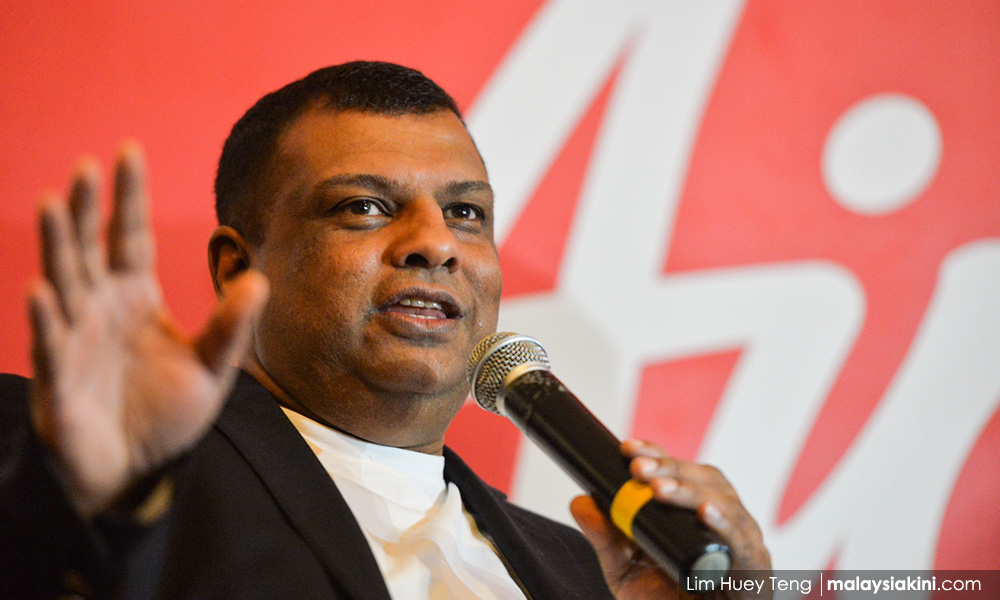

The government should adopt proactive strategies and policies to spur tourism as opposed to further burdening tourists, according to AirAsia Group Bhd chief executive officer Tony Fernandes.

Therefore, he hopes Putrajaya would reconsider its plan to impose a departure levy for all outbound air passengers, which was to be implemented in June but has since been deferred to after Hari Raya Aidiladha which falls on Aug 11.

Speaking to Malaysiakini today, Fernandes pointed to the existing hotel and airport taxes to argue that there is no need for an additional tax.

"We are not making Malaysia affordable or welcoming. Furthermore, 2020 is the Visit Malaysia Year. Imposing an exit tax would send the wrong signal.

"Tourism is a low hanging fruit. It contributes a huge part to the nation's GDP and creates a lot of employment opportunities.

"Air Asia wants to develop places like Sabah, Penang, Malacca and Desaru in Johor with the aim of making Malaysia the number one tourism destination or transit hub in Asean like how Dubai is to the world.

"I believe that Port Dickson has the potential to become a great transit stop," he added.

The exit tax would see outbound air passengers charged RM20 to Asean countries and RM40 to other destinations.

This is on top of the Passenger Service Charge (PSC) or airport tax of RM35 to Asean countries and RM73 to other destinations. Domestic destinations cost RM11.

Another existing tax affecting tourists is the tourism tax or hotel tax which is imposed at a rate of RM10 per room per night for foreigners.

Meanwhile, Fernandes also noted that all Asean countries have removed the exit tax and are now looking at reducing visa fees or implementing visa-free travelling.

He also argued that with oil prices rising, the government's income would increase.

"Furthermore, if we have proactive strategies with regard to tourism, we can more than make up for the income which is to be generated by the proposed exit tax.

"If tourism booms, the main beneficiary would be SMEs, which I believe would be the engine of growth for Malaysia," he added.

Previously, the International Air Transport Association (IATA) also urged Malaysia to reconsider imposing the levy, warning it would erode Malaysia's competitiveness as a tourist destination in the region.

The association said the levy would reduce the number of international air passengers departing Malaysia by up to 835,000 per year.

This, in turn, would decrease the aviation sector's contribution to the GDP by up to US$419 million and lead to a reduction of up to 5,300 jobs.

However, Tourism, Arts and Culture Minister Mohamaddin Ketapi is confident the levy would not hurt the tourism sector.

"I don't think this would affect tourists because almost everywhere this kind of levy is implemented. Some countries are collecting it as tax and some are putting it in the form of tickets," he added.

The government has yet to finalise if the levy would be incorporated into the PSC or customs/immigration. The PSC is currently paid to Malaysia Airports Holdings Bhd (MAHB) as the airport operator, to run airports’ operation. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.