THE current withholding tax (WHT) concession for Malaysian REIT distributions for investors except for resident corporate, is legislated only up to Year of Assessment (YA) 2025, effectively expiring on 31 Dec 2025.

Under IRB Public Ruling No. 1/2021, these investor groups currently benefit from a 10% final WHT rate, while resident corporates are taxed at 0% and non-resident corporates at 24%.

At the time of writing, there has been no clarification or extension announced, creating uncertainty heading into 2026.

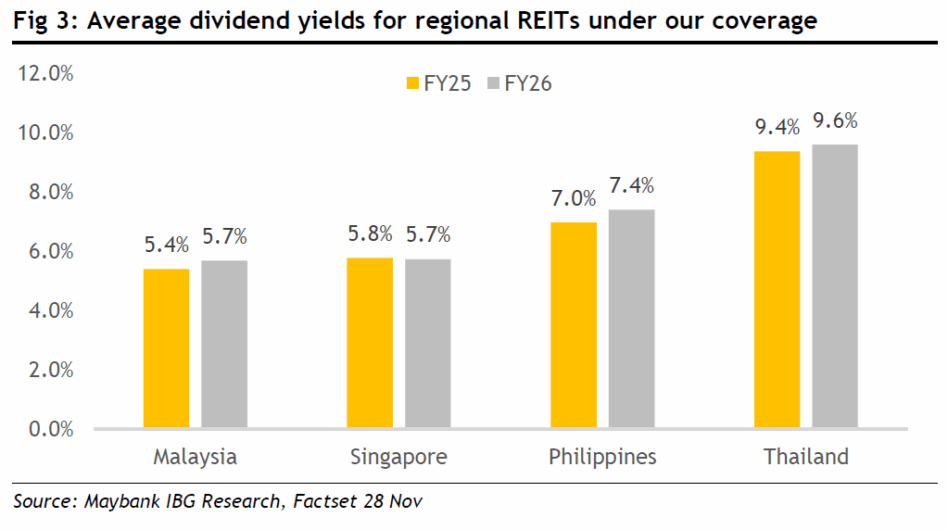

“A clear resolution would be crucial, in our view, given the attractive 5.7% dividend yields among the M-REITs,” said Maybank Investment Bank (MIB).

If the concession is not renewed beyond YA 2025, REIT distributions to affected investors would revert to their respective marginal income tax rates.

This could reduce post-tax yields by 50-100bps, and could weaken the sector’s attractiveness to regional REIT markets and lower net returns for retail and institutional yield-seeking investors.

For foreign investors, the loss of 10% flat rate would also diminish Malaysia’s attractiveness to invest in the REIT market.“Our base case assumes continuity of the 10% WHT concession into YA 2026, consistent with the government’s past practice,” said MIB.

Regularity clarity by year end would be critical for tax planning and portfolio allocation decisions.

The Malaysian REIT Managers Association is expected to raise this matter with the Ministry of Finance, given that the latest Finance Bill made no reference to the concession’s extension. — Focus Malaysia

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.