Bank Negara Malaysia (BNM) has been urged to do more to address financial fraud, which PKR treasurer Lee Chean Chung said has been happening frequently of late.

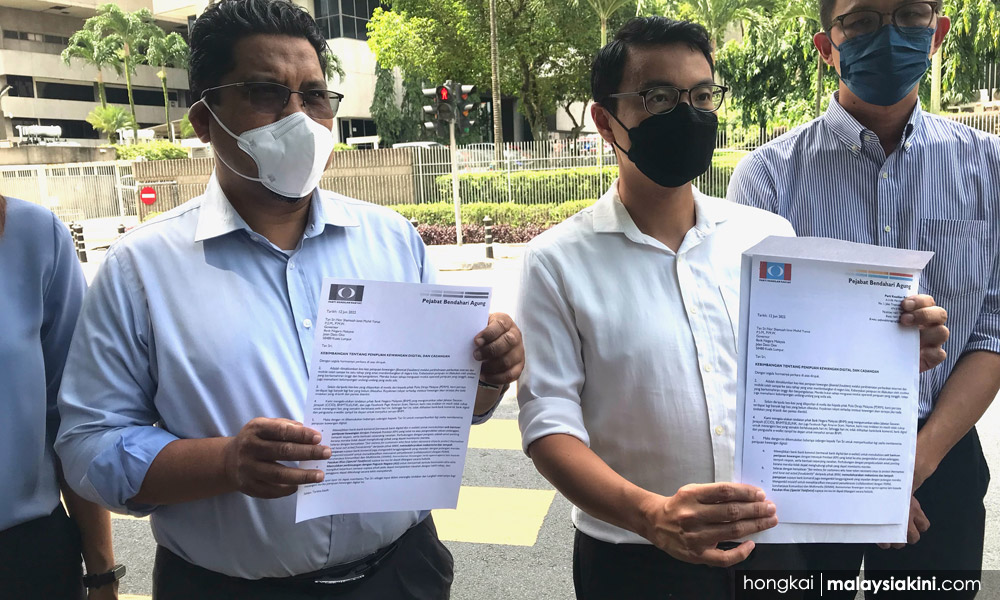

Lee submitted a suggestion letter to the BNM governor, which was received by three public relations representatives, and sought a meeting.

“We hope to have a meeting with the governor to directly convey our suggestions as it’s a growing crisis,” he said.

Lee was accompanied by Bakar Arang assemblyperson Simon Ooi, Teja assemblyperson Sandrea Ng, Simpang Pulai assemblyperson Tan Kar Hing, Negeri Sembilan MB’s special officer Romli Ishak and Putrajaya PKR leader Onn Abu Bakar.

Lee welcomed BNM’s initiatives to address financial fraud, such as by publishing the police hotline for its Commercial Crimes Investigation Department and BNMTelelink, but added that the measures were insufficient.

He also said banks and e-wallet operators have yet to respond to BNM’s call to be vigilant against fraud.

“Calling is not enough, we need to act quickly and efficiently in order to restore the people’s confidence in our banking system and financial institutions, and also bring these scam syndicates to justice,” Lee said.

In the letter to the BNM governor, sighted by Malaysiakini, four suggestions were given, which are:

1. To ensure that commercial banks set up a financial fraud assistance unit

2. To facilitate a mechanism of compensation if the banks were found to be liable

3. Enhancing collaboration with law enforcement agencies such as the police, Malaysian Communications and Multimedia Commission, and the Finance Ministry by setting up a task force led by BNM

4. To discuss with the attorney-general in order to review outdated laws to better respond to digital financial fraud

Similarly, Romli urged the government to tighten laws that deal with digital financial fraud.

“When it involves the country's financial system, the most worrying part of digital financial fraud is the erosion of the people’s confidence in banking institutions. Imagine if people lose their confidence in the banking system and withdraw their deposits from banks. This will further cripple the country’s financial system.

“The country is currently facing low currency exchange rate, the loss of people’s confidence in the country’s financial system will definitely cause a more severe blow to the country’s economy.

“The authorities have to amend the law, adding stricter clauses if needed, to address this issue, or else the country will face another severe blow.” - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.