When persistent mistakes and misstatements continue to be made by no less than the prime minister on key economic data and the level of the ringgit, one has to wonder who are these advisers feeding him such data and advice.

It seems almost a deliberate attempt to present the data in a manner that will make people misunderstand them rather than inform, educate, and give a true view of the situation.

Rarely are short-term movements in the ringgit because of fundamental reasons, whether positive or negative.

In the latest example, Prime Minister Anwar Ibrahim said in a Bernama report, and I quote verbatim: “The ringgit is at its strongest level in 14 years due to the coalition government’s policies and collective efforts to develop the country.”

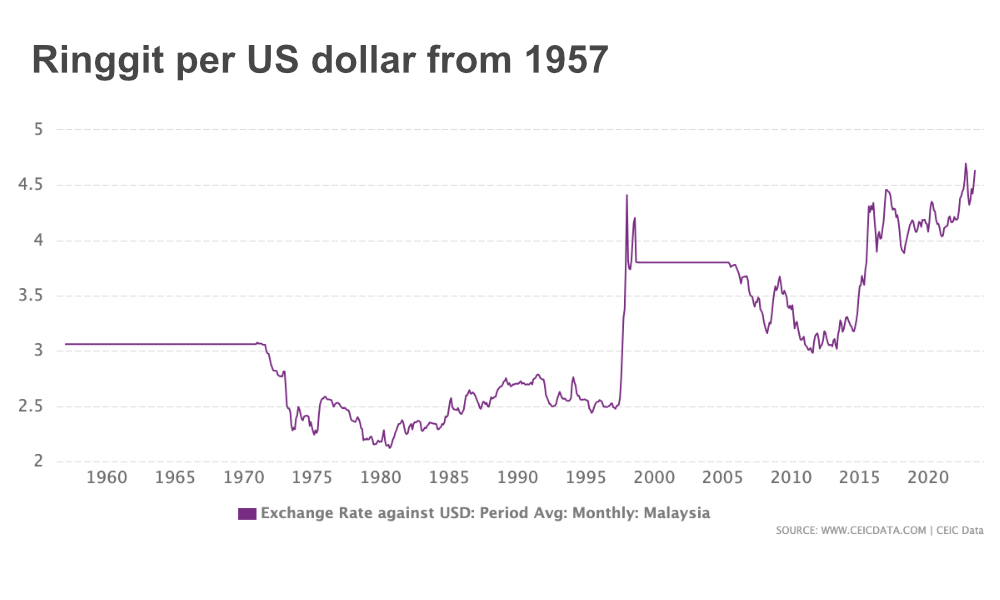

Whichever way you interpret that, it means that the ringgit is at its strongest relative to the US dollar, the de facto currency against which others are measured, in 14 years. That is simply not true as the chart below shows.

Empty boasting

The short-term strength of the ringgit was due to expectations that the interest rates would trend lower, thus reducing the gap with US interest rates which are higher. Malaysia has much lower interest rates compared to the US and most of the world. The ringgit level is still a lot lower than it was.

This is hardly something this government can take credit for. Even as the ringgit was strengthening, the stock market was paradoxically weakening. The government was responsible for neither - they are short-term movements that don’t count for much.

As the chart clearly shows, the ringgit 14 years ago was trading at around RM3-3.5 to $1, which was way stronger than the figure of around 4.5 now, in fact about a third stronger. (The more ringgit per US dollar, the weaker the ringgit.)

It’s true, however, that the ringgit has been strengthening recently but it is hardly anywhere near the kind of strength that it had in the past.

In fact, it has not even regained the strength that it had when the corrupt Najib Abdul Razak was prime minister - from 2009-2018.

Thus, the Madani coalition government cannot even claim any credit for the short-term strengthening of the ringgit, which is still trading at much lower values than it did 14 years ago.

It is better that Anwar and his bungling spin doctors let professionals handle these matters. In the case of the ringgit, it would be Bank Negara Malaysia.

Anwar also made a mistake over debt “reduction” recently as I pointed out in this article. This could be handled by Bank Negara, the Finance Ministry, or the Statistics Department.

These errors are embarrassing and people who matter such as investors and fund managers are going to question them. Some things cannot be spun away.

Same starting point, different outcomes

At the time of writing the ringgit was trading at around 4.46, not far off from the levels shown in the charts which puts it slightly above 4.5.

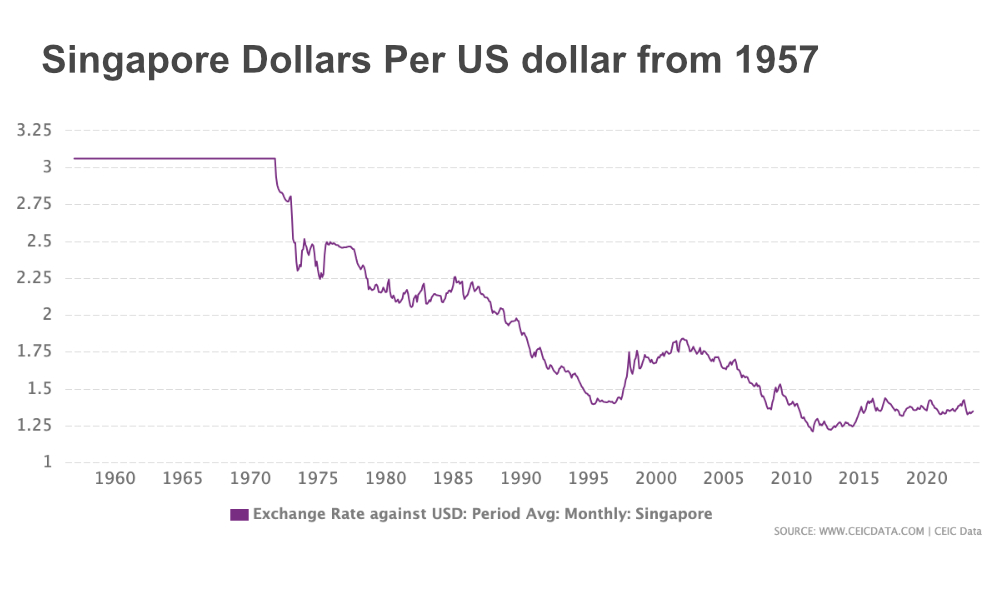

But this historical chart and the accompanying one for the Singapore dollar help us better understand how currencies move and how they are tied to economic strength.

The two charts show how two countries whose currencies were interchangeable for many years diverged strongly along with the direction of their economies, with the Singapore dollar now valued at more than three times the ringgit.

Before 1970, both currencies were fixed at an exchange rate of three to one US dollar under a fixed exchange regime. In those days, some would say better days, currency rates were far less volatile.

If a country got into foreign exchange problems, that is it did not earn enough money in foreign currency to pay for their imports, they devalued their currency with help and guidance from the International Monetary Fund.

That did two things. First, it made their exports more competitive by lowering their prices in foreign money - exporters got more money in local currency. But the population had to tighten their belts because they could only afford to buy less from overseas.

Then in 1971, the fixed exchange rate system collapsed and was replaced by a floating rate regime which allowed the market to determine exchange rates. In the long term, strong economies saw their currencies strengthen and weak ones saw them fall.

Malaysia and Singapore saw their currencies rise uniformly in the first years after the floating of the rates before diverging later in the eighties, coinciding with the arrival of Dr Mahathir Mohamad’s 22-year reign in 1981.

By 1995 the ringgit was around 2.5 to the US dollar, while the Singapore dollar was below 1.5, already much stronger than the ringgit.

These rates were about maintained until the Asian Financial Crisis (AFC) of 1997-98 when all Southeast Asian countries and South Korea came under attack from a combination of bad news and outright manipulation by international traders.

Mahathir fixed the exchange rate at 3.8 after it approached five at one stage in September 1998 to stop speculation and a day later dismissed and then subsequently jailed his deputy, current PM Anwar.

The point to note is that while the ringgit never reached its peak of 2.5 to the US dollar before the AFC, the Singapore dollar not only regained its previous level but strengthened further.

Recovery can start now

So what can the government do about the ringgit? I wrote about it here.

An extract: “If you run the economy well, reduce wastage, have political stability, are competitive, etc, the long-term effect on the ringgit will be positive - it will become stronger because the economy is strong, funds flow in, confidence all-around is high, and people are happy, educated, and productive.”

And another one: “It’s not difficult to identify what makes for a stronger ringgit. What is needed is the long-term political commitment to do what it takes, putting the right people in place and unrelenting and scrupulous implementation.”

It’s a long-term game but a start has to be made. Now is a good time - and long overdue. The weak ringgit is essentially a premium for risk - a lack of good leaders in other words. - Mkini

P GUNASEGARAM is a former business editor and head of equity research. He ascribes the continuing weakness in the ringgit to bungling political, business, and economic leadership since 1981 which has put our nation needlessly at grave risk.

The views expressed here are those of the author/contributor and do not necessarily represent the views of MMKtT.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.