference held in Singapore in 2017.

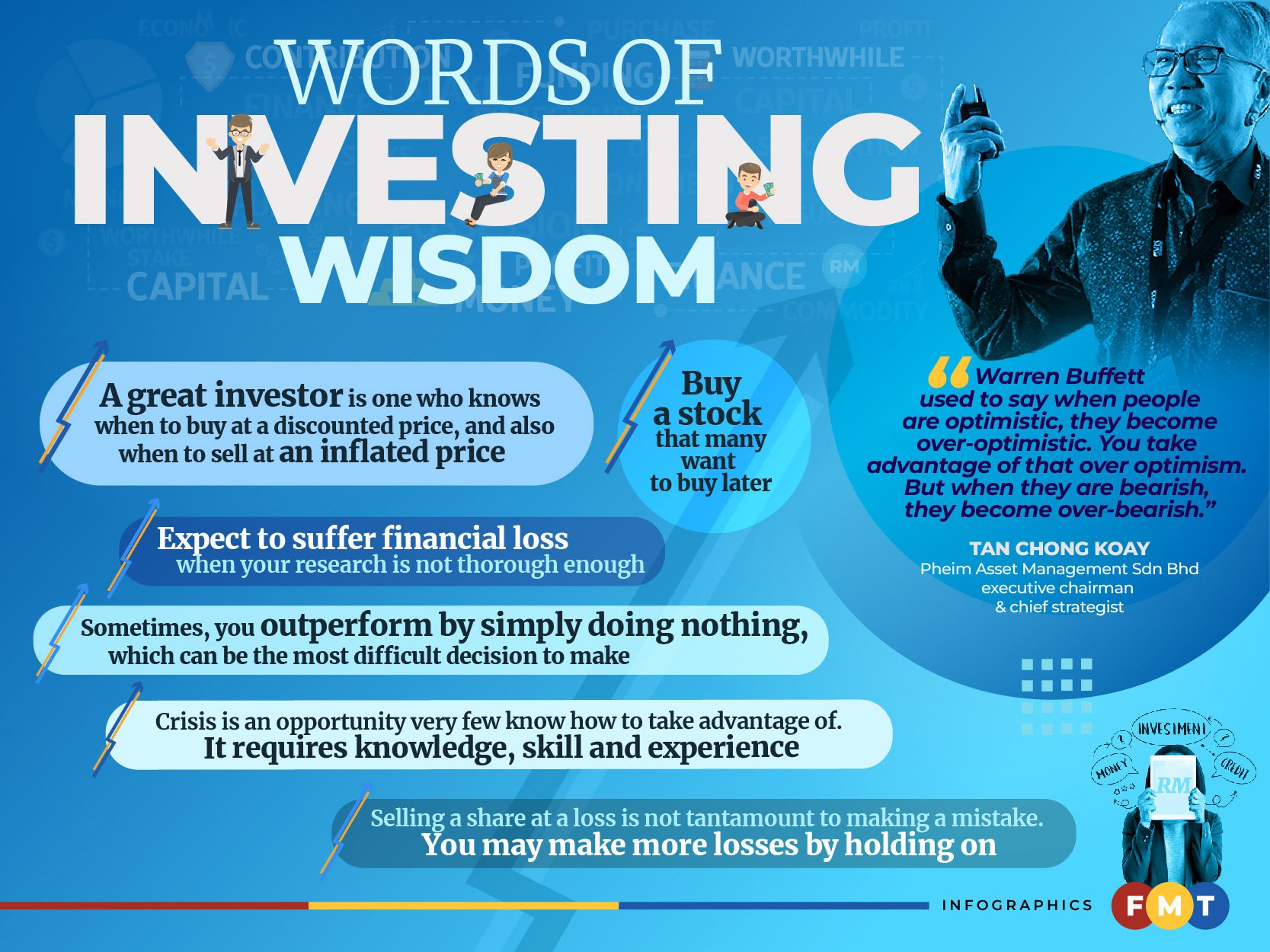

Tan, who is Pheim Malaysia’s executive chairman and chief strategist, also authored the best-selling book “Rising Above Financial Storms” in 2015 and is working on a sequel.

Pheim Malaysia has been an external fund manager for the Employees Provident Fund (EPF) for the past 25 years, and has outperformed the EPF’s benchmark index by more than 600% over the period.

Pheim Singapore also served as external fund managers for Singapore’s sovereign wealth fund – Government of Singapore Investment Corporation (GIC) – and the Norway sovereign wealth fund.

FMT Business had the opportunity to pick the brain of this celebrated fund manager during an exclusive interview in Kuala Lumpur recently.

BNM comes knocking

Recounting how he got a licence to set up an asset management firm, Tan said a senior official from BNM contacted him at the end of 1993 and made him the offer. At that time, he had been working as a fund manager for 18 years in Malaysia and Singapore, building his reputation as a top fund manager.

He said BNM’s offer was like a dream come true. He left his cushy job in Singapore and set up shop in the heart of Kuala Lumpur’s financial district on Jan 4, 1994. The rest, as they say, is history.

An interesting footnote to his story was that the finance minister then was Anwar Ibrahim, who is now the prime minister also reprising his role as finance minister.

“Anwar wanted Malaysia to have an asset management industry that could compete with its peers in the region,” he said.

Tan is proud of Pheim Malaysia’s achievement of being profitable every year for the past 29 years despite huge market crashes in 2001-2 (Dotcom crisis), 2007-8 (Global financial crisis), and 2020 (Covid-19 pandemic).

Value investing

Throughout his career, Tan has identified himself as a “value investor”, just like legendary American investor Buffett, the world’s fifth-wealthiest person with an estimated net worth of over US$108 billion (RM479 billion).

Asked if his investing style is the same as Buffett’s, Tan said: “His style of investing is a bit different. Buffett invests in big caps, which are more stable, and holds them for a longer time period.

“But our market here is small and very volatile. So many a time, we invest in small and medium-sized companies, and don’t hold them for a long time like Buffett.”

The wily investor says he seeks to take advantage of the “inefficiencies of a volatile market”.

“Warren Buffett used to say when people are optimistic, they become over-optimistic. You take advantage of that over optimism. But when they are bearish, they become over-bearish.

“If you understand that, you can also take advantage of that, too. Sometimes, people panic, the share price becomes so cheap, but he still sells to you. You are not going to complain,” he said.

What makes Tan stand out from most fund managers is his track record of not only safely navigating past market crashes over the past 45 years but also coming out a winner while others flounder.

The Pheim group’s success has been founded on its investment philosophy: “Never fully invest at all times”.

“If you are fully invested at the high point, you will get hit badly. If you are investing in a high-volatility environment, you definitely do not want to be fully invested at all times.”

Tan said he adopted this strategy in 1987 when he was head of investment at Arab-Malaysian Merchant Bank.

He managed to get out of the market before the infamous Black Monday crash on Oct 19, 1987, when the Dow Jones Industrial Average lost almost 22% in a single day.

He had seen the red flags in the run-up to the crash. “I sounded the alarm and raised so much cash – 65% – prior to the crash because the market had run up so sharply.”

So, when the then Kuala Lumpur Stock Exchange crashed the day after Black Monday, Tan was so flushed with cash that his funds were able to snap up many stocks at a massive discount.

Arab-Malaysian Merchant Bank ended the year ranked as the Top Fund Manager.

Better than Elon Musk’s Tesla

Tan’s overriding goal is to pick undervalued stocks that have the potential to outperform the market. That means buying such stocks during a market correction or crash.

“To do so, I apply the following investment criteria – the companies should have low gearing, rising profits and good management.

“We want the company to have low gearing because when the bad times come, the highly geared will go bust,” he said, adding it should also have a capable CEO or management team that has weathered through bad times.

To emphasise his point, Tan highlighted two stocks he invested in during 2019 and 2020 that met his criteria – glove maker Supermax Corporation Bhd and factory automation solutions provider Greatech Technology Bhd.

Pheim Malaysia made a killing on both stocks during 2020, a year when stock markets around the world, including Bursa Malaysia, were pummelled by the Covid-19 pandemic.

Greatech’s share price surged more than 2,100% within slightly more than one-and-a-half years while Supermax’s share price catapulted more than 1,400% between April and August 2020. Tan sold all the Supermax shares before the glove stocks came crashing down.

“Within a period of about five months, Supermax outperformed Tesla by a big margin,” he pointed out.

However, its best pick ever was a warrant that yielded 50 times or almost 5,000%. “So, value investing works.”

What value investing is not

So, will value investing work for the ordinary retail investor as it does for fund managers like Tan and Buffett? He responded with a resounding “yes”.

He said successful investing is not buying a stock based on a “hot tip”’ you get from someone. “It entails a lot of hard work, research, experience, knowledge, and wisdom,” he emphasised.

“You must understand the companies you invest in, and therefore you need to do your homework.”

He is often amazed at how little attention some investors pay to annual reports, and other reports of companies they invest in. “Paying attention to details makes a huge difference to the result.”

Tan opined that investment is an art, and not a science. “You always centre on value – when the share is overvalued, you want to get out.

“You know that sometime down the road, everyone will want to get out, so you always need to run ahead. On the other hand, before the run up of a share, you want to get in first.”

The one thing Tan always looks forward to is a crisis. “I occasionally say that ‘I need a crash to outperform’. Crisis creates problems but also provides opportunities that are hard to come by in normal times,” he said.

Failing to snap up stocks that have corrected sharply but are run by a good management team in growing industries is a missed opportunity, he noted.

“People say they do value investing, but very often they don’t, or they don’t do it well. When the stock is so cheap, they don’t buy, and when it’s so high, they don’t sell,” he said. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.