The clamour for more affordable housing may push the government to impose regulations on developers to control prices, but this will approach could backfire.

This is because empirical data analysed by the Rehda Institute shows that tight regulations on the industry have actually driven developers to price up homes to cover the cost of complying with such regulations.

Rehda Institute is a research house linked to the Real Estate Housing Developers Association (Rehda).

The study, which analyses data volunteered by property developers, showed compliance costs range from 12.8 to 32.5 percent of gross development value.

These include cross-subsidising the development of affordable housing by bumping up the price of free-market units, holding the cost of unsold bumiputera units, surrendering land for public facilities and lengthy process of approvals.

Compliance costs

The study estimates that compliance costs increase house prices by as much as 16.6 percent on average while in township developments, the price is bumped up as high as 50 percent to cover the cost of compliance.

"In reality, however, other costs will also increase due to inflation, market demand, change in policy direction, particularly land, building materials and interest costs and as such actual price increase can be much more than shown," the report reads.

On the flip side, it said, if compliance costs are halved, prices can go down by nine to 16 percent on average in a strata and township development respectively.

Asked if the developers use savings from lower compliance costs to raise profit margins instead of lowering price, Rehda Institute trustee Jeffrey Ng said this will not be the case because developers would prefer to sell more units.

They can do so by lowering prices to meet consumer demand, he said.

"The big picture is, whatever the authorities do will hit on compliance cost and it will raise the cost of housing.

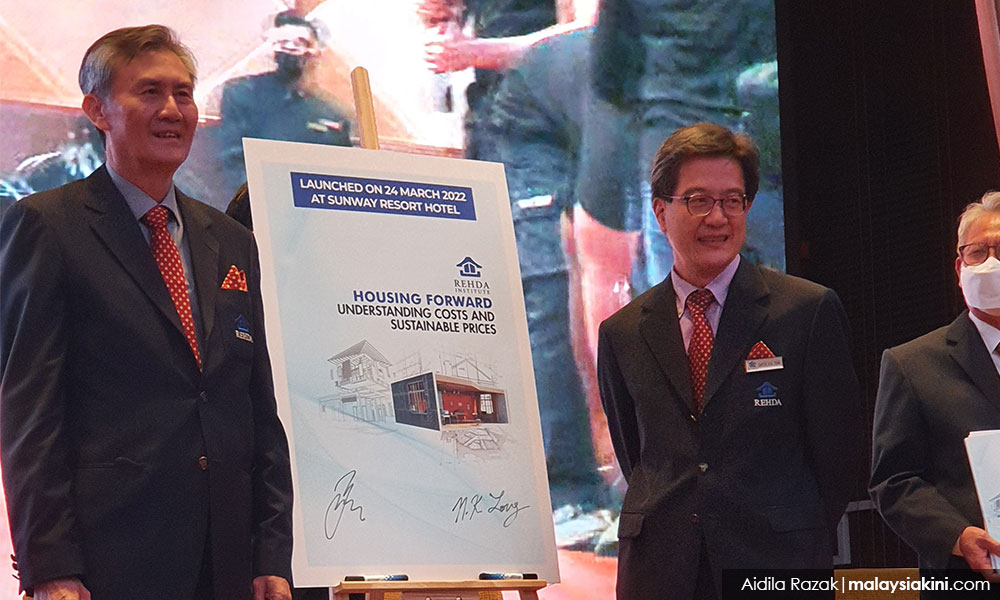

"The government cannot say we want housing cost to come down but hit on compliance cost. Opposite forces are at play," he said after launching the report in Bandar Sunway today.

Home prices gone up

Home prices have gone up an average 10 percent annually in the last 10 years from RM217,856 in 2010 to RM428,458 in the third quarter of 2021.

The average household income in 2020 was RM7,089 per month making homeownership beyond reach for many.

In 2019, a Khazanah Research Institute study showed owning a home is an untenable goal for most Malaysians due to high property prices.

'Very little skin left for developers to gain'

Ng said that there is a misconception that developers enjoy high-profit margins when data collected by researchers found developers were making an annual profit of five to seven percent on development.

"Is this fantastic margins for the risk of taking on a development? The answer is no.

"There is very little skin left for developers to gain, so we want the authorities to please consult everybody before imposing (more regulations)," he said.

He said developers are already weathering higher costs of labour, building material and land which cannot be brought down easily and depends on global market forces.

However, compliance cost is in the control of the authorities and can be used to influence home prices, he said.

"You may innocently look at it as 'I want to impose extra compliance cost for a certain segment' but what is the impact of the house pricing? You have triggered off something beyond control.

"If developers can absorb certain types of cost, they will but they have no choice but the pass on (the extra cost) to the project (price) so who suffers? Of course the buyers," he said.

Shrinkage of sellable land

According to the study, among drivers of rising costs of compliance is the shrinkage in sellable land.

It found that developers have had to surrender a greater percentage of their land for public facilities, leaving a smaller portion for development, leading to higher prices per unit.

Looking at federal and Selangor government planning guidelines, it said, the percentage of land which can be developed for profit has reduced from 55 to 45 percent

For example in Selangor, it said, the main road width was extended from 100 to 133 feet, while the land area for schools grew from nine to 10 acres for secondary schools and six to 6.5 acres for primary schools for a population of 10,000 people.

Lot sizes for houses have also grown, reducing the number of units that can be built, it said.

Ng added while surrendering land for public facilities is for the good of the community, there have also been various instances where such lands given up for parks or schools were "hijacked by third parties" and developed.

Other compliance costs which can be reduced include removing the need for two car parking lots per unit.

It said one feet basement parking lot costs RM125 to RM215 per square foot or about RM37,500 to RM64,500 per lot.

A simulation showed that two parking lots per unit plus visitor parking lots cost 16.5 percent of gross domestic value.

To reduce compliance costs, the study proposes a range of recommendations.

'State, not developers should build affordable homes'

This includes removing the condition to build affordable housing, with developers instead paying 2.5 percent of gross domestic value to the state to build affordable homes instead.

It also proposes the government purchase unsold built affordable homes, to be pooled and sold to eligible buyers.

Rehda Institute also proposes the government apply the use of plot ratio instead of density, to allow more units to be built and cost per unit spread out.

Smaller sized homes can cater to different types of buyers, including retirees, young couples and singles, it said.

Ng said house prices can be impacted even if the government takes on half of the proposals.

"If there is a need to impose (further regulations), first do a cost-benefit analysis on the impact on home prices.

"If the authorities were to add on (regulations) there must be something to balance it." - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.