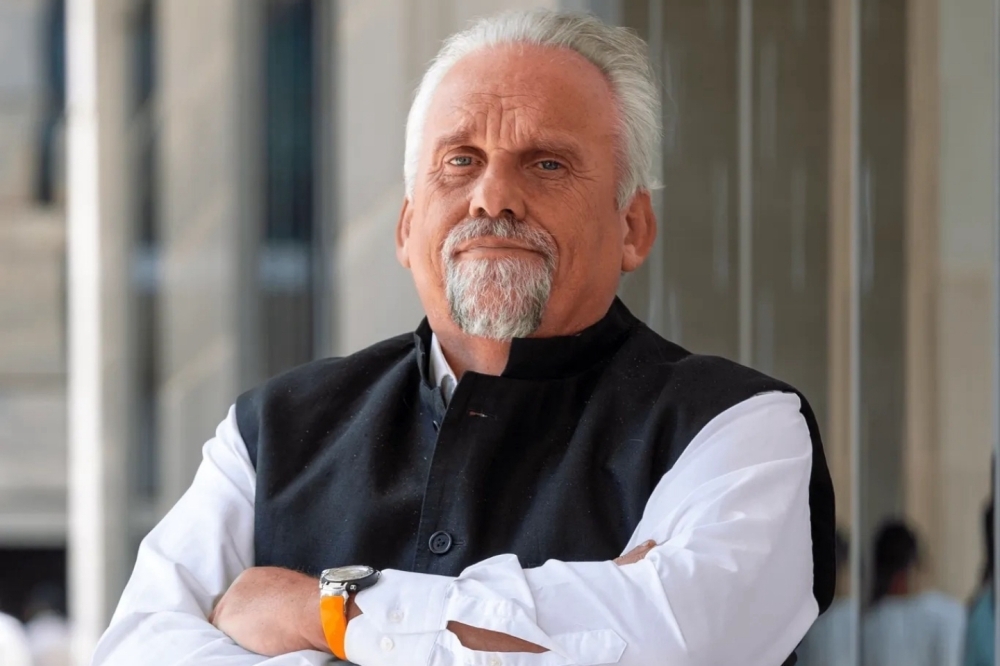

SINGAPORE, Dec 23 – 1Malaysia Development Bhd (1MDB) and its subsidiaries have announced today they filed a legal claim against Amicorp Group and its chief executive, Toine Knipping, accusing the corporate services provider of allegedly facilitating over US$7 billion (RM31.6 billion) in fraudulent transactions.

The claims, submitted in the British Virgin Islands (BVI) on December 20 against eight Amicrop entities, alleged fraudulent trading, dishonest assistance in fiduciary breaches, and conspiracy to commit unlawful acts — and demanded damages exceeding US$1 billion.

“We are bringing this action to seek justice for the role we allege Amicorp played in facilitating the laundering and dissipation of billions of dollars in stolen funds,” said a 1MDB spokesman in a statement here.

The fund alleged that this was achieved through “the creation of structures designed to purposefully obscure the theft”, and that Amicorp “deliberately and knowingly created complex structures to mask the stolen monies as assets and make them difficult to trace”.

“There is, in our view, strong evidence to suggest that Amicorp – at the highest levels – knew they were involved in a dishonest and illegal money laundering scheme designed to transfer large sums of cash away from its intended beneficiary — the people of Malaysia,” they added.

1MDB alleged that Amicorp created a global network of shell companies, sham transactions, and fraudulent structures to hide the origin and destination of misappropriated funds between 2009 and 2014.

Amicorp is also accused of using its Barbados-based bank to enable repeated asset transfers designed to appear as legitimate investments.

“We are committed to holding accountable those involved in misappropriating money from Malaysia’s sovereign wealth fund, ensuring its recovery and restitution to the Malaysian people,” 1MDB said.

1MDB said Amicorp has faced regulatory penalties recently, including fines in The Netherlands, Abu Dhabi, Malta, and the BVI for compliance and anti-money laundering violations.

The legal action is part of 1MDB’s ongoing global recovery efforts for assets stolen during one of the world’s largest financial scandals.

Earlier this month, the 1MDB board said that it welcomes the High Court’s decision to allow the government’s application to block PetroSaudi International Ltd (PSI) and its director Tarek Obaid from the fund.

It said it believes the US$340 million linked to the fund rightfully belongs to the Malaysian people, and that the judgment is a key step towards the restoration of these misappropriated funds. - malaymail

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.