When the head of the 1MDB task force Johari Abdul Ghani recently announced several moves to recover further money from 1MDB, he resurrected an enduring mystery.

Why did lawyers and negotiators do a lousy deal with Goldman Sachs when previous actions had the rogue investment bank on the ropes and a much higher settlement on the table?

The several moves would presumably include investigating whether there were other deals made which resulted in the settlement being compromised against Malaysia.

Johari said that lapses by the negotiators and lawyers to negotiate a fair and clear agreement may have compromised the government’s position in the ongoing dispute.

The July 2020 agreement was made when Muhyiddin Yassin was prime minister and Tengku Zafrul Abdul Aziz was finance minister.

Press reports at the time said that Malaysia was represented at the talks with Goldman Sachs by then-attorney-general Idrus Harun and solicitor general II Siti Zainab Omar.

They were reported to have been assisted by Rosli Dahlan and DP Naban, the two senior partners of Rosli Dahlan Saravana Partnership and also “chief legal trouble-shooters” for Muhyiddin.

The amount paid to the lawyers was never disclosed, and the inexplicable non-disclosure agreement on the terms of the deal with Goldman Sachs was used as an excuse.

Johari and his task force have a good handle on the outstanding problems and issues at 1MDB as far as recovering as much money as possible from rogue financial institutions is concerned.

It is to be hoped that they will be allowed to see to full completion of their tasks to bring to account those responsible and get fair compensation.

I had made similar points to those made by the task force head in an article I had written in February last year asking for the whole deal to be investigated.

This inferior deal was done despite the previous attorney-general Tommy Thomas, who initiated action against Goldman Sachs, saying he wanted something closer to US$9.6 billion (RM45.4 billion) as a settlement.

In his book, published in January 2021 Thomas said: “At meetings in Kuala Lumpur in May 2019, the DOJ (the US Department of Justice) informed us that they intended to seek a direct payment from Goldman Sachs to Malaysia of US$3.4 billion (RM16 billion).

“That when added to the estimated value of assets to be recovered, from Goldman Sachs bond proceeds, would mean that Malaysia could expect to receive about US$4.4 billion (RM20.8 billion) to US$4.7 billion (RM22.3 billion). I replied that I would expect much more and that we would negotiate with Goldman Sachs directly.

“....I was confident of recovering a sum closer to Malaysia’s actual losses of US$9.6 billion.” Further, he revealed that DOJ was amenable to a sum much closer to what he was seeking.

“Hence when I resigned at the end of February 2020, Malaysia was wonderfully placed to turn the screws on Goldman Sachs …I would never have advised Prime Minister Dr Mahathir Mohamad to accept a cash payment of US$2.5 billion (RM11.8 billion). I had sights on a much bigger sum…”.

Get Thomas’ help

Hopefully, Johari would ask for help from Thomas - the previous negotiators and decision-makers apparently omitted this simple but vital step.

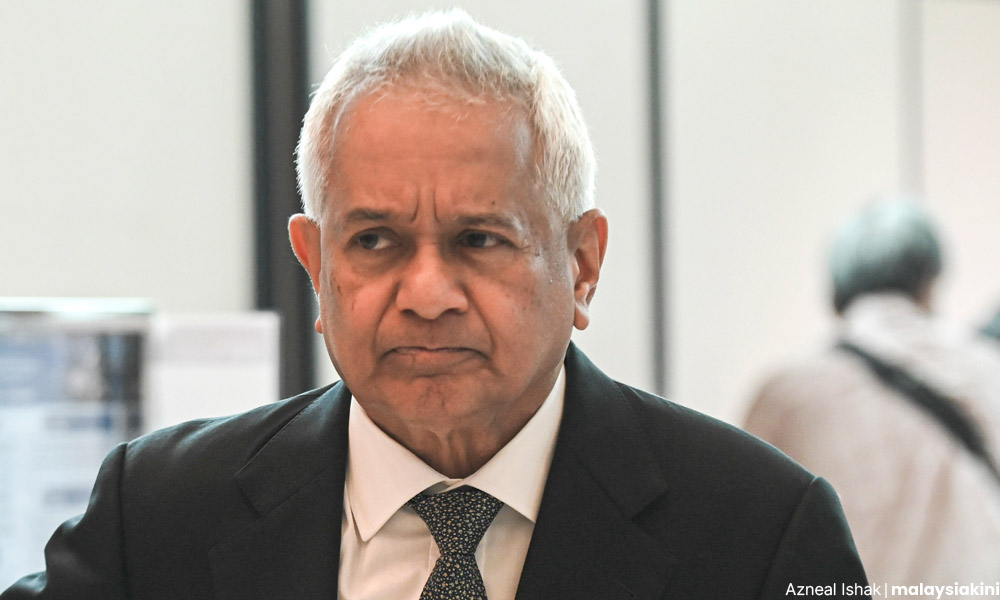

Malaysiakini quoted Johari, appointed plantation and commodities minister in a cabinet reshuffle last month, as saying the task force was examining whether the negotiators and lawyers representing the government in a 2020 settlement agreement with Goldman Sachs may have failed in their fiduciary duty or were negligent.

He further explained that the settlement agreement signed in August 2020 required Goldman Sachs to pay US$2.5 billion (RM11.8 billion) in cash and provide the government with a US$1.4 billion (RM6.3 billion) asset recovery guarantee.

As Johari correctly pointed out, Goldman Sachs had been fined US$2.9 billion (RM13.7 billion) by various regulators, surpassing its cash payment paid to the government.

“This is despite the country suffering the greatest repercussions from the 1MDB scandal by having to pay US$6.5 billion (RM30.7 billion) in principle plus interest of approximately US$3.2 billion (RM15.6 billion) over 10 years to service the 1MDB debt,” he said.

That puts the amount that the government should have claimed at some US$9.7 billion, close to the amount of US$9.6 billion Thomas wanted.

Johari said the dispute centres around Goldman Sachs’ attempt to offset the fine imposed on AmBank (RM2.8 billion) and the settlement agreement with International Petroleum Investment Company or IPIC (RM8.5 billion) against the US$1.4 billion asset recovery guarantee.

“Goldman Sachs contends that its obligations under the asset recovery guarantee have been discharged through this offset.

“However, the government disputes this, and asserts that the fines imposed on AmBank and the settlement with IPIC are not encompassed within the scope of the US$1.4 billion asset recovery guarantee,” he added.

Also, 1MDB paid unusually high advisory fees of US$606 million to Goldman Sachs for advising on the issuance of the three bonds totalling US$6.5 billion, about 10 times the usual amount of fees.

There are other things that Johari should investigate as well, which I listed in this article. They include:

China’s complicity in 1MDB involving a further RM30 billion in payments which remains unresolved.

A settlement with Abu Dhabi’s IPIC over a guarantee where there is a shortfall of RM18 billion.

Najib’s stepson Riza Aziz’s sweetheart deal where RM5.5 billion in fines were foregone.

The question of who else should have been charged for the 1MDB fiasco.

Without a resolution of these, serious questions will still abound over 1MDB and there will be no closure to the largest kleptocracy ever.

The sums involved are gargantuan. One hopes that Johari will look into these as well and that he will be given free rein to do so. - Mkini

P GUNASEGARAM launched the first book on 1MDB titled “1MDB: The Scandal that Brought Down a Government” in August 2018.

The views expressed here are those of the author/contributor and do not necessarily represent the views of MMKtT.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.