KUALA LUMPUR: The ringgit ended lower against the US dollar for the third consecutive day in line with other regional currencies after the US Federal Reserve (Fed) governor Christopher Waller said the Fed is in no hurry to cut rates.

Waller acknowledged that the US inflation rate is “not too far off from the 2% target” but called for caution and that the timing and actual number of cuts would depend on data.

Meanwhile, Bank Muamalat Malaysia Bhd chief economist Afzanizam Rashid said Waller’s views were noted globally.

“Meanwhile, China’s full-year gross domestic product which came in at 5.2% (2022: 3%) was within the government’s target of around 5%.

“However, sceptics remain as to how a soft landing can be achieved. In a nutshell, market participants seem wary about China’s economic prospects this year and next,” he said.

On that note, Afzanizam said seeking refuge against market volatility would be the most sensible thing to do and this has resulted in a higher demand for the US dollar.

He also expected the ringgit to remain weak in the near-term.

“The US retail sales data tonight will be closely monitored with a consensus estimate of a 0.4% month-on-month rise in December against November’s 0.3%.

“Should the figure turn out to be better than expected, it might result in further support for the US dollar,” he told Bernama.

Meanwhile, SPI Asset Management managing partner Stephen Innes said the ringgit experienced a significant decline, mirroring the trend observed in other Asian currencies.

He said the setback in global risk appetite followed through after Waller’s comments yesterday, indicating a potential delay and a slower pace for interest rate cuts compared with market expectations.

“This sentiment had a particularly adverse impact on Asian markets today, exacerbated by concerns over deflation in China.

“The People’s Bank of China’s decision to abstain from a medium-term lending facility (MLF) cut earlier in the week added to apprehensions about the strategies available for economic recovery,” he added.

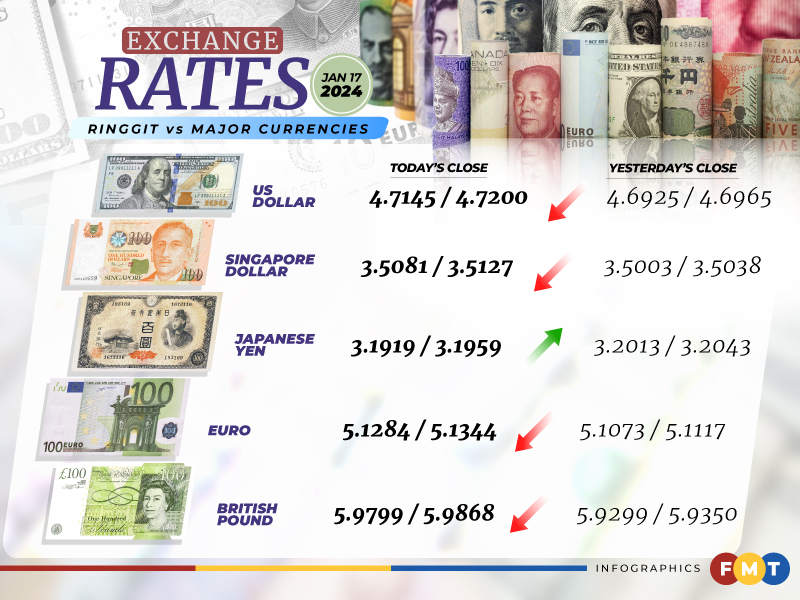

At 6pm, the ringgit eased to 4.7145/4.7200 versus the greenback from yesterday’s close of 4.6925/4.6965.

At today’s close, the ringgit was traded mostly lower against a basket of major currencies.

It was marginally lower versus the euro at 5.1284/5.1344 from 5.1073/5.1117 at yesterday’s close, depreciated vis-a-vis the British pound to 5.9799/5.9868 from 5.9299/5.9350, but strengthened against the Japanese yen to 3.1919/3.1959 from 3.2013/3.2043 previously.

The ringgit was traded mostly lower against Asean currencies.

It was down against the Thai baht to 13.2795/13.3010 from 13.2579/13.2748 previously and was slightly lower against the Singapore dollar at 3.5081/3.5127 from 3.5003/3.5038 at yesterday’s close.

It declined vis-a-vis the Philippine peso to 8.43/8.45 from 8.40/8.42 and the Indonesian rupiah to 301.3/301.8 from 300.9/301.3. - FMT

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.