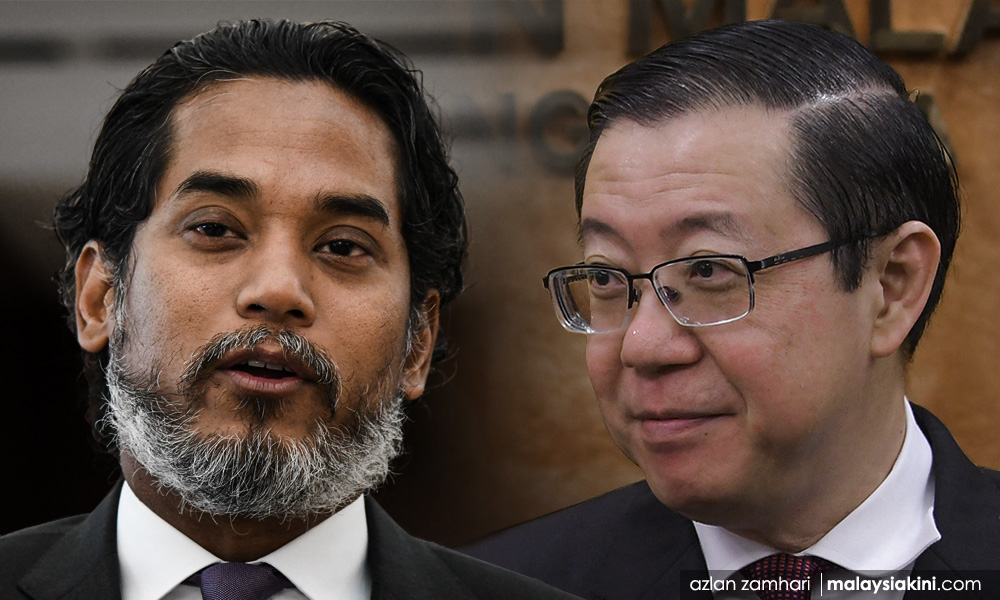

I support neither Lim Guan Eng nor Khairy Jamaluddin over their spat on the need for the Finance Ministry to entertain complaints from those who were unable to get loans from banks to buy houses. I am referring to the news article, “KJ: Guan Eng's soft spot for developers appearing again”.

Malaysian politicians only can talk sense when they are out of power. When in power, they have either become very arrogant or stupid.

First question: Why would banks want to deliberately reject loan applications when they are in the business of lending money?

The only reason I could think of banks refusing to lend is when potential borrowers are not a “good bet” or the banking industry is not competitive enough.

When borrowers have poor credit records or have income levels/collateral not commensurate with the quantum of loans asked for, surely banks would be hesitant to lend.

Similarly, do we really know the Malaysian banking industry is competitive? When the banking industry is poorly regulated or is not competitive, it is inevitable that the banks may resort to profiteering. If they can charge high-interest rates on good customers, why would they want to lend to risky customers at lower interest rates?

Banks will do their business “naturally” if the banking industry is competitive, i.e. dishing loans to customers based on risk and return trade-off.

I wonder how could the Finance Ministry handle complaints from those who are unable to get bank loans to buy houses? How could it help if the rejection is due borrowers’ income being too low? How could it help if the price of house is too high based on borrowers’ income? How could it help if the borrowers’ credit records are bad?

Sometimes I am amazed by the measures being used to “help” borrowers. Let’s extend the repayment periods to a ridiculous length, two generations, if possible. Let’s allow the repayment on interest alone, leaving the principal later. Let’s allow 100 percent loan and zero down payment when buying a house.

Has it ever occurred to us that all these measures have in fact helped to sustain property prices and committed the borrowers to lifelong debts that they could ill afford to repay?

I hope by now we could all see that past measures have not helped the buyers but only further escalated the prices for the benefits of developers.

Today, the price of properties has completely decoupled from the income of an average person. If we can’t solve this problem, including income distribution, there is nothing much that banks, Finance Ministry, and Bank Negara can do. We can talk and pretend to do something, but the situation will not be getting better.

More than 40 years ago, to buy a house, a buyer must have 30 percent down payment. The maximum repayment period was 15 years. This was how many have bought their first house when they first started out. If everything is relative, why is it that we could afford then but not now? What has economic development done to us, going astern?

Singapore is land scarce. It has only one public housing agency, the HDB. The nation was able to provide decent and clean housing to most Singaporeans over the years.

Here in Malaysia, we have more public housing agencies than houses being built. But what have we got to show other than substandard homes, more corruption and abuse?

Seriously, I think we have become a master of diversion. We think we have simple solutions to complex problems. Opening up the Finance Ministry to entertain complaints from unsuccessful home loan applicants will achieve nothing significant, read my lips. - Mkini

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.