Contentions made by senior lawyer Shafee Abdullah regarding the 1MDB case against his client, Najib Abdul Razak, have all been raised and argued with during the case trial in the High Court, said the Attorney-General’s Chambers (AGC).

The AGC maintained in a statement today that it remains committed to conducting the prosecution independently, fairly, and with integrity.

It added that any decisions made regarding prosecutions were always based on the law and the evidence available.

“(This is) to ensure that justice is upheld by the public interest, which is always protected,” the statement said.

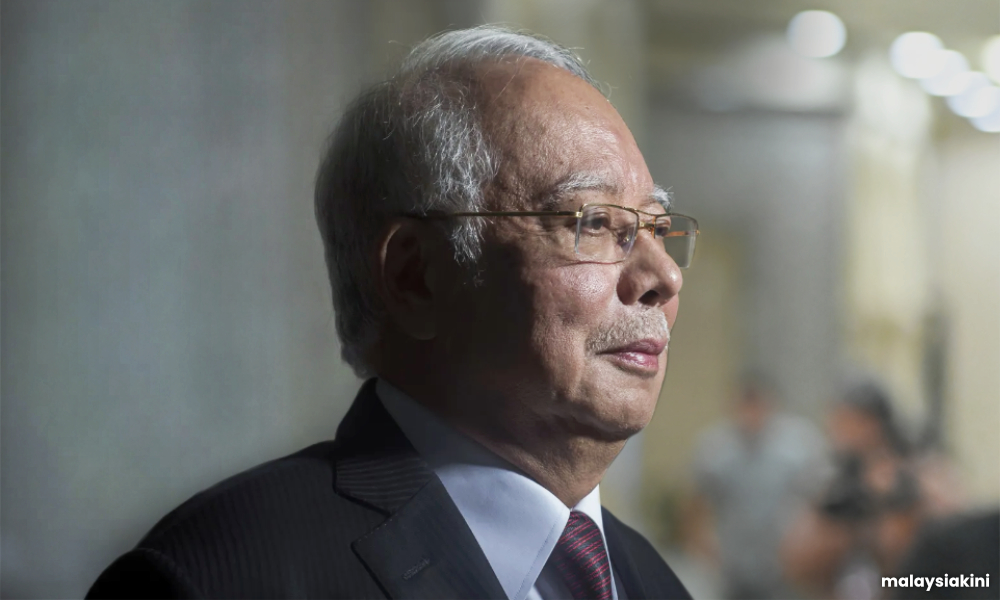

Shafee yesterday again claimed that Najib did not receive a fair trial in his 1MDB case, in response to AGC’s earlier statement that it had uncovered “new information” following the repatriation of Roger Ng two years ago.

Shafee claimed that Ng, who previously testified as Najib’s 25th defence witness, had declined to answer several material questions on the basis that Ng was bound by a protective order issued by the United States District Court for the Eastern District of New York, despite the High Court saying that Malaysian courts are not bound by US court orders.

‘Favourable evidence’

Shafee further claimed that the evidence which fell under the protective order could have cleared the former prime minister.

Federal Court judge Collin Lawrence Sequerah, who was elevated to his post recently, is set to deliver his decision on the 1MDB case on Dec 26 in his previous capacity as a High Court judge.

Najib was charged in 2018 with four counts of using his position to obtain gratification totalling RM2.3 billion in 1MDB funds at the AmIslamic Bank Berhad branch on Jalan Raja Chulan, Bukit Ceylon, between Feb 24, 2011 and Dec 19, 2014.

He was charged under Section 23(1) of the MACC Act and can be punished under Section 24(1) of the same act, which carries a maximum 20 years' jail time and a fine of either five times the amount of the bribe or RM10,000, whichever is higher.

He was also slapped with 21 money laundering charges, where he was accused of committing the offence at the same bank between March 22, 2013 and Aug 30, 2013.

The charges are framed under Section 4(1)(a) of the Anti-Money Laundering and Anti-Terrorism Financing Act, which provides a maximum fine of RM5 million and imprisonment of up to five years or both, upon conviction. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.