Mahathir cannot be worth RM100 billion and Daim cannot be worth RM60 billion the honest way. Even if Mahathir had saved his 22 years salary, as he claims, he cannot be worth more than RM20 million. And what did Mahathir live on over those 22 years? More importantly, how did Mahathir and his family become multi-billionaires if the money was not stolen? The RCI can probably answer these questions.

THE CORRIDORS OF POWER

Raja Petra Kamarudin

Malaysiakini’s 3rd June 2012 report (SEE BELOW) quoting Dr Rosli Yaakop, an ex-manager of Bank Negara, is very interesting. First of all it fingers Tun Dr Mahathir Mohamad and Tun Daim Zainuddin as two of the four culprits involved in Bank Negara’s FOREX fiasco. Secondly, Dr Rosli said, “Experts estimated Bank Negara’s exposure for having lost that much was USD27 to USD33 billion, which was five times more than its foreign reserves and its entire assets of USD20.7 billion in 1992.”

If what Dr Rosli said is true (and since Malaysiakini carried it then it must be true since Malaysiakininever lies and always tells the truth) that would mean Bank Negara lost an equivalent of RM255 billion in today’s value. Well, whether you take the value then (US$27 to US$33 billion), or the value now (roughly RM255 billion), both are a colossal amount of money and Malaysians must be told the truth regarding this episode.

Dr Rosli went on to say:

Kit Siang’s suggestion for a royal commission of inquiry was ignored and Jaffar even did not bother to attend public accounts committee (PAC) inquiry. He suggested that Pakatan Rakyat, if were to capture Putrajaya, should re-open investigation on the scandal, which was approved by the audience.

Yes, considering there are so many different stories as to who is behind this and who is to blame, plus the figure that Bank Negara lost varies from a mere RM10 billion to a huge RM155 billion, this makes the RCI even more important. We all know what happened in the 1MDB matter and so many investigations have already been conducted and reports issued. But not a single investigation or report has been done on the Bank Negara FOREX scandal.

What is feared is that not all that money (whether RM10 billion, RM30 billion, US$30 billion, or whatever is actually the correct amount) may have been lost playing the FOREX market. ‘Black Wednesday’ was on 16th September 1992 and George Soros got out in just a few days and made a profit of US$1.2 billion. Bank Negara, however, was gambling away from 1989 to 1994, which is a period of five years, and not over just a few days like what Soros did. So it does not make sense that Bank Negara lost all that money because of Soros. It sounds like Bank Negara suffered a misappropriation of funds and they hid that crime under ‘FOREX losses’ whereas only part of it was due to the FOREX losses.

The RCI would be able to determine this and if a lot of that money was actually misappropriated, and not actually lost playing the FOREX market, then some, if not all, of that may still be recoverable. After all, Mahathir and his children are estimated to be worth a few billion Ringgit (or RM100 billion if you include all those assets parked under trustees, proxies, nominees and cronies) while Daim is estimated to be worth another RM60 billion. Hence the government can recover quite a bit of money once the RCI manages to dig deep into this matter.

Mahathir cried when he announced his resignation in 2002 knowing that his past criminal deeds are going to catch up on him

Mahathir’s and his family’s wealth is enormous. No doubt Mahathir tried to explain this by saying he did not need to spend any of his monthly salary over 22 years because as Prime Minister everything is paid for. But even if Mahathir did not spend a single sen and saved even penny over 22 years, he should not have more than RM20 million, let alone RM20 billion or RM100 billion. That maths just does not add up, which means that the money must have come from somewhere else and not from saving his salary and not spending a penny for 22 years.

Daim’s and Mahathir’s family wealth cannot have come from legitimate sources. For Daim and Mahathir’s family to have that much money it can only be from criminal activities such as corruption and misappropriation of funds. The question is, how much of that was misappropriated from Bank Negara? The RCI can determine this and if necessary make moves to recover the money from Daim, Mahathir and his sons.

The fact that Daim, Mahathir and his three sons are multi-billionaires is no secret. The whole world knows this. But what all of us do not know is where did all these billions come from other than Mahathir saving his salary for 22 years and not spending a penny? If Mahathir saved his salary for 22 years and did not spend a penny that would mean someone else is paying for whatever they own and spent, or the money was stolen. And that would make Mahathir the biggest thief in Malaysian history.

Lim Kit Siang has been demanding that the RCI be set up to investigate Bank Negara’s losses (even though since Mahathir agreed to make him the Deputy Prime Minister if Pakatan Harapan wins the general election Kit Siang has been keeping very quiet). Anwar Ibrahim also demanded the same. Prime Minister Najib Tun Razak must prove he is honest, open and transparent by not ignoring Kit Siang’s and Anwar’s demands for the RCI to be set up and set one up as soon as possible. Then we will know how much Bank Negara really lost, and why they did so, and whether it is all due to playing the FOREX market or whether misappropriation is involved, like many people suspect.

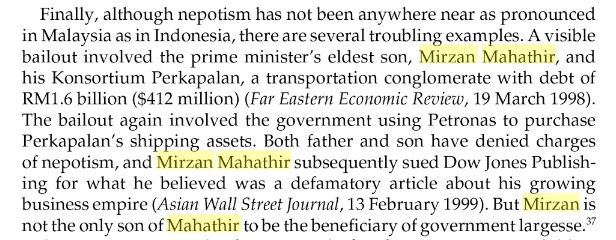

(The Wall Street Journal, 1 May 1998) – MISC to Pay US$220 Million Price For Assets From Mahathir’s Son (READ MORE HERE)

(Malaysiakini, 12 November 2012) – Mirzan Mahathir is ‘entrepreneur of the year’ (READ MORE HERE)

Mohamad Ezam Mohd Noor wants Dr Mahathir to explain the alleged 1998 bailout using public funds.

(Astro Awani, 14 May 2015) Ezam Mohd Noor alleges Dr Mahathir bailed out his son’s company in 1998 (READ MORE HERE)

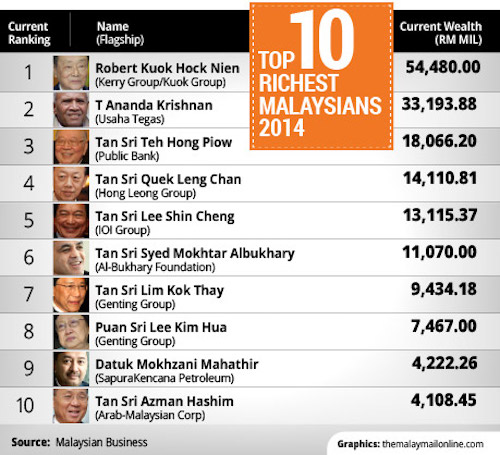

(Malay Mail Online, 20 February 2014) – As rich get richer, Mokhzani breaks into billionaires’ top 10(READ MORE HERE)

This was what www.worldsrichpeople.com reported:

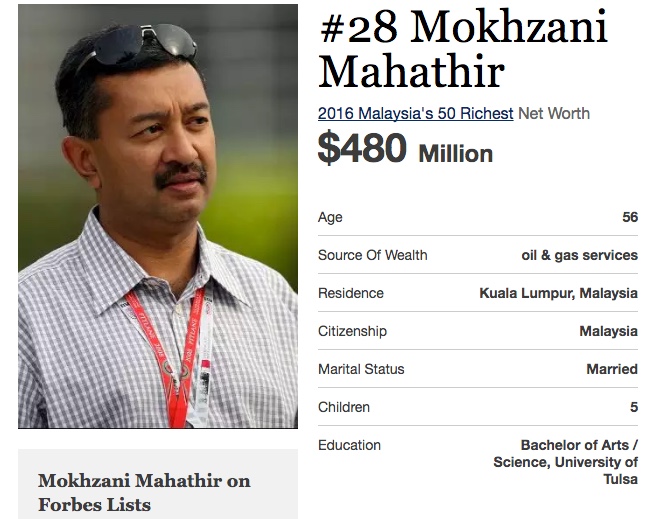

In 2013, Forbes reported that his second son Mokhzani Mahathir has a net worth of US$980 Million. Although there are no official reports of how much the former Prime Minister is worth, it can be safe to say that his net worth is estimated to be more than US$550 million.

(Malay Mail Online, 14 July 2015) – How did your son afford RM36.2m collection of supercars, Malay group asks Dr M (READ MORE HERE)

(Malaysia Today, 20 September 2016) – The story of Mokhzani Mahathir and the biggest coup in Malaysian banking history (READ MORE HERE)

Mukhriz Mahathir’s house (SEE MORE HERE)

**********************************************

Mahathir and Daim amongst those behind the Bank Negara FOREX scandal

An ex-Bank Negara manager reveals the inside track on the currency speculation undertaken by Tun Dr Mahathir Mohamad, Tun Daim Zainuddin and Nor Mohamed Yakcop about 20 years ago.

(Malaysiakini, 3 June 2012) – A former Bank Negara insider has named four powerful elites as main players to have caused the central bank’s massive RM30-billion loss in the international foreign exchange speculation scandal some 20 years ago.

In his explosive revelation, retired Bank Negara deputy manager, Dr Rosli Yaakop named former Prime Minister Dr Mahathir Mohamed, ex-finance minister Daim Zainuddin, ex-Bank Negara Governor, the late Jaffar Hussein and current Minister in Prime Minister’s Department in charge of Economic Planning Unit Government Nor Mohamed Yakcop as the “forex scandal elite club masters.”

Rosli said the central bank ventured into speculative forex market in a big way during Daim’s tenure as finance minister. “The order to go and make money in the forex market was from Daim with Dr Mahathir’s blessing,” Rosli disclosed, adding that Jaffar was their “Yes Man” Governor at that time.

He said Bank Negara strategy was to hit a currency for a couple of yards and once the initial transaction has gone through, re-hit it again with another couple of yards normally only minutes later. This will send shocks to the market and dealers will scramble to buy the currency, sending the currency value up. Bank Negara would then sell the currency with a healthy profit.

“But then, dealers caught on to the scheme hit back,” said Rosli.

Rosli said experts estimated Bank Negara’s exposure for having lost that much was USD27 to USD33 billion, which was five times more than its foreign reserves and its entire assets of USD20.7 billion in 1992. Rosli said that Bank Negara was indeed such a real gambler that Alan Greenspan of the US Federal Reserve warned the central bank to stop its speculative activities.

“Bank Negara claims of losses were schematically understated. Losses were hidden through revaluation of BNM’s gold holding and revaluation of quoted investment,” disclosed Rosli. Bank Negara was once the largest player in the international currency market and in April 1991, Reuter described it as “a dominant force in the foreign exchange scene for some years.”

“That’s real gambling … even closest rival, Japanese Fund Managers, would trade in USD50 million-lot only once or twice a year,” said Rosli.

Kit Siang’s suggestion for a royal commission of inquiry was ignored and Jaffar even did not bother to attend public accounts committee inquiry. He suggested that Pakatan Rakyat, if were to capture Putrajaya, should re-open investigation on the scandal which was approved by the audience.

He said certain people would have been in jail as criminal elements existed in the forex scandal.

He said the criminal elements were negligence, overstepping of power, falsification of accounts, “creative accounting”, misinformation, breach of trust and corruption. “But, they had protectors,” he said.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.