Opening up the Finance Ministry to complaints from unsuccessful home loan applicants would result in banks being scapegoated, said Rembau MP Khairy Jamaluddin.

Referring to Lim Guan Eng's speech yesterday, Khairy said the finance minister appeared to be putting the blame on banks for home ownership woes.

Khairy said the real problem, as reaffirmed by a recently published Khazanah Research Institute paper, was that developers failing to meet market demand for cheaper homes.

"The finance minister's statement again showed his 'developer friendly' attitude. Instead, the finance minister should control developers who keep selling 'fantasy' or 'mampu tengok' (see only) products.

"He should not be turning banks into a scapegoat while giving developers a lifeline," said Khairy in a statement.

In his speech at a property show yesterday, Lim said his ministry would investigate complaints from loan applicants who believed that they were unfairly rejected.

However, Khairy said commercial banks rarely reject applications if all conditions are met.

According to the opposition lawmaker, a previous example of Lim's "developer friendly" inclination was when he introduced a stamp duty exemption for the purchase of homes priced between RM300,000 to RM2.5 million.

"Though it looked like a way of helping people own homes, the Home Ownership Campaign was seen to be a means of providing a lifeline for developers to sell unsold units," he said.

The Khazanah Research Institute paper had identified that the cost of owning a home had risen at a much faster rate compared to household income between 2002 and 2016.

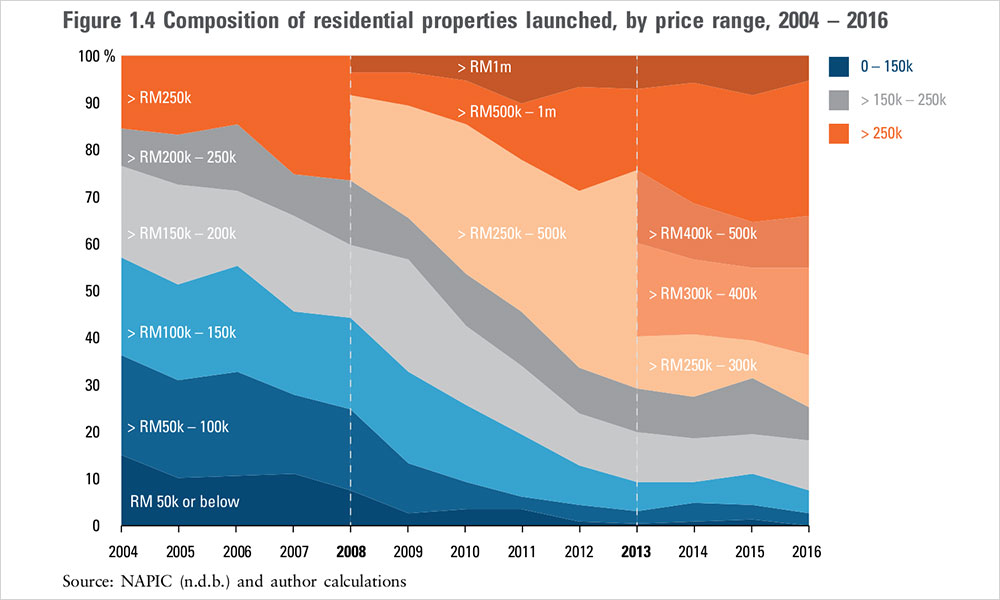

The paper said the supply side was unresponsive to real demand and the proportion of affordable housing launches had reduced dramatically since 2004.

While house prices have doubled since 2008, cost of production — labour, material and machinery, and equipment — increased only slightly during the same period.

"The disproportionate increase in prices and costs suggests either increasing profit margins, land prices or regulatory costs," read the report. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.