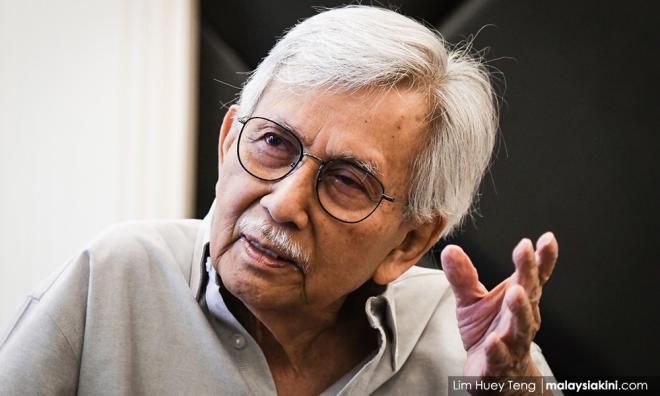

Ex-finance minister Daim Zainuddin said that an unelected 'all-Malay government' does not bode well for the future.

Question: The IMF refers to the current financial crisis as the "Great Lockdown". They now expect the global economy to shrink by 3 percent this year from a growth of 3.3 percent previously. The speed and scale are unparalleled. They said this is unlike any financial crises we've seen in recent decades where the epicentre of the problem was quite specific ie the collapse of house prices, the burst of the financial bubble. This time every industry everywhere is collapsing. Would you agree and how do you deal with this?

Daim Zainuddin: Covid-19 has forced society into completely changing our daily norms, and put all the weaknesses of every business, government, and community out on display. We have been given an opportunity to pause, take stock, recalibrate our values, our relationships not only with our fellow mankind but with nature too, and rethinking our priorities in life. It is our chance now to take steps to improve what we can and change what we must for the sake of a better future.

The 1997-98 Asian Financial Crisis (AFC) was triggered by unsustainable economic imbalances (excessive speculative investment in stocks and properties; unproductive consumption and investment); and mismatch in currency and maturity. The 2008-09 Global Financial Crisis (GFC) – subprime housing loans, toxic assets, unsustainable borrowings and over-leveraged to finance consumption and investment. This crisis is a more complex inter-linkage of shocks between health and economic crises that have disrupted and brought our usual ways of spending, doing things and working to an almost complete stop.

The impact of Covid-19 has been devastating; not only from the loss of lives, but also the collapse of economies and businesses which have led to massive job losses. Businesses which have taken years to build collapsed in a matter of months, people from all age groups suddenly finding themselves with no incomes. We are also faced with the threat of food shortages and the corresponding fear of an inability to even afford basic needs. Economic and social gaps are going to widen further, wiping out many of the strides that have been achieved to narrow these gaps over the last few decades. Above all, we are still unsure of whether we will ever be able to return to “normal” because so much work and effort have been wiped out in a space of five months.

Not every industry has been impacted negatively. We have seen the technology firms flourish at this time, and those who had put their faith in technology have seen it pan out for them.

How do we deal with it? I feel we have to go back to basics. We have to assume that things need to be rebuilt from the ground again. How do you create jobs for people; and how to provide retraining for those who have left their jobs, and what sort of retraining? This then leads to the question of how do we get our education systems to adapt – online learning? Which leads to confronting the glaring truth of the disparity in internet connectivity in this country.

We talk about food shortages; is this an opportune time to revive the agricultural industry, our food production industry? Maybe we can do it better this time, with greater use of technology and robotics perhaps. Again, this affects our education system. Do we need to emphasise on agricultural studies from a more elementary level and combine it with the study of robotics and AI?

Obviously, I cannot answer in detail how we deal with this economic situation. But I can say we need to go back to the building blocks and prioritise. How do we get people back into jobs? How do we put money into people’s pockets? How do we keep alive the SMEs who are the biggest employers? How do we make food cheaper and supply more sustainable?

You have dealt with two major financial crises. What were the takeaways/lessons that you gained from those two experiences?

Political and social stability, clarity of policies, strong and wise leadership and respect for the Rule of Law are very important. Without these 4 ingredients, we will have a tough time, and investors’ will run away. Investors’ confidence matters. We must remember that about 40 percent of investments in this country are contributed by foreign investors. Now is the time to court them.

We know Japan is moving out from China, and so is America. Indonesia and Vietnam are working hard to entice foreign firms to relocate to their countries. And America has decided to invest in Indonesia. We will be left behind if we are not serious. Even local investors will invest in other countries if we are not careful.

If Malaysia is not stable, with U-turns in policies, they will go elsewhere. Case in point is the loan moratorium for car and housing loans. So many conflicting statements.

Rule of law seems different for the rich and the poor, you steal a packet of Milo you end up in jail, but if you launder billions, you walk away a free man.

In order to revitalise the economy, it is important to obtain first-hand information about the economic and business conditions. During the 1998 crisis, the NEAC met daily to monitor and track daily/weekly information and news flow closer to the ground and also held regular engagements with various industry associations/chambers/economic sectors. This was to provide prompt policy responses to ease the impact of economic disruptions on domestic households and businesses.

You must have a plan and you must have a good team to implement the plan. You must have your short-term, medium-term and long-term goals. You must know how to carry out the implementation, how to monitor progress, how to adjust with changing circumstances and how to communicate with the Rakyat about what is being done.

The government must also remember that handling an economic crisis requires coordination and cooperation of all arms of the government and not just the responsibility of the Finance Ministry. It is the whole government, all the Ministries, with the state governments, working in tandem o ensure that the plan is implemented effectively. It will be difficult to focus on revitalizing the economy if the government effort is also focused towards other agendas which can distract from the economic situation at hand.

Governments and central banks are doing all they can to limit the shutdown with stimulus packages. But some argue that the stimulus isn't working as effectively. People are not spending as much and businesses are not investing as they should for the economy to run. What are your thoughts about the stimulus packages that we have in place?

Governments worldwide have rolled out trillions worth of fiscal spending package and central banks have slashed interest rate to record lows; pumped in massive in some cases, unlimited liquidity injections. The Fed has reactivated Quantitative Easing (QE). So has the Bank of England.

The undeniable fact remains that the scope of interest rate cuts are limited this time round compared to 2008-09 GFC as interest rates were already at low levels and some central banks have long been trapped in negative interest rate trajectory as in the case of Bank of Japan and ECB. Both Japan and Eurozone economies have yet to show convincing economic expansion despite the QE and negative interest rates, alluding to the fear that the monetary stimulus has not been effective.

The effectiveness of both fiscal and monetary stimulus depends on how responsive households and businesses will be to these packages, the revival of confidence and the progress of COVID-19 containment.

Malaysia’s RM260 billion Prihatin Economic Stimulus Package, with RM35 billion direct fiscal injection is expected to blunt the economic recession and ease the magnitude of impact (economic and financial pain) on households and businesses, although the impact from the stimulus is short-term.

However, Malaysia cannot escape a recession this year.

We are a trading nation, if major economies are not doing well, we will not do well either. The global economy is expected to contract by 3 percent in 2020 – the worst recession since the Great Depression in the 1930s.

USA, the biggest economy in the world, has entered into a recession. It has contracted at an annualized rate of 4.8 percent in the first quarter - the highest since 2008. So far, 33.5 million people have filed for unemployment benefits in the last seven weeks up to May 7, 2020, which translated to an unemployment rate of about 15.5 percent, a Depression-era level. Last week alone, 3 million Americans filed for unemployment benefits and 21.7 million jobs have been cut in April. That is 27 times than the worst monthly decline during the 2008 Global Financial Crisis and 11 times worse than the previous record decline in September 1945 at the end of World War II.

China is also in recession; the Chinese economy in the first quarter shrank by almost 7 percent, the first contraction since 1992. The UK economy also shrank in Q1, its largest fall since the financial crisis.

Malaysia would not be spared. The government expect the economy to fall into recession this year, with GDP expected to contract by at least 2 percent, although my own assessment is that it will much higher than that. Look at Q1, except for a slight expansion in the services (3.1 percent) and manufacturing (1.5 percent) sectors, all other sectors had negative growth. We must remember that MCO only started in the last two weeks of March, yet most of the economic sectors are not doing well.

The government fiscal position will be tougher, revenue will be much lesser as many firms are struggling to stay afloat. A survey done by SME Association in March highlighted that nearly 82 percent of SMEs predicted a loss for the financial year 2020, which means tax collection will be much lower. The latest statistics from the Department of Statistics show that 68 percent of firms reported zero income during the MCO. The loss of income by businesses, especially the SMEs will translate to higher unemployment rates. That means there will be less demand. So if exports not doing well, consumers’ pool is shrinking, and firms not investing, where will growth come from? How then can we collect tax to finance expenditure and development?

I am very worried about unemployment. The number of unemployed are already up by 17 percent in March, and it will get worse. We soon will have about 51,000 graduates coming out of university, and they will have a harder time to find jobs. This is not good for stability. We will see an increase in poverty rates too.

The policy must be to ensure that firms survive, and jobs are protected. This is where monitoring implementation matters. I received lots of complaints on the bureaucratic process of obtaining assistance.

When I look at the latest report from MOF, not many SMEs are getting the assistance. Despite that 92.1 percent of the RM6.3b allocation of soft loans for SMEs have been utilised, it benefited only 14,075 SMEs. That is merely 1.55 percent of the 907,065 establishments of SMEs in Malaysia.

The beneficiaries of the wage subsidy are also rather small. As at May 17, 2020, it is reported that the number of firms applying to the wage subsidy programme is 267,752, or roughly three in 10 of the total SME establishments in Malaysia.

The utilisation of the microcredit loan provided by BSN and TEKUN for micro-enterprises is equally small. Only 35 percent of the RM700 mil has been approved, and only 15,641 micro-enterprises have received this assistance. That’s about 2.3 percent of the total 693,670 micro-enterprises in the country.

The delivery is slow, and the coverage is weak. This need to be addressed immediately. The effectiveness of the stimulus packages will depend on execution and how the financial assistance is being utilised.

Are governments financially prepared for crisis? The PM said we lose about RM2.4 billion a day under MCO. Did we rush to reopen the economy? Is it the case that the government is incapable of supporting the economy in desperate times?

Our fiscal space or the government’s balance sheet must be strong enough to deal with the crisis. We have some fiscal space and debt borrowing capacity (52 percent of GDP) to adopt a counter-cyclical fiscal stimulus. The government should spend more.

The government announced a Stimulus Package of RM260 billion but the actual direct fiscal injection is only RM35 billion, or about 2 percent of GDP which is too small to make a meaningful impact. The fiscal deficit, according to MOF, is expected to increase to about 4.7 percent from 3.4 percent, although with the reduction in GDP and higher borrowing, the deficit will be higher.

I am firmly of the view that the government can afford a higher deficit in order to save jobs and firms. When the economy recovers, we can and must pare the deficit down. We have done this many times, during the 80s crisis, 98 crisis, and 2008 crisis. When the economy recovers, we managed to reduce the deficit. Let’s not be too dogmatic, our focus is to save the rakyat. We must do whatever it takes.

To be fair, I can understand why the government was eager to reopen the economy. I think the point of contention by the stakeholders is how it was carried out – their view was that it was very haphazard and lacking very much in a detailed map.

There was no timetable, there were only two days for everyone to prepare themselves, the SOPs differed from sector to sector. In fact, many SOPs were further changed and finetuned after the PM’s announcement. Many NGOs and business bodies themselves have related how they were called in for consultation only after the announcement was made.

So much was left to be desired in terms of how the lifting of the restrictions was carried out. We have gone from such a strict level where police were everywhere and peoples’ movements were very restricted, to a state where it seems that it’s anything goes. Families can go shopping together, people can travel from district to district at any time. So, the rakyat doubt there was any real map or timeline for the conditional MCO.

As to whether the government is incapable of supporting the economy in desperate times, the question that you should ask is “does this government know what it is doing and does it have the right people to lead the country out of this crisis?

Do we have sufficient reserves that could be pumped into the economy immediately or does the government need to raise funds?

The government has been running 23 consecutive years of fiscal deficit since the 1997/98 AFC, implying that not much of reserves (surpluses or savings) have been accumulated. There are some trust funds that can be mobilised. Petronas can contribute either through a higher petroleum income tax (PITA) and dividend payment but with low oil prices, that will be challenging.

Let us explore and discuss some of the options open to the government:

a) Some reprioritisation and reordering of expenditure.

b) Revenue enhancement through the listing of GLCs’ assets, the disposal of assets (but timing is crucial and priority to GLICs); privatisation, etc.

c) The government should revamp our tax policy. The problem with GST is that it was introduced at a high rate, and rakyat didn’t see the benefit. I had advocated GST a long time ago, but the rate that was introduced was too high and the monies collected were not spent on the Rakyat and not refunded back to the companies and cost of living went up. We need to revamp our tax policy so that it is fair, efficient, and progressive.

d) Borrowings through the issuance of domestic securities as the investors’ appetite for Malaysian bonds is still strong. There is no foreign exchange risk exposure and the cost of borrowing is cheap given the prevailing low interest rate environment. External borrowings (debt): under the External Loans Act 1963, foreign currency debt is restricted to RM35 billion (estimated outstanding debt as at March 2020: RM29.4 billion).

e) Review the government’s self-imposed administrative limit of 55 percent of GDP. The last time the government raised the ratio was in June 2008 (45 percent of GDP) from April 2003 (40 percent GDP) and further to 55 percent of GDP in July 2009.

f) The government can borrow from Bank Negara Malaysia. There is scope for this under Part X (Relations with government), Section 71 of the Central Bank Act.

These are extraordinary times, and requires extraordinary policy measures. We cannot be confined to orthodox and business as usual thinking. Those in charge must think outside the box.

The IMF said there have been close to 100 countries who have come to them for financing needs. Should Malaysia seek international help? Is that ever an option?

No, based on our personal past experience and based on what we have witnessed of how countries which have borrowed from the IMF have suffered, the simple answer is no. During 1997-98 AFC, Malaysia had successfully steered the economy out of a deep recession (GDP contracted by 7.4 percent in 1998) through its own style of unorthodox policy responses, including the unpopular selective capital controls and the fixing of the ringgit peg without seeking financial assistance from the IMF’s conditional lending facilities.

The government still has some fiscal policy capacity and Bank Negara Malaysia has policy tools at its disposal to mitigate the Covid-19’s inflicted economic impact.

The crisis is impacting poorer/more vulnerable people more, i.e. daily wage workers, self-employed people, those who operate restaurants, in tourism. We've seen massive layoffs and complete shutdowns involving SMEs resulting in loss of income for people at the lower end of income gap. What are some of the measures that need to be put in place to prevent the inequality gap from widening further?

No one can be spared from the economic crisis. The priority is to protect the vulnerable households and groups as well as businesses, especially SMEs. For corporates, besides tapping on the RM50 billion Danajamin Guarantee Fund, they can seek feasible debt solutions via the Corporate Debt Restructuring Committee (CDRC).

This crisis exposed the inadequacy of our social safety net. I give you an example. If you are a private employee and contribute to SOCSO, the moment you lose your job, you can get income from the employee insurance scheme. The 1st month you’ll get 80 percent of your last drawn salary, and gradually reduced to 30 percent of last drawn salary in the 5th and 6th month. But if you are self-employed like Makcik Timah or Pak Ali, you have no protection. Do remember that almost half of the self-employed in the country have already lost their jobs.

The government currently provide wage subsidy to firms; the same assistance should be extended to the self-employed too. During the rehabilitation and recovery phases post Covid-19, job placement, skill training and income support programs must be continued for the vulnerable groups. Some form of financial grants and soft loans can be given to support micro-entrepreneurs, including e-commerce and online business.

With the collapse of global oil prices and the ushering of a new norm, what do you think will be the driver of Malaysia's economy in this "new world"?

Innovation, technology, digitalisation and increasing productivity are the key enablers to drive Malaysia’s growth catalysts ahead. These include the core electronics and electrical products using more digital and technology-enabled processes; the acceleration of e-commerce; value-added services in knowledge-based; content creation; e-payment gateway; fintech solutions; smart agriculture; medical equipment and healthcare, food processing and Halal products, sustainable products (eco-green, organic, sustainable sourcing and suppliers); biotechnology; data solutions; and nano-tech etc.

Incentives and policies, including clear strategies and road-maps, are urgently needed on investing in “new smart infrastructure” used for high-tech, digitalisation and sustainable purposes (renewable energy, climate change, eco-green). These include big data centres, 5G infrastructure, and charging stations for new energy vehicles (NEVs), solar energy, healthcare, etc.

The Covid-19 pandemic has shown that digitisation and technology can enable countries like South Korea, Taiwan to respond swiftly to the crisis and minimise disruption to businesses. As we move forward, innovation and the New Economy are likely to be critical areas of development for Malaysia, and significant creators of economic value.

Indeed, innovation and the New Economy were identified as key growth catalysts for Malaysia even prior to the Covid-19 outbreak. As we emerge from the crisis, we need to multiply and accelerate efforts to ensure that we can compete tenaciously in this fiercely competitive landscape. The pandemic has also exacerbated the need for having back-up plans and alternative sources – be it in supply chain or even service-centric areas.

Oil prices will recover with time. Maybe not to the levels we enjoyed previously but they will recover. The important thing here is to improve efficiency in our production processes. We cannot keep doing things the same way. If you realise it, a lot of traditional industries are still very relevant today such as farming and agriculture. The same can be said for construction and manufacturing for example.

But what is vital is how efficiency and production can be increased through the use of robotics and artificial intelligence. So, it’s not so much a case of not being able to do what we have been doing all these years, but more about how do we improve the way we have been doing these things.

When we talk about the current situation, there are a lot of words that are being used to shape today's narrative. Words like unprecedented" and "the new norm" are some favourites to describe the situation that we are in. In your own words, how would you describe what we are going through right now?

We hear these words ‘unprecedented’ and ‘new norms’ repeated in many countries. ls it really unprecedented? Is this something new? Has it not happened before? Facts and knowledge matter.

l like to be educated. l would ask historians to educate me than economists. l am a student of history. We will be told that this is not the first time so we study deeper and understand how was it handled then. The last global pandemic was the Spanish flu in 1918 and Malaya then was not spared either. How did it become global? Very interesting to read and be educated. We learn from past experience; for example, how did Philadelphia handle the Spanish Flu compared to St Louis or San Francisco and what was its consequences?. How did US handle the Spanish pandemic then, compared to now?

Remember conditions then were different from now. The world has advanced in all sectors especially science and technology yet many countries were slow in responding to present pandemic. We learn how Bali, Kerala and Vietnam successfully responded to this pandemic. Yet many governments fail to protect the lives of their citizens. Everyone has his own style and way of handling a crisis so we wait to see the results of the policies implemented so far.

This is a Black Swan event – a global health pandemic, which has imploded into an economic crisis, and forcing countries around the globe to go into lockdown to contain the outbreak. Prior to the Covid-19 pandemic, there was already stress on the global economy punctuated by the US-China trade tension. Global debt hit an all-time high at US$255 trillion in 2019, topping 322 percent of GDP, according to the Institute of International Finance (IIF). Many countries have high level of debt. In developed countries, interest rates were almost near zero. We entered the pandemic with little ammunition, both fiscal and monetary.

The scalable impact of economic and financial losses is deeper compared to, for example the 1930s Great Depression.

Post-Covid-19’s new normal path would eventually become “normal” as people and businesses accept social distancing as a social norm in our daily routine. Remote office and interface, as well as virtual social networking, will be commonly adopted in the business world. The contactless commerce platform will be accelerated and fast track with the advent of 5G wireless technology. There will be reverse globalization, where firms would try to limit the supply chain to only few outposts. While the fight against this global pandemic is likely to be arduous, protracted, and costly, it can pave the way for large-scale transformative opportunities ahead.

What are your thoughts on cryptocurrency? Do you think that will also be a major force/currency of the post-Covid-19 economy?

The expansive growth of cryptocurrencies over the past few years has prompted more national and regional authorities in 130 countries to grapple with their regulation. Governments should regulate instead of banning totally cryptocurrency as it kills off digital innovation.

One of the most common challenges raised by the central banks is largely about how to educate consumers and investors on the difference between actual currencies, which are issued and guaranteed by the central bank, and cryptocurrencies, which are not. There are transactions and investment risks resulting from the high volatility associated with cryptocurrencies as they are unregulated. Besides, cryptocurrencies create opportunities for illegal activities such as money laundering and terrorism.

There is serious thinking and thought that central banks should be the ultimate authorities that recognise any rising new form of money. If anything replaces fiat currencies, it needs to get the central bank support or even result in a digital currency issued by a central bank. At least 18 central banks are currently developing digital currencies but they are done on an individual stand-alone basis. The most effective way to counter private digital currencies is via a collaborative approach to manage monetary and financial stability as well as foreign exchange controls.

Several institutions are predicting that cryptocurrencies will play a greater role in our post-Covid-19 economy. Deutsche Bank is predicting that this pandemic will dramatically accelerate the adoption of digital payments systems such as cryptocurrencies as many governments see the handling of cash as a potential risk factor. This will likely add to calls to move towards digital cash. Researchers from Oxford University recently said that crypto is becoming more important than ever in the face of global financial woes.

However, many still perceive cryptocurrencies as somewhat of an enigma. Terms such as “bitcoin”, “crypto” and “blockchain” are familiar to many, but few know what exactly they mean. A fundamental understanding of cryptocurrencies could prove vital in succeeding in the post-Covid-19 economy. The cryptocurrencies market remains very volatile but it will continue to grow and mature especially with the many central banks looking at the Central Bank Issued Digital Currency (CBDC) initiatives in a very serious manner.

With so much uncertainty happening due to Covid-19, I anticipate that most investors and entities would be focused on things that are more established and proven, while focusing on necessary areas to innovate, to put them on a more stable footing – be it for growth or investments. Cryptocurrency, being still relatively unknown, does not strike me as something that will take off immediately post Covid-19. It will grow and develop further, just as it did pre-Covid-19.

What are your thoughts also about the aviation industry? You were previously against the KL-Singapore HSR (High-Speed Rail) because you said it will kill the airlines business. Does that mean you support aviation more than the rail industry, why?

The aviation industry is the hardest hit sector in this pandemic and is likely to be the last sector to recover, along with the tourism industry. The world’s commercial airlines and other aviation businesses face significant financial stress and perhaps bankruptcy in the coming months from the unprecedented broad shutdown of travelling due to the rapid spread of Covid-19 forcing them to layoff thousands of employees and adopt big pay cuts.

Governments have started to unleash rescue packages for the industry to prevent a catastrophic disruption to aviation. But we must be careful, there is a difference in ensuring that people can travel from point A to point B, and bailing out owners. This is not the time to bail out billionaires. We cannot socialized losses, and privatized profits.

On HSR, I believe there is room for both transportation systems to co-exist, and even complement each other, even in a small country like Malaysia.

I expressed my reservations on the KL-Singapore HSR because I felt the agreement that was signed by the government was lopsided and detrimental to Malaysia’s interests. For example, it would have allowed Singapore to have joint say in how the line was used in Malaysia. I don’t think that is right and I still believe that such a clause would impact on the nation’s sovereignty.

Malaysia will lose “sovereign ownership” of the track works, signalling and control systems, and neither will she possess full rights over the train services and schedules for the usage of the track which lies in Malaysian territory. This means that any domestic usage of the HSR track and systems such as inter-operability with other rail networks available in the country by Malaysia will be subject to the prior approval of Singapore.

It is common in this day and age for train services to operate across borders and this has been made possible through common inter-operability standards and regulations. Countries not only build and own the infrastructure, track and systems, they also possess full control to regulate the use of the tracks and the train services in its sovereign territory. Having this control enables countries to maximise the potential of rail tracks within their territory in order to provide for inter-connectivity with existing and future domestic and/or international rail networks.

With the on-stream of the 680 km ECRL and a potential to connect and integrate it with both the HSR and existing ERL tracks, Malaysia has the opportunity of developing a 1,070 domestic high-speed rail network “instantly”. This high-speed rail network can be further expanded northwards to the Malaysia-Thailand border, thus forming a National Domestic High-speed Network: North-South and East-West for Peninsula Malaysia. This will also lead to the realization of the Trans-Asia Railway Network in the near future.

Ceding control for the usage of our HSR track to Singapore would put this vision in jeopardy of being derailed. In addition, sovereignty should always be the top priority in safeguarding our national interests.

You have spoken against the idea of a Perikatan Nasional coalition. Does it still stand? What are your thoughts on UMNO and PAS? Bersatu reconciliation?

My principle has not changed, it is a question of legitimacy. The parties concerned can set up whatever coalition they want, but to do it in order to form a new government is not in line with the will of the Rakyat. We need to respect the mandate of the people. In 2018, the rakyat voted in a Pakatan Harapan government to rule for five years until a new general election is called. That needs to be respected. The formation of a Perikatan Nasional (PN) government did not respect that mandate.

Another is the issue of a totally Malay government. Yes, the PN government can say they have included GPS and MIC and MCA, but as far as far as MCA and MIC are concerned, they are very much token appointments, simply because these two non-Malay parties had such an insignificant number of parliamentary seats. And while MCA has proceeded to appoint several of its officials to GLC positions, these have no say in the running of the government. So, who is representing the non-Malay communities in the government?

Representation must not be token.

Umno and PAS seem to have forged a pretty tight partnership. But it is still early days as in we are still 3 years from the next GE. Come GE15, will they still be so close when each will be competing for seats in the Malay areas?

I do not know whether Bersatu reconciliation is on the cards. It is up to the members to decide.

The PN coalition of Umno, PAS and Bersatu are all Malay based parties and will compete for the same Malay seats. I am not sure how 3 competing coalition members will be able to satisfy their members on the ground. Will these push and pull from the ground destabilise the government machinery and interrupt the multi-ministerial initiatives planned for the people? If they cannot work as a team, how can the government’s plans to rehabilitate the economy and uplift the people’s lives be effective?

Do you think Dr Mahathir Mohamad made a mistake by stepping down as PM?

You have to listen to his reasons. He has stated very clearly in his FB video that he was left with little choice but to resign as PM and Bersatu chairperson because at that point of time, Bersatu had rejected him and refused to follow his advice and plea to stay with Pakatan Harapan. It was only after this fact, that some within Bersatu appealed to him to withdraw his resignation. He was talking about principles, but by then the die was cast.

It really isn’t so simple as whether or not he made a mistake. You need to understand what was happening at that time. It was not as if he could have taken time to consider all avenues. He had to make a decision quickly. Now after the fact, it is easy to say mistake, no mistake. But at that time and under those circumstances, was it a mistake?

There have been a lot of new appointments made at GLCs/GLICs. It is not out of norm but should we be worried that politicians are coming in and technocrats are pushed out? Will we see a return of old norms of rewarding contracts to grassroot leaders to sustain political activities?

It may not be out of the norm to have some political appointees at GLCs and GLICs but it is certainly out of the norm to have so many political appointments.

People see this as being done very blatantly with the sole intention of buying political support. We have a truly bloated cabinet of more than 70 people including those appointed as special ambassadors with Ministerial ranks. And at the latest count there were 13 political appointees as chairmen of various government companies and bodies. These do not include those appointed to BoDs.

The main issues here are whether these appointees have the background and qualification to be leading these bodies, and secondly whether they are able to divide their time and yet commit themselves fully to the tasks they have been given? People also question why the government is intent on enriching the MPs?

Why is this government putting so much wealth and power into the hands of a privileged, unqualified few? Why must the cake be made smaller? Why are the many talented people this country has produced being ignored? Why are the commitment and capabilities of so many professionals who could have done a much better job being insulted? The media should ask the government these questions.

If the government wants to help the MPs and retain their loyalty and support, there are many ways of doing it without inviting criticism and definitely not at the expense of the well being of the GLCs and GLICs.

You were also the PM's special envoy to China. Would you say you have completed your mission? Was there a list of things that had to be negotiated with the Chinese apart from ECRL? (i.e. pipelines, ports, South China Sea, Jho Low) What is your advice on how we should deal with China?

Well, I was negotiating the gas pipeline project but then the change in government happened. I have written to the PM as he may have other candidates to take over.

The PN government has appointed a special envoy to China, so he should be able to advise them accordingly as to how they should deal with China.

There were many reforms that the Pakatan Harapan government tried to push for. One of them is political funding. Would you agree that one of the causes of the 1MDB scandal is because we failed to establish a good political funding system? What is the most ideal political funding system that we can have here that is practical?

I think the main cause of the 1MDB scandal were greed and lack of integrity, honesty, good governance; and the self-preservation by those who were in a position to check and question. Those in a position of responsibility must have principles. How much of the funds that were siphoned out were actually used for the general election or for political purposes as compared to the amount that was spent on luxury homes, yachts, artwork, jewellery, etc? And don’t forget that the initial amount was never deposited into any party account as would be the case if it was for political funding. 1MDB was a slush fund for the personal use of the individual and along the way, he also utilised some of it for political purposes.

But then the fact that relatively large sums were also given to various BN members and divisions points to the weaknesses or even the absence of any regulations to political funding. As you know, Bersih has come up with a model for political financing. They have suggested setting limits to annual contributions, making transparent the identity of donors and how much they donate and a total ban on any type of slush funds. Others have also suggested a total ban on any form of foreign political funding.

Given the close nexus between businesses and political parties, it is understandable that there needs to be some transparency in the political funding process. But we must find a system that is suitable and particular to this country. Have we found it yet? We must start somewhere.

How important is Parliament in the process of reform and what does a one-day sitting mean to this reform process?

We are talking about principles here. When we want to discuss our Westminster style of Parliament then we must go back to where it started. Learn the history of Parliament. Who controlled it at early stages? Members were not paid. Who were the voters? Then many reforms were instituted and why these reforms? The end result was a Constitutional monarchy and Parliamentary democracy.

l think for us but especially the young, it is best to revisit the King’s speech to Parliament in 1959 which in my view was a very good one.

Democracy as we understand it is a government by the people for the people. People choose the govt for good or bad. lt is their choice and they must live with their choice at least for the next five years until the next election is called.

Even the PM recently admitted that this is not a government chosen by people. People elect their MPs and therefore their government so we must respect their choice and must not betray them. Their wishes must prevail. Any government of the day must be sensitive to the voice and wishes of the Rakyat as the government will have to go back to the Rakyat to ask for the next mandate.

Parliament has its standing orders, rules procedures, conventions and Speaker is independent. Democracy and Parliament go together hence parliamentary democracy as practised here in Malaysia. By limiting Parliament to a one-day sitting, what the PN government did was unprecedented in our history. It is silencing the voice of Parliament and really riding roughshod over the standing of Parliament in a democratic country. And if you reduce and ignore the role of MPs to be just rubber-stampers or merely as onlookers then you are ignoring the voice of the people.

The MPs in Parliament represents the voice and will of the people, the Rakyat. In Parliament MPs speak and they speak as representatives of the people. It is undemocratic to silence them. What you are really doing is telling the Rakyat that their opinions do not matter, that their choice does not matter, that their voice does not matter and ultimately their votes do not matter.

As you know, the Harapan government was in the process of carrying several major institutional and parliamentary reforms. The Institutional Reform Committee under the CEP had recommended a long list of reforms and submitted this to the PM at the time. Unfortunately, many were placed on the backburner, some were killed even before they got off the ground, and others were in the process of being carried out when Harapan lost its hold on the government.

Even then the Harapan government did manage some important reforms such as the move to lower the voting age to 18 years, appointing an opposition MP to head the PAC and setting up a Special Select Committee to give Parliament and MPs greater oversight over government decisions.

These were the easier reforms to carry out because they did not require amendments to the Constitution. It is when reforms require such amendments that Parliament becomes imperative. So here we are talking about things like limiting the number of terms for the PM and even regulating political funding.

You’ve spoken about how the NEP should evolve into a needs-based policy as opposed to race-based. Do you see that happening?

In order for this to happen, we need political stability which will create the political will which will then allow for a comprehensive plan to be drafted and initiated by the government. However recent events have shown that this will not happen any time soon since there is no working consensus among the parties in the present government.

What was your vision for the agriculture sector? Everywhere you’d go you would talk about agriculture and there was a lot going on as well with Felda restructuring their land plots, FGV venturing into farming and durian planting, collaborations with telcos to bring 5G into agriculture. What was the plan there?

My vision is to see the Malaysian agriculture sector to develop into a great equaliser – to give fair compensation to farmers and fishermen, and to bring greater development to rural areas. As you said, I spoke a great deal about agriculture, particularly modern precise agriculture, because this is the key to increasing income for our farmers. Modern agriculture techniques allow us to make the most of our resources, increasing output and reducing waste, labour, and environmental impact.

With the larger corporate groups venturing into farming, this was to accomplish another goal of developing the Malaysian agriculture sector, which is to achieve a higher level of self-sufficiency. In Malaysia, we rely heavily on imported goods. When we do have local goods, there is a disproportionate profit taken up by middlemen who often control storage and logistics. Both these factors contribute to the higher cost of goods borne by the end consumer, the higher cost of living that burdens the rakyat.

Unlike smallholder farmers, larger groups like Felda and Felcra have access to large plots of land and have the capital to invest in modern farming technology. These high initial costs are what often hold smallholder farmers back from being able to take the leap from traditional farming to modern farming.

Once modern techniques become more common in Malaysia, and the ecosystem develops, the hope is that more local companies take note and increase local production of the various cogs that make up the agricultural machine. For instance, we have local drone companies, but not enough to bring the costs down sufficiently to cater to smallholders. Much of our animal feed and vegetable fertilizer is imported, which adds to costs and our vulnerability to currency changes.

I hope that the large companies that were planning to invest in agriculture will follow through on their plans, as people will always need to eat, and Malaysia is far behind in achieving a self-sufficient and sustainable agriculture sector. Since the MCO started, the weaknesses throughout the agricultural supply chain have been laid bare.

Those in charge must have a clear grasp of the supply chain if the dream of a modern agriculture sector are to come true in Malaysia. They must continue to encourage investment in the agriculture industry, enhance training for graduates who wish to pursue a career in agriculture or aquaculture, and provide the necessary support to remove the barriers to entry for budding new farmers.

Were there targets that were set out for the agriculture sector? Maybe reducing our food import cost or cutting our reliance on palm oil? Do you think what you did will continue? Should there be an urgency to do it?

When I speak of the agriculture sector, I always reaffirm that the goal is to increase output, increase income for the farmers, and to reduce the food import bill. This, in turn, will reduce the cost of consumer products, as well as strengthen the ringgit. Rather than cutting out palm oil, the target should be to diversify the agricultural industry to improve food production and reduce monocropping, which is both risky to the farmer as well as bad for the environment.

As to whether or not it will continue, in my opinion, we have no choice but to continue this pursuit. The current model of relying on imports is not sustainable. Subsidizing farmers and fishermen indefinitely is not sustainable. What is needed is targeted investments to improve their livelihoods, and give them a long-term increase in income which is reflective of the importance of their work. By investing in modern agriculture, we are investing in our future – ecologically friendly technological to reduce environmental impact, modern techniques which reduce labour and resource costs.

During this MCO period, we started to hear more and more of the term “essential worker”. What is more essential to our community that the ability to feed ourselves? We have heard many stories of everyday Malaysians becoming MCO farmers, starting to grow their own crops during this time. I highly commend those that have been able to do so, and hope that we all continue to cultivate home farms even after the restrictions are lifted. However, I hope that all of you who have started home farming now realise the time and effort that goes into producing food.

Is it fair that essential workers, including those that produce our food, are often the least paid, the ones living in uncertainty, depending on daily wages to survive? No. This must change, and it must change now.

Now more than ever, there must a great sense of urgency to pursue food self-sufficiency in Malaysia. After the MCO is lifted, we will be contending with the economic repercussions of Covid-19. One such repercussion is the widening of the income gap and worsening inequality. The B40, of which many are farmers and fishermen, will be the worst hit.

Both the government and the private sector will need to play their roles in mitigating this impending crisis, and ensuring that all Malaysians are able to put food on their plates. By this, I mean that not only must all Malaysians be able to earn a consistent living, but also that there is no risk of food shortages in Malaysia. The best time to start was yesterday, the second-best time to start is now.

DAIM ZAINUDDIN is a former finance minister and former chairperson of the Council of Eminent Persons. He has retired from politics and business and currently attends to his small farm. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.