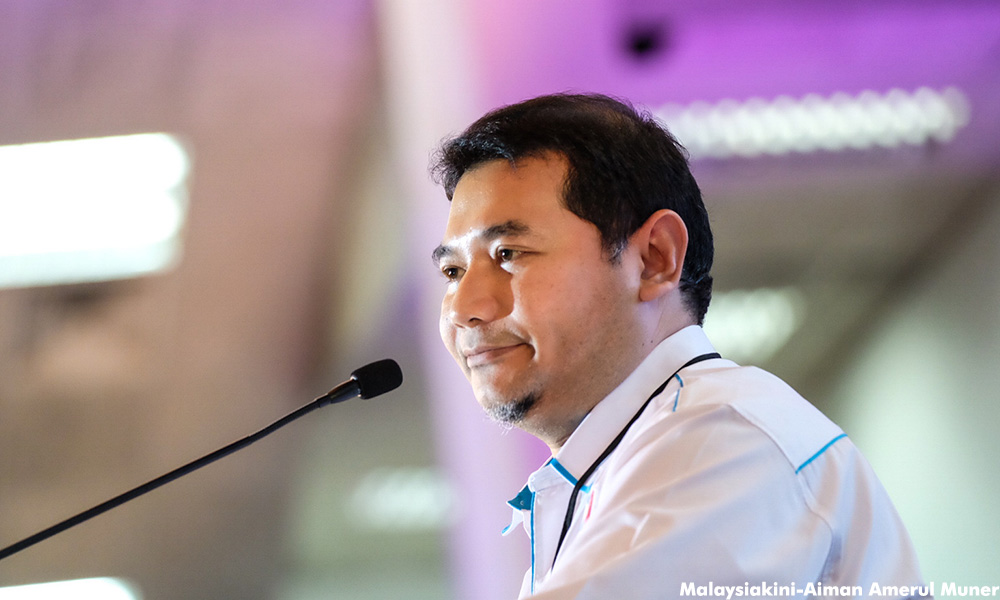

PKR vice-president Rafizi Ramli has hit out at Finance Minister II Johari Abdul Ghani, whom he believes had portrayed that the imposition of the Goods and Services Tax (GST) on 60 additional food items, was made by the Royal Malaysian Customs Department, without first referring it to the finance ministry.

Rafizi cited a Bernama report which quoted Johari as saying that any imposition of the GST on any new items must be approved by the cabinet for it to come into effect.

Johari said the proposed imposition of the GST on 60 food items was made at the level of the department without referring to the ministry to be finalised.

Rafizi, however, expressed his "sympathy" to the director-general of the customs department, as well as to the department's personnel for having been made the scapegoat in the matter.

"When in fact the motion to approve the imposition of the GST on the 60 food items was tabled by the Finance Ministry itself during the last Dewan Rakyat session.

"I remember this because I was in the Dewan when Deputy Finance Minister Othman Aziz tabled the motion," said Rafizi in a statement today.

The Pandan MP cited the Dewan Rakyat standing orders and the Hansard, showing that the motion was indeed tabled on April 4 this year.

"The deputy finance minister explained about food items that will be taxed such as kuey teow, laksa, and yellow mee," he said, citing page 212 of the Hansard.

Explaining the process of gazetting a new list of items to be taxed under the GST, Rafizi said once passed in Parliament as part of the Goods and Services Tax Order, the list will become a statutory paper.

"Once it has become a statutory paper, it is the responsibility of the Customs department to enforce the order.

"Therefore, it is irresponsible for Johari to blame the customs department when it was the Finance Ministry which tabled and obtained approval to tax these 60 food items."

Rafizi said both Johari and Prime Minister Najib Abdul Razak, as finance ministers, were responsible in this matter.

"Blaming the customs department is highly irresponsible every time the government decides to collect the GST, as the decision to do so comes from the finance ministry, and is only enforced by the customs department.

"Johari should apologise to all customs department staff over this."

Public consultation needed

Meanwhile, Perak DAP economic development bureau chief Chong Zhemin wonders whether Johari had signed the latest Goods and Services Tax (Zero-Rated Supply)(Amendment) Order without understanding what he was signing.

"If so, do we have a puppet finance minister who will sign whatever order put on his table?" asked Chong in a statement today.

Commenting on Johari, who had said that the customs department cannot impose GST on items without the cabinet's approval, Chong cited Section 17(4) of the Goods and Services Tax Act 2014 that only the minister has the power, by the order published in the gazette, to determine which goods are zero-rated.

The order, Chong pointed out, was signed by none other than Johari.

"Is Johari trying to put the blame on the customs department after the decision to collect GST on items of necessity such as vegetables, fruits and noodles earned the wrath of netizens?

Pointing out how there must be due process before items are removed from the zero-rated supply order, Chong said the government must first seek public consultation especially from business and consumer groups in the matter.

"I urge Johari himself to clear the air and explain how the zero-rated supply amendment order fiasco could happen since he was the one who signed the order," he said.

Malaysiakini has contacted Johari and is awaiting his response on the matter.

The customs department yesterday scrapped plans to subject 60 new food items to six percent GST from July 1 onwards.

The department said the items were removed from the Goods and Services Tax (Zero-Rated Supply) Order 2014, which was gazetted on June 6.

Customs director-general T Subromaniam said feedback was sought from the Finance Ministry following media reports on the gazetting of the Order, and a decision was made to scrap the implementation of the Order.

The plan was cancelled less than 24 hours after several media outlets reported about the Order, setting social media on a frenzy with condemnations against the tax and the federal government.- Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.