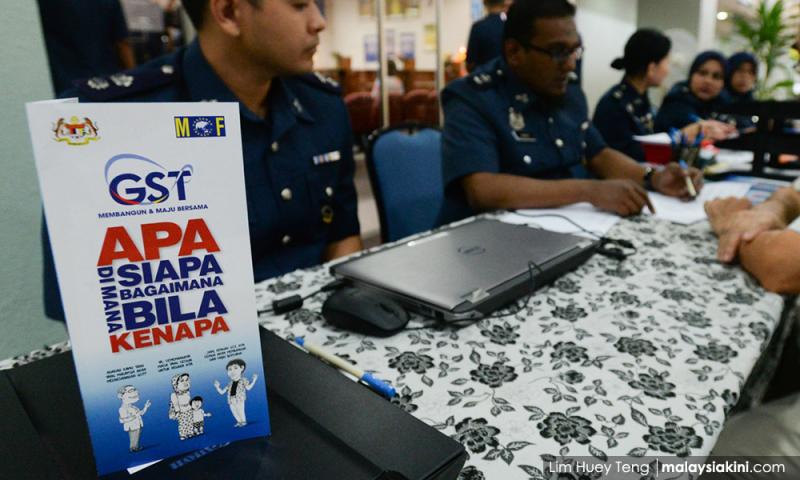

The government is still studying all tax systems in the world, including whether or not to reintroduce the goods and services tax (GST) in the country.

Finance Minister Tengku Zafrul Abdul Aziz said 175 countries had introduced the GST as it contributed to the country’s GDP because the government’s tax revenue would be relatively low without the GST revenue.

Speaking to reporters after attending Aidilfitri open house organised by Putrajaya Media Club today, Zafrul said the process to reintroduce the GST had taken quite some time as the tax had been abolished before.

“If the study found that the GST benefits are clear, we will take it to the cabinet. The final decision is not for the government to make, it’s for the Parliament,” he said.

Zafrul said the fastest the GST could be reintroduced is about nine months after it gets the green light from the Parliament.

The GST of six percent was introduced in 2015 before it was abolished in 2018 by the then ruling Pakatan Harapan government.

Zafrul said the study is now at the engagement stage as one of the issues was to ascertain a fair rate of three to four or seven to eight percent, other than looking for an alternative to improve the existing sales and services tax (SST) which had been rendered inefficient and caused many countries to introduce the GST.

When asked about the fair rate of GST, the minister said whatever it is, it should be able to generate a higher revenue than the existing tax system.

He said some countries had even imposed a higher rate as they were able to give so many exemptions like in Saudi Arabia which imposed 15 percent GST due to the high revenue from higher oil prices.

“There should be a study on the fair rate so as to generate revenue for the country’s development, while at the same time ensuring that it will not burden the people and the business community,” he said.

- Bernama

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.