Directives to six government-linked investment companies (GLICs) managing RM1.8 trillion to invest RM120 billion over five years in potentially risky high-growth ventures are dangerous and misplaced.

Such investments should be through direct government funding via cutbacks and new revenue sources, and channelled into one professional, government-owned investing company rather than a number of them with different objectives.

This is especially so since the six - the Employees Provident Fund (EPF), Retirement Fund Inc (Kwap), Permodalan Nasional Berhad (PNB), Khazanah Nasional Berhad, Tabung Haji, and Armed Forces Fund Board (LTAT) - have different obligations to their different stakeholders.

Importantly, the RM1.8 trillion invested by these GLICs is not liquid. Most of it is not available because they are already invested, much of them in long-term stable, solid investments. To say that they are liquid is incorrect.

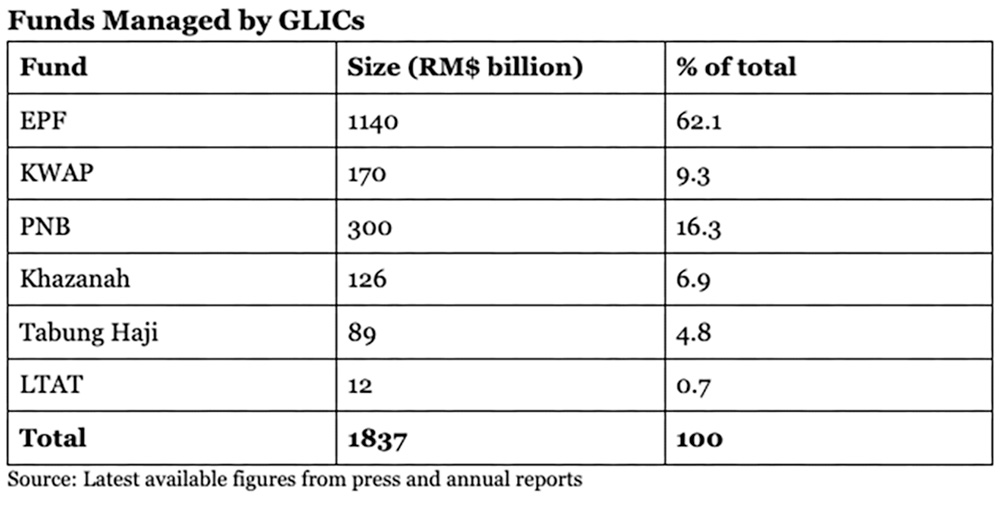

The second thing to note is that retirement funds EPF (RM1.14 trillion under management) and Kwap (RM170 billion) account for over 70 percent of total funds managed by the six (see table), with the EPF alone accounting for 62 percent.

They are obliged to preserve capital with stable longer-term investments such as quality bonds and stocks.

They should not risk them in potentially high-risk new investments which are the preserve of entrepreneurs and companies who know the business. We have not come to a stage where we really know these businesses in which the funds are supposed to be invested.

Catalysing growth in key economic sectors is not, repeat, not, the aim of retirement funds. It’s to provide safe, stable returns to protect old-age savings.

In the case of Kwap, it is government-funded but it is to fill potential gaps in government pension obligations. Prudence dictates it must have similar criteria to pension funds.

PNB, which has over RM300 billion invested, was set up to increase the participation of bumiputera in key businesses. It too has to preserve the quality and safety of its investments as a repository of savings of mainly bumiputera.

Similarly, both Tabung Haji (savings for pilgrims to go to Mecca) and LTAT (supplementary retirement savings for armed forces personnel) have particular obligations to their stakeholders to provide safe, steady returns.

Both have recently been embroiled in questions over the previous management’s capability and professionalism in recent years. Therefore they are hardly candidates to entrust with difficult, troublesome investments.

Asking for trouble…

The type of investments these funds are required to make are given in a Finance Ministry press release.

I quote verbatim: “These investments are primarily directed towards high-growth, high-value industries such as the energy transition sector; advanced manufacturing especially in the semiconductor space; investments across all life cycles of firms from start-ups, venture capital to mid-tier companies; and finally to support listing of such companies.”

That’s a rather ambitious and scary undertaking which will carry tremendous risk, akin to a private equity firm which takes high risk for high returns but in areas where they have expertise to contribute.

The only one among the six qualified to do this and has a clear mandate to do so by the government is Khazanah (RM126 billion in management), which over the years has built up expertise in investing.

Note that they do not usually engage in start-ups in these fields though, which is much more complex. Even they don’t have the expertise to start these up from scratch - we are asking for trouble if we do so.

Remember the wafer fabrication plant, SilTerra, paradoxically under Khazanah, which reportedly lost some RM5.5 billion over nine years to 2017? We cannot move faster than our capabilities.

Has Khazanah applied to amend SilTerra’s local shareholding requirement?

These investments should be put under one government investment authority - Khazanah comes close and has expertise built up since its transformation in the 2000s.

It has the advantage of both local and foreign investment experience.

The government should provide the RM24 billion a year to the fund to make RM120 billion over five years - it must come out of their own pockets from cuts in spending and new revenue sources.

It must ensure that they have reasonable chances for success, otherwise RM120 billion will be so much money down the drain.

It should not be taken out of retirement funds, which is dangerous, and downright irresponsible, something which was used by the previous backdoor government to reflate the economy and promote irresponsible spending.

Learn from the past

An older example is instructive. In the ‘80s, then PM Dr Mahatahir Mohamad started a push into heavy industries such as steel, cement, cars, bikes, trucks and so on when the need and viability for such industries were not established and no feasibility studies were made.

An earlier industrial master plan by experts had recommended a focus on resource-based industries instead such as industries needing rubber, furniture and wood products and palm-based products. Mahathir ignored it and we paid the price and are still paying up.

That caused the country tens if not hundreds of billions of ringgit, much wasted time and effort, setting us back many years in terms of lost opportunities. Ambition must always be matched with capability and competitive advantages.

We have had a history of less profitable investments and even losses in many government-owned companies. We must not make such mistakes again by pushing for projects we are not capable of undertaking yet.

Think it through, plan properly

In the latest episode, we have put the cart before the horse. You can’t industrialise by edict, which is what Mahathir tried to do and failed miserably and which the Madani government is emulating now.

Hire competent people first to investigate the ground and make a sound assessment of what is possible and a plan of action, budgets and forecasts. Evaluate them and then move if all checks out.

To say we will invest RM120 billion over five years in these areas without even so much as studying how these can be implemented and the benefits they will bring is foolhardy.

You need to do the groundwork before you decide to invest what, where, how, how much and over what period.

These things can’t be done by instructing GLICs to simply go out and invest - that’s a recipe for disaster.

Where is the feasibility study and plan? They need to come first and only then should a decision be made - for or against. - Mkini

P GUNASEGARAM says political grandstanding is a dangerous game, both for the rakyat and those engaging in them.

The views expressed here are those of the author/contributor and do not necessarily represent the views of MMKtT.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.