A QUESTION OF BUSINESS | Last week’s announcement by the prime minister that members of the Employees Provident Fund (EPF) can withdraw up to a further RM10,000 from their accounts represents the continued rape and pillage of the retirement scheme at the expense of its over 15 million members.

As we shall show, there is really no reason for this when the economy is already recovering, employment is up, and only a very small percentage of EPF members actually have been affected in terms of income by the Covid-19 pandemic.

The only reason for this now is not even to stimulate the economy anymore but to provide a feel-good factor to millions of voters so that they will vote for BN in the coming 15th general election (GE15). Even the opposition has jumped on this bandwagon.

They are supporting this ongoing outrage of depleting retirement savings, especially of the poor, while previously they had been vehemently against it, in a clear indication that politics is taking precedence over what is right.

Ahead of the Johor election, Pakatan Harapan chief Anwar Ibrahim joined his voice to the dishonourable chorus (which included “bossku” Najib Abdul Razak of 1MDB infamy) to allow the withdrawals in a surprising abdication of the welfare of workers in retirement.

He said on March 9, just three days before the Johor polls: "As it appears the government has no way to overcome this failure (to give relief), therefore, I support the immediate and unconditional withdrawal (of EPF) and unencumbered by bureaucratic restrictions.”

The DAP secretary-general at the time Lim Guan Eng said earlier, after getting feedback from Johor voters, that DAP supported EPF withdrawals after opposing and criticising them.

"The government should allow the public to withdraw their EPF contributions, if not by RM10,000, then at least RM5,000 to allow them to meet their financial obligations," he said on March 6.

Despite this capitulation to getting votes for something which will hurt the voters in the long run and adversely affect their life in old age, Pakatan Harapan performed abysmally in the Johor elections.

Straying from the straight and narrow did not help them but what it demonstrated was that parties that supposedly have tougher moral fibre than BN/PN showed they cared more about their short-term success at the long-term expense of the rakyat.

The surprising thing was that this was done even over the clear objections of finance minister Bersatu’s Tengku Zafrul Abdul Aziz who warned in Parliament that if this were to happen, some 6.3 million EPF members will be eligible and the potential withdrawal could be as high as RM63 billion.

RM160 billion ‘scam’

The latest move adds on to the earlier RM101 billion withdrawn via three schemes by members which means that the withdrawal could amount to some RM160 billion in all, a massive 16 percent of the funds of some RM1 trillion currently with the fund.

What that means is the collective savings of over 15 million EPF members falls by some RM160 billion. If we assume an average return of six percent per annum, this would have turned to over RM500 billion in 20 years, a needless savings shortfall of some RM340 billion! If an investor withdraws, say RM30,000 from the four schemes so far, he forgoes over RM96,000 20 years from now.

For many people who may not even have RM250,000 to their name at retirement, that is a substantial sum of money.

All these started under the backdoor government of Bersatu’s Muhyiddin Yassin, back in November 2020 when, against EPF objections, it allowed withdrawals to be made from retirement accounts, supposedly to ameliorate the hardship caused by Covid-19.

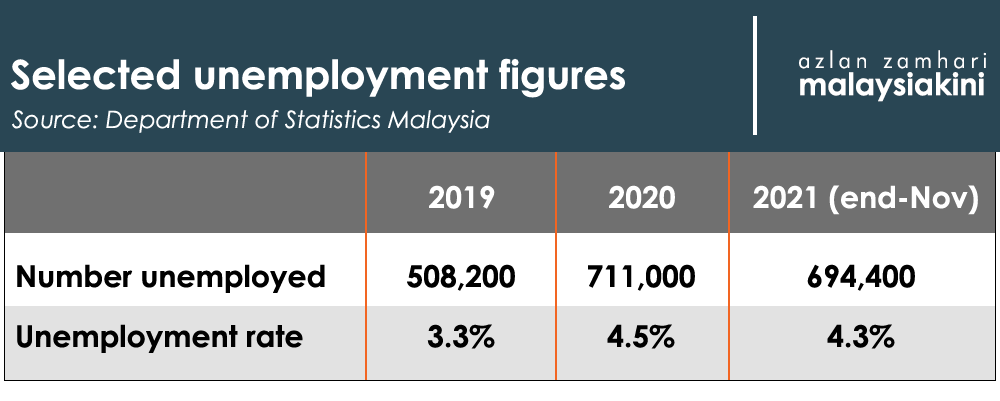

It was a rather insidious scheme, which I called EPF’s RM60 billion scam in an article but eventually, the amount of withdrawals grew to RM101 billion. But employment figures showed only 745,000 people lost their jobs while the scheme permitted over 15 million members to withdraw their savings, over 20 times the number of unemployed.

It was a scam because retirement money was used to reflate the economy while at the same time, it gave millions a feeling of well-being because it returned part (a huge part for most) of their savings which they squandered needlessly. Further relaxation of conditions resulted in eventually RM101 billion being withdrawn from the schemes.

Let’s look at whether the latest withdrawals were really necessary. The unemployment rate has actually fallen from 4.5 percent at the end of 2020 to 4.3 percent at the end of November last year.

As the employment situation is improving, as is the economy which grew 3.1 percent in 2021, and is forecast by the Finance Ministry to grow 5.5-6.5 percent in 2022, it is time to retreat from the wrongful attack on the EPF to stimulate the economy.

The latest foray into EPF is particularly despicable because it is purely an election ploy by making millions of people feel good ahead of GE15 by simply returning their retirement savings to them.

The sad thing is even the opposition had abdicated its check-and-balance role in favour of playing politics, leaving the EPF its only defender of itself, squeaking up weakly to say that this should be the last withdrawal from EPF savings.

If only the rakyat knew how they were being diddled, making them happy by giving them their hard-earned savings back to them prematurely instead of letting it multiply, they would surely not vote for those responsible. - Mkini

P GUNASEGARAM, a former editor at online and print news publications, and head of equity research, is an independent writer and consultant.

The views expressed here are those of the author/contributor and do not necessarily represent the views of MMKtT.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.