1Malaysia Development Bhd. said it defaulted on a $1.75 billion bond after missing a $50 million interest payment amid a dispute with Abu Dhabi’s sovereign wealth fund over who is required to make the payment. The ringgit fell and 1MDB’s dollar bonds slumped.

The Malaysia state fund is withholding an interest payment because Abu Dhabi’s International Petroleum Investment Co., the co-guarantor of the 5.75 percent bonds maturing in 2022, hadn’t met the obligation either, according to an e-mailed statement. The missed payment triggered cross defaults on 7.4 billion ringgit ($1.9 billion) of 1MDB debt, the Malaysian fund said.

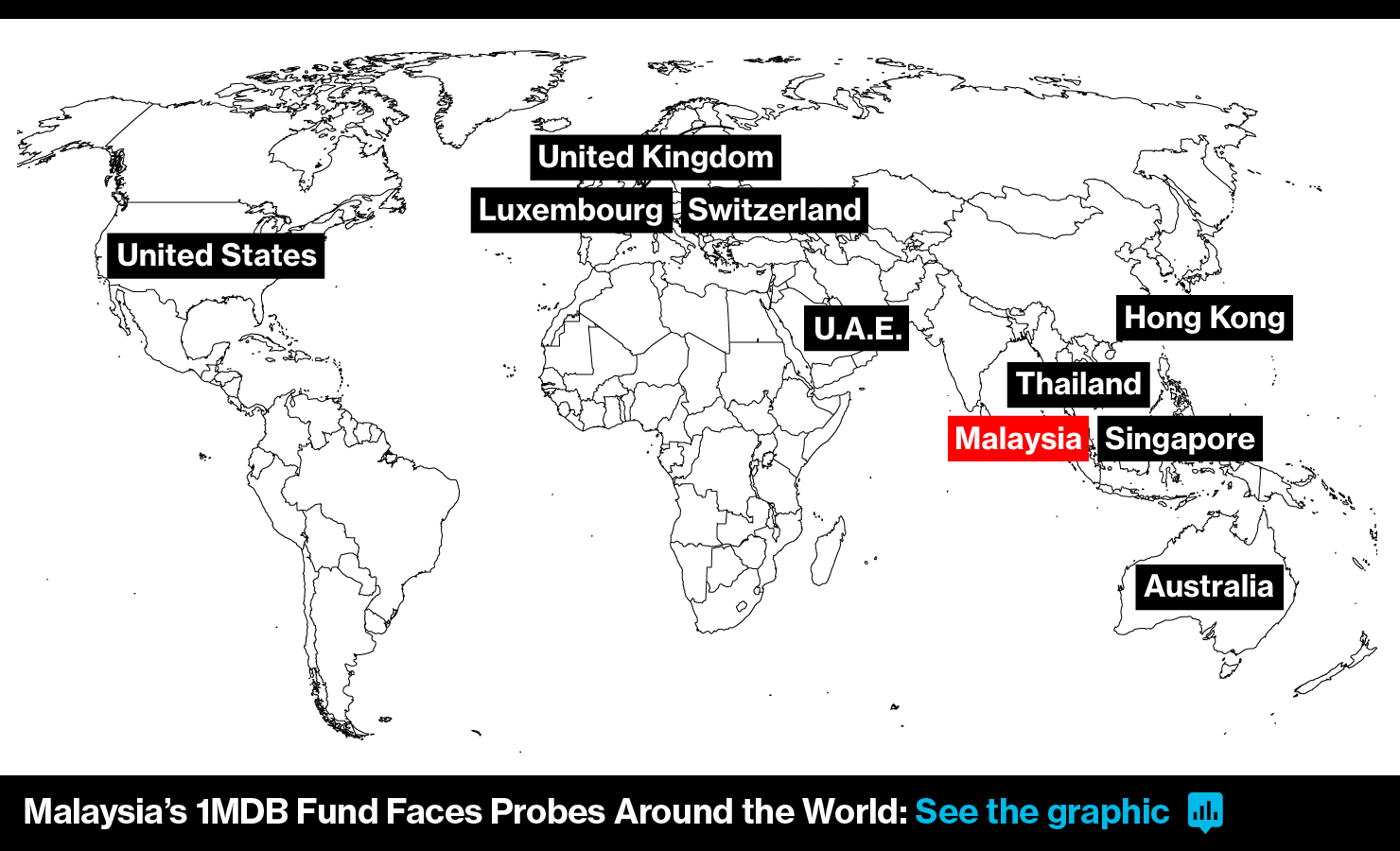

The default is the latest episode in financial scandals that have rocked 1MDB, already a target of global investigations into allegations of money laundering and embezzlement. A Malaysian parliamentary committee this month identified at least $4.2 billion of irregular transactions by the fund, including those that involved Abu Dhabi companies. 1MDB has consistently denied wrongdoing.

“Investors are pulling back now and it’s a knee-jerk reaction," said Geoffrey Ng, director at Fortress Capital Asset Management Sdn. in Kuala Lumpur. “It presents a credit risk issue to foreign investors and it causes uncertainty in terms of the outlook for Malaysian government credit ratings."

In Dispute

1MDB has been locked in a dispute over its debt obligations to IPIC under an agreement reached in May last year. As part of the pact, the Abu Dhabi wealth fund said it would assume obligations to pay interest due under $3.5 billion of 1MDB bonds that it guaranteed. IPIC said this month that 1MDB was in default of the agreement after the Malaysian fund failed to pay it more than $1 billion in connection with a loan.

That spat spilled over to the interest payment, with each side saying the other should fulfill the obligation. The payment was due on April 18, with the grace period of five business days expiring Monday in London, 1MDB said.

‘IPIC’s Obligation’

"Whilst 1MDB has the funds to have made the interest payment, it is 1MDB’s position, as a matter of principle, that it was IPIC’s obligation to do so," the Malaysian company said. "Until IPIC accepts that all obligations have been met, 1MDB is obliged to withhold payments and will seek legal recourse and resolution."

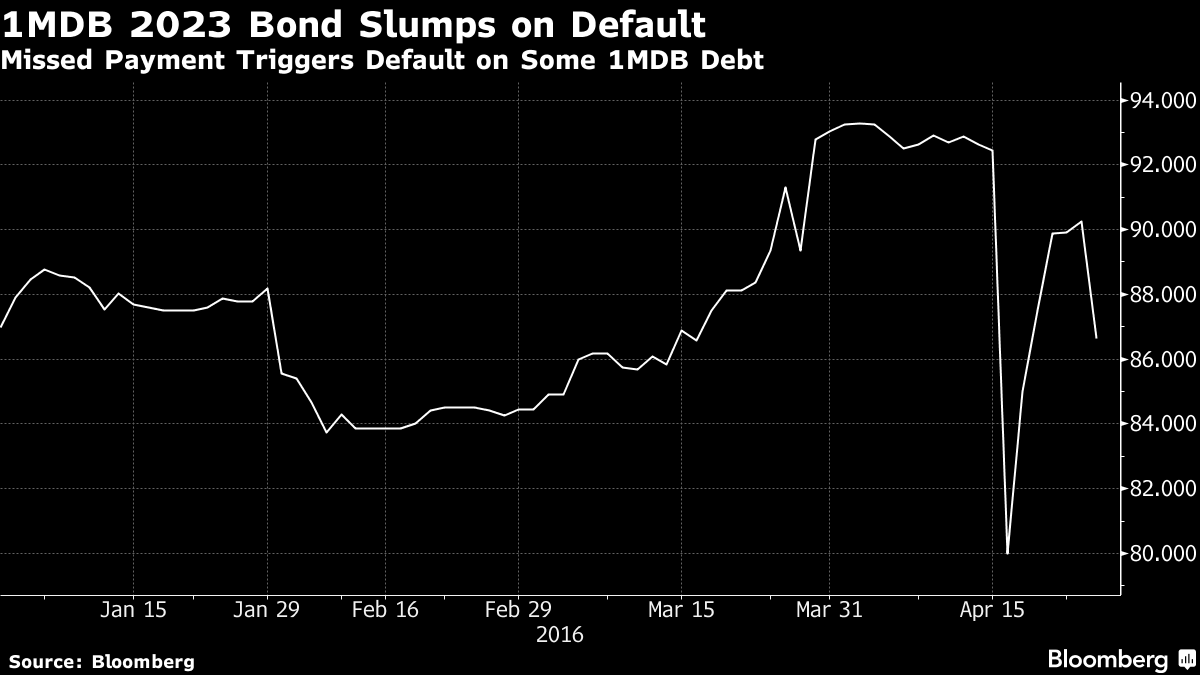

1MDB bonds maturing in March 2023 halted a five-day gain. The $3 billion 4.4 percent notes dropped 3.7 cents to 86.5 cents on the dollar to yield 6.9 percent as of 11:40 a.m. in Hong Kong, according to prices compiled by Bloomberg. The bonds were sold at par of 100 cents in March 2013 in a deal arranged by Goldman Sachs Group Inc. and rated at A- or four levels above junk by Standard & Poor’s.

The ringgit headed for the longest stretch of losses since November, falling 0.8 percent to 3.9380 per dollar as of 11:40 a.m. in Kuala Lumpur, according to prices from local banks compiled by Bloomberg. The cost to protect Malaysia’s sovereign notes with credit-default swaps jumped 4 basis points to 167 basis points, prices from Nomura Holdings Inc. show. That leaves the measure set for its highest close since March 8, according to data provider CMA.

"Although the market has been following this story for some time, the factual default could still create negative sentiment on corporate and banking debt in Malaysia," said Raymond Chia, the Singapore-based head of credit research for Asia excluding Japan at Schroder Investment Management Ltd.

1MDB has enough cash to pay the $50 million of interest that was due and in fact its surplus is 11 times that amount should it decide to make the payment, President Arul Kanda said in an interview last week. But it’s IPIC, which earlier agreed to pay interest on the bonds, that should be making the payment, he said.

IPIC said on Monday it will pay bondholders should 1MDB default on the interest payment. - BBG

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.